A. Importance of Investing

Welcome to the world of investing in the vibrant and rapidly growing Indian stock market! In this introductory section, we’ll explore the significance of investing, especially for beginners looking to embark on their financial journey in India.

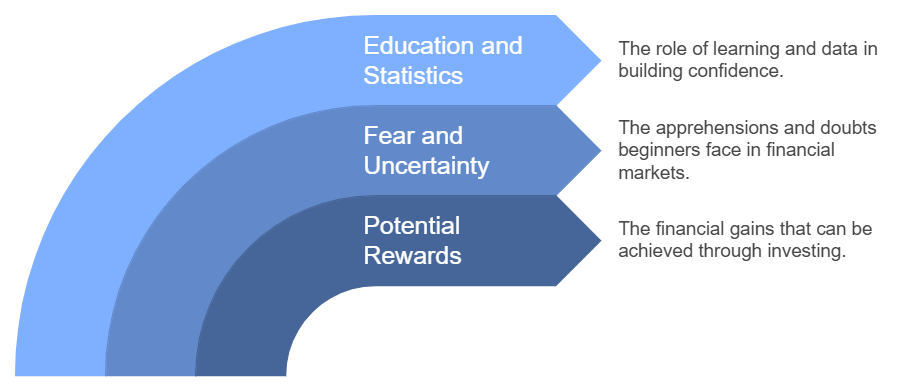

B. Overcoming the Fear of Investing

While the potential rewards of investing are substantial, many individuals, especially beginners, may grapple with the fear and uncertainty associated with financial markets.

Let’s address these concerns and pave the way for a confident start to your investment journey.

Data and statistic Shows:

- Numerous online and offline courses are available to learn the basics of stock trading and investing, emphasizing the importance of education in overcoming the fear of the unknown (Provided Statistics).

- India’s stock market has seen a significant increase in retail participation, with the number of Demat accounts growing to over 100 million, indicating a rising interest in overcoming financial apprehensions (NSDL).

Key Points:

- Educational Empowerment: Education is a powerful tool for overcoming fear. As a beginner, gaining knowledge about the fundamentals of investing, market dynamics, and financial literacy is the first step towards building confidence.

- Growing Community of Investors: The substantial rise in Demat accounts reflects a growing community of investors in India. Knowing that you are part of a larger group navigating similar waters can be reassuring and motivate you to overcome initial apprehensions.

II. Understanding the Basics

A. What Are Stocks?

1. Definition and Ownership

Stocks represent ownership in a company, and understanding this fundamental concept is key to entering the market confidently.

In India, the retail investor community has surged, with over 100 million Demat accounts, reflecting a growing interest in stock ownership (NSDL).

2. Different Types of Stocks

Diving deeper, beginners need to grasp the various types of stocks available. Whether it’s common or preferred shares, each type has distinct characteristics that influence investment decisions.

B. How the Stock Market Works

1. Market Participants

Navigating the stock market requires understanding its players. India’s market has seen a significant increase in retail participation, contributing to its status as the 5th largest in the world (Bloomberg).

2. Price Movements

Stock prices are influenced by a myriad of factors, including global economic conditions and political events. This volatility, though challenging, opens avenues for potential profits.

III. Setting Financial Goals

A. Identifying Short-term and Long-term Goals

Setting clear financial goals is a crucial first step for any investor, and it’s particularly vital in the dynamic landscape of the Indian stock market.

Let’s delve into the importance of identifying both short-term and long-term goals.

Data and Reference:

- India’s GDP is projected to grow at a robust rate of 7.4% in 2024, providing a favorable economic backdrop for investors with varied financial goals (World Bank).

- The Indian stock market, being the 5th largest globally with a market capitalization exceeding $3.7 trillion, offers diverse investment opportunities for both short-term gains and long-term wealth accumulation (Bloomberg).

Key Points:

- Short-term Goals: With India’s rapidly growing economy, short-term goals could include capitalizing on market fluctuations or taking advantage of specific industry trends for quick returns.

- Long-term Goals: Long-term goals may involve building a portfolio that aligns with the sustained economic growth of India, contributing to wealth accumulation over the years.

IV. Assessing Risk Tolerance

A. Importance of Risk Assessment

Understanding and assessing your risk tolerance is fundamental to crafting an investment strategy that aligns with your financial objectives and personal comfort level, especially in a market as dynamic as India’s.

Data and Reference:

- The average investor in India faces challenges, with studies suggesting that only a small percentage are consistently profitable, highlighting the importance of effective risk management (Investopedia).

- India’s stock market is highly volatile, susceptible to global economic conditions and political events, emphasizing the need for investors to assess and manage risk effectively (Provided Statistics).

V. Building a Strong Financial Foundation

A. Emergency Funds

Before venturing into the world of stocks, it’s crucial to establish a robust financial foundation. One cornerstone of this foundation is the creation of emergency funds, acting as a safety net during unforeseen circumstances.

The need for such funds is emphasized by India’s dynamic economic landscape and the potential for unexpected market fluctuations.

Data and Reference:

- India’s GDP is projected to grow at 7.4% in 2024, indicating economic dynamism (World Bank).

- A volatile market, as seen in India’s 5th largest stock market by market capitalization, underscores the importance of financial preparedness (Bloomberg).

Key Points:

