Introduction:

Hey there, fellow investors! Navigating the stock market can feel like riding a roller coaster blindfolded.

That’s where a trustworthy stock advisor comes into play – your financial GPS, if you will. In this fast-paced world of markets and madness, finding the right advisor is like finding a needle in a haystack.

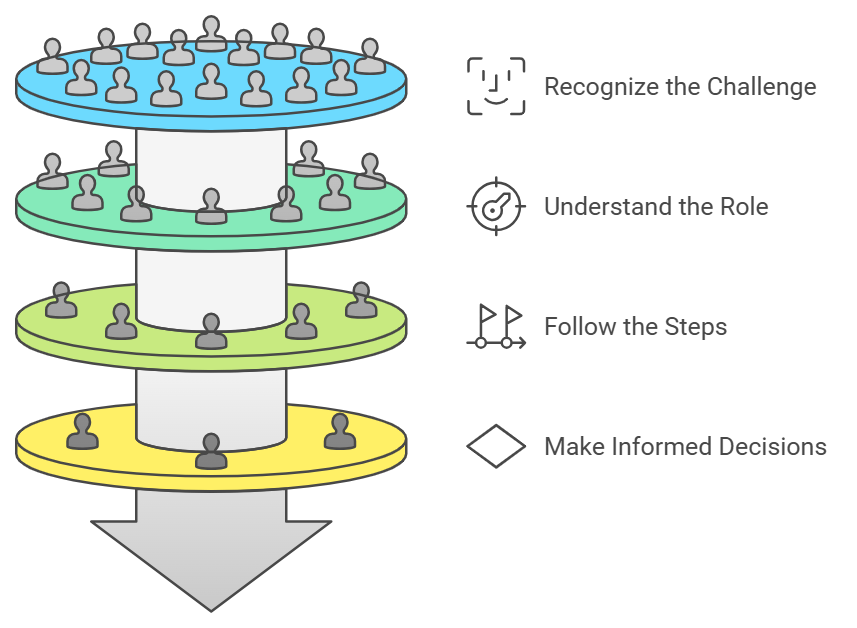

But worry not! We’re here to guide you through a 10-step journey to choose the best stock advisor for your unique financial ride. Your decisions today can sculpt your financial future.

Here’s the 10-step process for choosing the best stock advisor, we will discuss in detail about them.

1. Understanding Your Financial Goals

2. Defining Your Investment Strategy

3. Researching Stock Advisors

4. Checking Qualifications and Credentials

5. Assessing Communication and Accessibility

6. Fee Structure and Transparency

7. Compatibility with Your Investment Style

8. Seeking Recommendations and Referrals

9. Conducting a Personal Interview

10. Trial Period and Performance Evaluation

Impact of a Good Stock Advisor:

In a Charles Schwab survey from 2022, a whopping 41% of investors sought financial advice.

That’s almost half of the financial jungle looking for a guide! Some crave professional wisdom (who wouldn’t?), others need help with asset allocation, and a bunch simply want to beat the market. And guess what? You’re not alone in this quest.

Now, let’s talk numbers. There’s a constant tug-of-war on whether stock advisors really make a difference.

A 2019 University of Chicago study showed that recommendations from Motley Fool Stock Advisor provided a solid 14.5% annual return over 15 years, outshining the S&P 500. But, hold on, a Morningstar study countered that with an average return of 7.4% over a decade.

It’s like trying to predict the weather in the stock market world – unpredictable.

We get it. Information overload is real, and time is a luxury. A FINRA Foundation study found that 53% of investors feel bombarded by financial info.

And here’s the kicker – a Vanguard survey from 2022 spilled the beans that nearly half of us spend less than an hour a week researching investments.

No judgment here; life’s busy, and markets wait for no one.

So, why bother with a stock advisor? Well, professionally managed portfolios often outshine DIY efforts. According to a DALBAR study, the average equity mutual fund underperformed the S&P 500 by 0.71% annually over ten years.

It’s like having a financial fairy godparent guiding you through the market’s twists and turns.

Now, let’s get down to business. Choosing the right stock advisor is your secret weapon. It’s your chance to navigate the complexities, tame the market’s volatility, and keep those emotions in check.

Because, let’s face it, markets can be emotional roller coasters, and we’ve all made impulsive decisions we’d rather forget.

A stock advisor acts as your emotional anchor, helping you sail through the stormy market seas.

It’s your guide to finding that financial confidant who’ll help you grow your money and achieve those market dreams.

II. Understanding Your Financial Goals:

Financial goals refer to specific objectives or targets that individuals set for their financial well-being. These goals are personal and can vary widely from one person to another It’s like setting sail without a destination; you might end up somewhere, but it might not be where you want.

Identifying Short-term and Long-term Objectives:

Are you saving for a dream vacation, a new car, or maybe that fancy coffee machine you’ve been eyeing? Now, think long term – retirement, a beachside villa, or building a financial fortress for generations to come.

In a Charles Schwab survey from 2022, they found that folks like us are all about financial advice. 41% of us are waving our hands, saying, “Help! Guide me!” Why? Because we’ve got dreams, and we need a roadmap to get there.

Assessing Risk Tolerance and Investment Preferences:

Investing is like a roller coaster – there are highs, lows, and sometimes, unexpected loops.

It’s not just about where you want to go; it’s about how much turbulence you’re willing to endure. That’s what we call risk tolerance.

In our financial world, risk tolerance is as unique as a fingerprint. Some of us are adrenaline junkies, ready for the craziest rides the market throws at us.

Others prefer a more leisurely stroll, enjoying the scenery without the heart-stopping drops. It’s crucial to know where you fall on this spectrum.

Here’s a tidbit from the Charles Schwab survey: 47% of those seeking paid financial advice admit it’s because of a lack of investment knowledge or experience. Guess what? That’s okay! We all start somewhere.

Explorer and acknowledge what we don’t know and use it as fuel for our journey.

Aligning Investment Goals with the Right Stock Advisor:

Now that you’ve got your financial roadmap and risk tolerance compass, it’s time to find a stock market advisor who speaks your language.

Think of it like finding a tour guide who knows the hidden gems of a city – in this case, the twists and turns of the stock market.

Ever heard the saying, “It’s not about the destination; it’s about the journey”? Well, in investing, it’s a bit of both. Your journey is unique, and your destination is personal.

The right trading advisor is like a co-pilot, understanding your goals and navigating the market turbulence alongside you.

know where you’re heading, understand the thrill factor you’re comfortable with, and find that perfect stock advisor who’ll turn your financial dreams into reality. Next we will discuss, Defining Your Investment Strategy!

III. Defining Your Investment Strategy:

It’s like choosing the type of road for your journey; scenic routes, expressways, or maybe a bit of off-roading.

Introduction to Various Investment Strategies:

Some love the slow-cooked value investing stew, others prefer the fast-paced growth investing sushi. Now, let’s dish out the options.

Here’s the deal: there’s no one-size-fits-all strategy. It’s like picking an outfit – what suits you might not suit your best friend.

In our financial world, strategies range from conservative to aggressive. Some focus on undervalued gems, patiently waiting for them to shine.

Others chase the fast-moving, high-growth stars.

So, let’s get personal. What’s your flavor? Are you the patient chef, slow cooking your investments for long-term gains?

Or are you the adventurous soul, seeking the thrill of quick wins? Your investment strategy is your financial fingerprint, unique to you.

Determine Your Preferred Investment Approach:

Now, let’s dive deeper. Picture this as choosing your travel style. Are you the meticulous planner who likes to know every detail, or the spontaneous wanderer who embraces the unknown? Same goes for investing.

Are you drawn to fundamental analysis, scrutinizing every financial statement like a detective? Or do you lean towards technical analysis, reading the market’s mood like a seasoned psychologist? Your approach defines your journey, and finding a share market advisor who vibes with your style is crucial.

In that Charles Schwab survey, a whopping 56% sought professional guidance because they desired that experienced hand in crafting their investment strategy.

It’s like having a chef guide you through a menu – they know what works best with your palate.

Identifying Stock Advisors with Expertise in Your Chosen Strategy:

Now, imagine this: you’re assembling a team for a mission. Your investment strategy is the battle plan, and you need the right warriors – enter the stock advisors.

Some are like strategists, analyzing the battlefield before making a move. Others are bold commanders, leading with confidence.

Remember that University of Chicago study we talked about earlier? Motley Fool Stock Advisor recommendations provided an average annual return of 14.5% over 15 years.

That’s like having a trusty sidekick who knows the terrain inside out. But hold on, Morningstar threw a curveball, citing a more modest 7.4% return for newsletter recommendations.

It’s like different chefs presenting their own spin on the same recipe.

So, here’s the drill: know your investment strategy, find a stock advisor who specializes in your chosen flavor, and let them be your financial co-chef.

IV. Researching Stock Advisors:

our next pit stop on this financial road trip – researching stock advisors.

It’s like choosing a travel buddy for your epic adventure; you want someone who knows the way and can navigate the twists and turns.

Utilizing Online Platforms for Advisor Reviews:

Let’s kick things off with the modern age treasure hunt – online reviews. It’s like crowd-sourcing your travel recommendations.

In the financial world, websites are the TripAdvisor for trade advisors. Charles Schwab’s 2022 survey told us 25% of investors rely on free online resources.

We’re in that crowd, looking for nuggets of wisdom.

But hey, it’s not all sunshine and rainbows. Online reviews can be a bit like reading restaurant critiques – some love it, some hate it, and you’re left wondering who to trust. Don’t worry, we’re in this together.

Analyzing Track Record and Performance History:

Now, let’s talk about track records. Remember that University of Chicago study? Motley Fool Stock Advisor recommendations clocked in at an impressive 14.5% annual return over 15 years. That’s like a chef consistently dishing out Michelin-star meals.

On the flip side, Morningstar threw a curveball, citing a more modest 7.4% return. It’s like debating the merits of a restaurant – everyone has an opinion.

Think of a stock advisor’s track record as their menu. Are they offering consistent winners, or is it a hit-and-miss affair? Dig deep into their performance history; it’s your way of checking the chef’s expertise in the kitchen.

Investigating the Advisor’s Approach to Risk Management:

Now, let’s talk risk – the spice of the financial world. It’s like exploring a new cuisine; some dishes are mild, others are fiery. A share market advisor who knows how to balance flavors is crucial.

Remember that University of Chicago study we mentioned earlier? It’s not just about returns; it’s about risk management.

A good stock advisor is like a chef who knows how to control the heat – preventing your financial portfolio from burning.

So, dive into the reviews, scrutinize the track record, and assess their approach to risk. It’s like studying a restaurant’s menu, reading the reviews, and checking if they cater to your taste.

V. Assessing Communication and Accessibility:

Hey there, fellow financial explorers! We’re on the fifth leg of our journey – assessing communication and accessibility.

It’s like choosing a travel buddy who not only knows the route but is always just a text away when you need directions.

Importance of Clear and Transparent Communication:

Picture this: you’re in a foreign city, and your GPS is speaking a language only it understands. Frustrating, right? Clear communication is key, and the same goes for your stock advisor.

Communication is the lifeline between you and your advisor. It’s not just about what they say; it’s about how they say it.

Are they breaking down complex financial jargon into bite-sized pieces, or are they leaving you more confused than before? The key is finding someone who speaks your language.

Evaluating the Advisor’s Responsiveness and Availability:

Now, let’s talk availability – your financial buddy should be there when you need them. Ever tried calling a friend in a crisis, only to get voicemail? Not a pleasant experience.

In a fast-paced financial world, responsiveness matters.

In our digital age, waiting days for a response feels like eons. The Vanguard survey from 2022 spilled the beans – 48% of individuals spend less than an hour per week researching investments.

Time is of the essence, and your advisor should respect that. Are they prompt in responding to your queries, or are you left hanging in financial limbo?

Assessing Communication Channels and Frequency of Updates:

Let’s dive into the nitty-gritty. How do they communicate – is it through carrier pigeons or high-speed internet?

Okay, maybe not pigeons, but you get the point. Your advisor should be reachable through channels you’re comfortable with.

Do they prefer email, phone calls, or perhaps carrier pigeons after all? Everyone has a preference. You want updates that match your pace – not too frequent to feel overwhelming, but not so sparse that you’re left wondering if your advisor fell off the financial radar.

Remember, it’s not just about their expertise; it’s about how well they keep you in the loop. Finding an advisor who aligns with your communication style is like finding a travel companion who enjoys the same road trip playlist as you do.

So, my fellow financial journeyers, let’s recap: seek clear and transparent communication, ensure your advisor is as available as your trusty GPS, and find someone who communicates through channels that resonate with you.

VI. Fee Structure and Transparency:

Ready for the next stretch of our adventure? We’re diving into the intricacies of fee structures and transparency – the toll booths on our financial highway. It’s like choosing a road that won’t surprise you with hidden tolls around every bend.

Understanding Different Fee Structures in the Advisory Industry:

First things first, let’s talk about money. Investing isn’t a free ride, and your stock market advisor is like the tour guide charging a fee for showing you the best sights.

Understanding their fee structure is crucial, just like checking the admission fee before entering an amusement park.

In the world of financial advisory, fees come in different flavors – flat fees, hourly rates, or a percentage of your assets under management.

Each has its pros and cons, and finding the right fit is like selecting a dining option that suits your appetite and budget.

Analyzing the Transparency of Fees and Potential Hidden Costs:

Now, transparency – a word that’s like music to our ears. Hidden costs are like those surprise bills in the mail; nobody likes them. Our financial journey should be as clear as a sunny day, not clouded by unexpected financial storms.

Our financial pals at Vanguard showed us in a survey that transparency is key. We need to know what we’re paying for and if there are any sneaky charges waiting to pop up.

Are there additional fees for special services, or is everything laid out on the table? A trustworthy trading advisor is like an upfront waiter – they tell you what’s included in the menu and what comes with an extra charge.

Choosing an Advisor with a Fee Structure Aligned with Your Preferences:

Now, let’s align those stars – your preferences with their fee structure. Imagine going to a restaurant and realizing they only accept a currency you don’t have.

Bummer, right? Similarly, your advisor’s fee structure should align with your financial preferences.

Do you prefer paying a flat fee, so it’s clear and simple, or are you comfortable with a percentage of your assets under management?

It’s like choosing between a set menu or à la carte. Your financial journey, your rules.

Remember, it’s not just about the numbers; it’s about feeling comfortable with how you’re investing your hard-earned cash.

Finding an advisor whose fee structure aligns with your preferences is like choosing a restaurant that serves your favorite cuisine. The experience should leave you satisfied, not regretting your order.

So, my financial companions, let’s recap: understand the different fee structures, demand transparency like you would from a trustworthy friend, and choose an advisor whose fees align with your financial taste buds.

VII. Compatibility with Your Investment Style:

Welcome to the junction where personal preference meets financial strategy – Compatibility with Your Investment Style.

It’s like finding the perfect dance partner for the financial tango. Are you ready to groove?

Identifying Advisors Who Understand and Appreciate Your Investment Preferences:

Imagine this scenario: you’re at a dance party, and the DJ is playing your favorite beats. The vibe is just right, and you’re having a blast.

Now, let’s transpose that to the financial dance floor. Your investment preferences are your chosen dance moves, and your stock advisor should be able to sway to your rhythm.

In our Charles Schwab survey, a whopping 56% sought professional guidance because they craved a dance instructor who understands their unique moves.

It’s not just about the technical steps; it’s about syncing with your style. Whether you’re into the cha-cha of active trading or the slow waltz of long-term investing, your advisor should be your perfect dance partner.

Ensuring the Advisor’s Approach Aligns with Your Risk Appetite:

Risk, my friends, is the spice of the financial tango. Some love a bit of salsa with high-risk, high-reward moves, while others prefer the steady waltz of low-risk, steady returns. It’s crucial to find an advisor who won’t force you into a dance style you’re not comfortable with.

Remember that University of Chicago study? It wasn’t just about returns; it highlighted the importance of risk management.

Your advisor should be like a skilled dance instructor, guiding you through the risky twirls with finesse. It’s about ensuring your dance floor isn’t filled with financial missteps.

Compatibility in Terms of Long-term Versus Short-term Investment Goals:

Now, let’s talk about the length of our financial dance – the duration of the song we’re grooving to. Are you into the short-term cha-cha, looking for quick returns, or are you more of a long-term Waltzer, patiently waiting for the music to unfold?

In our Vanguard survey, we learned that 48% of individuals spend less than an hour per week researching investments.

Time is a precious commodity, and your advisor should respect your schedule. They should be your dance partner in sync with your preferred tempo, whether it’s a quick jitterbug or a slow, deliberate waltz.

So, fellow financial dancers, let’s recap: seek advisors who understand your unique moves, ensure they can dance to the rhythm of your risk appetite, and find a partner whose tempo aligns with your long-term or short-term preferences.

Stick around because our next move is all about Seeking Recommendations and Referrals – hearing what others have to say about the dance instructors they’ve twirled with. Happy dancing!

VIII. Seeking Recommendations and Referrals:

Hello, fellow financial explorers! We’ve hit the phase where wisdom from fellow travelers becomes your compass – Seeking Recommendations and Referrals. It’s like asking for local stock market tips when exploring a new city.

Are you ready to tap into the collective knowledge of the financial community?

Utilizing Personal Networks for Recommendations:

Let’s kick things off with the power of connections. Think of your financial journey as a grand expedition, and your friends, family, or colleagues are your seasoned travel companions.

In that Vanguard survey, we learned that recommendations play a vital role, much like hearing about that hidden gem restaurant from a friend.

Personal experiences speak volumes. Imagine sitting with a friend who’s been on this financial journey, sharing tales of their advisor – the highs, the lows, and the unexpected twists.

Personal networks are your treasure trove of insights, offering recommendations seasoned with real-life encounters.

Exploring Online Communities and Forums for Peer Reviews:

Now, let’s embrace the digital era. Online communities and forums are the bustling markets of financial advice. Ever tried choosing a restaurant based on Yelp reviews? Well, finding a stock advisor is no different.

In our information-overloaded world, forums act like guidebooks, full of stories from fellow financial wayfarers.

In that Charles Schwab survey, 25% relied on free online resources. It’s like tapping into the collective wisdom of a global village.

Peer reviews give you a glimpse into the diverse experiences of others – the good, the bad, and the invaluable lessons.

The Significance of Testimonials and Success Stories in Decision-making:

Now, let’s add a sprinkle of inspiration – testimonials and success stories. Think of these as postcards from those who’ve reached the summit.

A good stock advisory services is like a tour guide with a scrapbook full of happy memories.

In our grand financial journey, success stories are like beacons of hope. If a stock advisor has transformed financial landscapes for others, it’s a sign that they might just be the Sherpa you need. Personal stories resonate, offering reassurance and motivation for the path ahead.

So, my financial companions, let’s recap: lean on your personal network for tried-and-tested recommendations, explore the vibrant bazaars of online communities for peer reviews, and draw inspiration from testimonials and success stories.

Stick around because our next stop is Conducting a Personal Interview – the face-to-face encounter with your potential financial guide. Happy gathering insights, my fellow financial wayfarers!

Here are some effective ways to gather quality recommendations and referrals:

1. Tap into Your Personal Network:

– Reach out to friends, family, and colleagues who have experience with stock advisors.

– Ask about their personal experiences, the pros and cons, and whether they achieved their financial goals.

– Consider the advice of those whose financial preferences and goals align with yours.

2. Explore Online Communities and Forums:

– Join reputable online forums and communities dedicated to finance and investing.

– Participate in discussions and ask for recommendations from members who share similar investment interests.

– Look for detailed reviews and personal anecdotes from individuals who have worked with specific advisors.

3. Leverage Social Media Platforms:

– Utilize social media platforms to seek recommendations from your network.

– Post inquiries in finance-related groups or communities on platforms like LinkedIn or Facebook.

– Consider reaching out to influencers or experts in the finance field for their insights.

4. Attend Financial Workshops and Seminars:

– Attend local financial workshops, seminars, or networking events.

– Engage with fellow attendees and speakers to gather recommendations based on their experiences.

– Connect with professionals in the financial industry who may provide valuable insights.

5. Consult with Professionals in Related Fields:

– Reach out to professionals in related fields, such as accountants, estate planners, or lawyers.

– They often have insights into reputable stock advisors and can provide referrals based on their knowledge of your financial situation.

6. Utilize Online Review Platforms:

– Explore online review platforms dedicated to financial services.

– Read reviews and testimonials from clients who have shared their experiences with specific stock advisors.

– Look for patterns in feedback to gauge the consistency of the advisor’s performance.

7. Seek Recommendations from Local Financial Institutions:

– Consult with local banks, credit unions, or financial institutions.

– They may have partnerships or recommendations for reputable stock advisors.

– Inquire about any advisory services they offer or endorse.

8. Engage with Industry Professionals:

– Connect with professionals in the finance and investment industry.

– Seek recommendations from financial planners, analysts, or experts who have a deep understanding of the market.

– Participate in industry conferences or events to broaden your professional network.

IX. Conducting a Personal Interview:

We’ve arrived at the pivotal moment in our quest – Conducting a Personal Interview with your potential financial guide.

It’s like that face-to-face meeting with a travel guide before embarking on an epic adventure. Are you ready to delve into the heart of the matter?

Drafting a List of Questions to Ask Potential Advisors:

First things first, imagine this as preparing for a blind date. You want to know if you’re a match made in financial heaven or headed for a rocky road.

So, what’s in your arsenal? A list of questions! This isn’t a courtroom interrogation; it’s a friendly conversation to get to know each other better.

In that Vanguard survey, we learned that 48% of individuals spend less than an hour per week researching investments.

Time is precious, and your questions should be like a compass, pointing you in the right direction.

What are their investment philosophies? How do they handle market turbulence? It’s your chance to see if you’re on the same financial wavelength.

Assessing the Advisor’s Communication Skills and Ability to Explain Complex Concepts:

Now, let’s talk about vibes.

Ever met someone who spoke in riddles, leaving you more confused than enlightened? A good financial guide is like a translator, breaking down complex financial concepts into digestible bites.

In our exploration of Compatibility with Your Investment Style, we emphasized the importance of clear communication.

The personal interview is where you put this to the test. Can they explain their strategies without drowning you in financial jargon? Are they translating the financial language into a melody you can dance to?

Trust-Building Factors During the Interview Process:

Trust is the glue that holds this financial relationship together. Think of the interview as a trust-building dance – one step at a time.

What factors contribute to this trust dance?

Personal experiences shared during the interview are like stories around a campfire. Has your potential advisor weathered financial storms themselves?

How do they handle challenges? Real-life anecdotes humanize the financial journey, fostering a sense of connection.

So, my financial friends, let’s recap: draft your list of questions, assess their communication skills, and focus on trust-building factors during the interview.

Stick around because our next destination is a Trial Period and Performance Evaluation – the test drive before committing to the financial journey. Happy interviewing, fellow financial adventurers!

——————

Here are ten questions investors can ask during a personal interview with a potential financial share advisor:

1. Can you walk me through your investment philosophy?

– This helps you understand the advisor’s approach and whether it aligns with your own financial goals and values.

2. How do you handle risk management, especially during market fluctuations?

– Understanding how the advisor deals with risk can provide insight into their strategy and your potential comfort level with their approach.

3. What types of clients do you typically work with, and what is your ideal client profile?

– This question helps you gauge if the advisor has experience working with clients similar to you and if you fit within their specialization.

4. How do you communicate with your clients, and how often should I expect updates?

– Communication is key. Ensure the advisor’s communication style matches your preferences and that they keep you well-informed about your investments.

5. Can you share some success stories or examples of how you’ve helped clients achieve their financial goals?

– Real-life examples can demonstrate the advisor’s track record and provide tangible evidence of their ability to deliver results.

6. What is your fee structure, and are there any hidden costs I should be aware of?

– Clear understanding of fees ensures transparency and helps you assess if the financial arrangement aligns with your budget and expectations.

7. How do you tailor your approach to meet individual client needs?

– This question probes into the advisor’s ability to customize strategies based on your unique financial situation, goals, and risk tolerance.

8. What is your experience and expertise in handling [specific investment area or strategy] that I’m interested in?

– If you have a specific interest or strategy, inquire about the advisor’s experience in that area to ensure they are well-versed in your preferences.

9. How do you stay informed about market trends and changes in the financial landscape?

– This question assesses the advisor’s commitment to ongoing education and staying abreast of market developments.

10. Can you explain any past challenges you’ve faced with clients and how you resolved them?

– Understanding how the advisor navigates challenges provides insight into their problem-solving skills and adaptability.

XI. Trial Period and Performance Evaluation:

We’ve reached a crucial juncture in our journey – the Trial Period and Performance Evaluation.

It’s like test-driving a car before committing to the road trip of a lifetime. Are you ready to put your potential financial guide through their paces?

Considering a Trial Period with the Selected Advisor:

Think of this as a trial date – a chance to get to know each other better before deciding to tie the financial knot. A trial period is your safety net, ensuring you’re comfortable with your potential advisor’s style and strategies.

In our world of financial complexities, it’s like dipping your toes in the water before diving in. Why rush into a long-term commitment without testing the waters first?

A trial period lets you gauge if this financial partnership feels like a snug fit or a forced match.

Monitoring Performance and Assessing the Advisor’s Ability:

Now, let’s talk about performance – the heart and soul of our financial journey. In that University of Chicago study, Motley Fool Stock market Advisory recommendations boasted a solid 14.5% annual return over 15 years. It’s like assessing the track record of a seasoned musician before deciding to attend their concert.

During the trial, closely monitor how your selected advisor handles the financial stage. Are they hitting the right notes, or do they seem out of tune with your expectations?

It’s your chance to see if their strategies align with your financial playlist.

Making an Informed Decision Based on Trial Period Outcomes:

After the trial, it’s decision time – to continue the financial journey together or part ways amicably.

Your trial period outcomes are like the reviews after a movie premiere. Did it meet your expectations, exceed them, or fall short?

In our dynamic financial landscape, adaptability is key. If your potential advisor adjusts their strategies based on trial feedback, it’s a positive sign of their commitment to your financial success.

On the flip side, if they resist change despite evident shortcomings, it might be time to reassess the partnership.

So, financial comrades, let’s recap: consider a trial period to test compatibility, closely monitor performance like a hawk, and make an informed decision based on the outcomes of the trial.

XIII. Apna Research Plus: Your Trusted Partner in Stock Market Success

Greetings, fellow financial adventurers! Before we bid farewell to our epic journey, let me unveil a beacon in the stock market wilderness – Apna Research Plus.

Think of them as your seasoned guide, the Gandalf of the financial realm, here to ensure your success in the stock market.

Introduction to Apna Research Plus:

Picture this – a bustling market, filled with noise and confusion. In the midst of it, Apna Research Plus stands tall, a premier stock market advisory company in India.

Why choose them, you ask? Well, let me unfold their story.

SEBI Registration:

First and foremost, Apna Research Plus is a SEBI registered company. It’s like starting a journey with a certified guide, ensuring regulatory compliance, transparency, and investor protection.

In the financial wilderness, having a registered guide is your safeguard against unforeseen challenges.

Expertise and Experience:

What sets Apna Research Plus apart? It’s the A-team they boast – experts with extensive experience and expertise in market analysis and predictions.

Imagine having a guide who not only knows the path but can predict the weather.

That’s the kind of foresight Apna Research Plus brings to the table.

Client-Centric Approach:

In this journey, your needs are paramount. Apna Research Plus prioritizes client needs, tailoring advisory services to individual goals and risk profiles.

It’s like having a guide who understands your preferred route, whether you’re into the scenic detours or the direct ascents.

How Apna Research Plus Helps Investors Grow Their Money:

Now, let’s talk about the magic Apna Research Plus weaves for investors.

Customized Investment Strategies:

Every adventurer has a unique map, and Apna Research Plus crafts personalized strategies aligned with individual financial goals.

It’s like having a guide who tailors the route based on your preferences and aspirations.

Comprehensive Market Research:

In the ever-changing landscape, knowledge is power. Apna Research Plus conducts in-depth market analysis, empowering clients with informed investment decisions.

It’s like having a guide equipped with the latest maps, ensuring you navigate the market with confidence.

Risk Management and Mitigation:

The stock market is a wild terrain, filled with uncertainties. Apna Research Plus implements effective risk management strategies to protect and grow your investments.

Imagine having a guide who not only points out the scenic spots but also ensures a safe passage through challenging terrain.

Educational Resources and Guidance:

Knowledge is the compass that guides your journey. Apna Research Plus provides educational resources – webinars, articles, and consultations – to empower investors.

It’s like having a guide who not only shows you the path but also equips you with the skills to navigate independently.

Transparent Communication:

In the financial world, communication is the key to a successful journey. Apna Research Plus commits to transparent and open communication, providing regular updates for client confidence.

It’s like having a guide who keeps you informed about the twists and turns ahead.

Client Success Stories:

Now, let’s add a touch of reality – success stories. Real-life tales of triumph that showcase the positive impact of Apna Research Plus on investors’ financial journeys.

It’s like hearing from fellow travelers who conquered the same peaks you aim to summit.

In the grand scheme of our financial adventure, Apna Research Plus emerges as a reliable ally, a trustworthy companion in the unpredictable world of stocks.

So, my financial comrades, as we conclude our journey, consider Apna Research Plus as more than a guide – think of them as your trusted partner, your ally in stock market success.

Here’s to conquering financial peaks together! Until our paths cross again, happy investing!

XII. Conclusion:

Hey there, financial champions! Can you believe we’ve reached the final chapter of our grand adventure – the Conclusion? It’s like arriving at the summit after a challenging climb, taking a moment to soak in the breathtaking view. Are you ready to wrap up this epic journey?

Summarizing the 10-Step Process for Choosing the Best Stock Advisor:

Let’s take a stroll down memory lane, shall we? We embarked on a 10-step quest, much like a treasure hunt, to find that perfect stock advisor.

From understanding your financial goals to conducting personal interviews, we’ve covered it all.

In our financial safari, we navigated through stats and studies. Charles Schwab told us that 41% seek financial advice, while Vanguard spilled the beans that almost half spend less than an hour per week on investments.

It’s a testament to the chaotic financial jungle we traverse daily.

Emphasizing the Importance of Diligence and Research:

As we conclude, let’s pause for a moment of reflection. Choosing a stock advisor is no walk in the park; it’s a strategic dance.

Our journey highlighted the significance of diligence and research. The FINRA Foundation’s study showed 53% feel overwhelmed by financial info. We waded through that sea of data, seeking clarity.

In the cacophony of financial voices, our 10-step process emerged as a guiding melody. The journey may be complex, but diligence is our compass, and research is our trusty steed.

Encouraging Continuous Monitoring and Adaptation:

But here’s the secret sauce – the journey doesn’t end here. As the financial landscape evolves, so must we. The University of Chicago’s study and the CFA Institute’s findings emphasized the importance of adaptability.

It’s like upgrading your gear for a more challenging trail – a continuous process.

So, financial comrades, here’s to continuous monitoring, adaptation, and the unwavering spirit of financial exploration.

It’s not just about finding an advisor; it’s about building a lasting partnership.

Apna Research Plus: Your Trusted Partner in Stock Market Success:

Before we bid adieu, let me introduce you to a beacon in this financial wilderness – Apna Research Plus.

Think of them as your seasoned guide, navigating the stock market with the precision of a well-tuned compass.

SEBI registration? Check. A team of market virtuosos? Double-check. A client-centric approach, comprehensive research, risk management strategies, and a treasure trove of educational resources? Triple-check.

It’s like having a sherpa who not only knows the route but also shares insider secrets for a successful ascent.

In Closing:

As we wrap up our journey, remember – the financial world is vast, dynamic, and occasionally unpredictable.

But armed with knowledge, guided by diligence, and partnered with the right advisor, your path to success becomes clearer.

Frequently Asked Questions (FAQs) – Choosing the Best Stock Advisor with Apna Research Plus:

1. Why is choosing a stock advisor important?

Selecting a stock advisor is crucial for making informed investment decisions, especially if you lack the time or expertise to navigate the complex stock market terrain. A reliable advisor can provide guidance tailored to your financial goals and risk tolerance.

2. What makes Apna Research Plus stand out among other stock advisory services?

Apna Research Plus stands out due to its SEBI registration, a team of experienced experts, and a client-centric approach. The company prioritizes transparency, compliance, and personalization, making it a trustworthy partner in your stock market journey.

3. How can Apna Research Plus help me grow my money in the stock market?

Apna Research Plus offers customized investment strategies, conducts comprehensive market research, implements effective risk management, and provides educational resources. These elements empower investors to make informed decisions, manage risks, and potentially enhance returns.

4. Why is a trial period important before committing to a stock advisor?

A trial period allows you to test the compatibility between you and the advisor. It’s like a test drive, helping you assess if the advisor’s strategies align with your preferences and if the communication is effective. It ensures a comfortable fit before making a long-term commitment.

5. What role does the performance evaluation play in choosing a stock advisor?

Monitoring performance during a trial period is like evaluating a guide’s ability to navigate challenging terrains. It’s essential to ensure that the advisor’s strategies align with your expectations and contribute positively to your financial goals.

6. How can I ensure compatibility with my investment style when choosing a stock advisor?

Identifying advisors who understand and appreciate your investment preferences is crucial. It’s like finding a dance partner who can groove to your rhythm. Ensuring alignment in risk appetite, investment goals, and preferred investment duration is key for a successful partnership.

7. Is it necessary to seek recommendations and referrals when choosing a stock advisor?

Yes, seeking recommendations and referrals is akin to tapping into the collective wisdom of fellow investors. Personal experiences and success stories shared by others provide valuable insights and can guide you in making an informed decision.

8. What role does communication play in the advisor selection process?

Clear and transparent communication is paramount when choosing a stock advisor. It’s like having a guide who can explain complex financial concepts in a way that resonates with you. Assessing the advisor’s responsiveness and communication style ensures a smooth and effective partnership.

9. How can I ensure transparency in the fee structure of a stock advisor?

Understanding different fee structures, analyzing transparency, and choosing an advisor with a fee structure aligned with your preferences are essential steps. It’s like knowing the cost of your journey upfront, ensuring no hidden surprises along the way.

10. Why should I consider Apna Research Plus for my stock market advisory needs?

Apna Research Plus combines SEBI registration, a team of experts, a client-centric approach, and a track record of success. The company offers a comprehensive package, including personalized strategies, market research, risk management, educational resources, and transparent communication, making it a reliable partner in your stock market success.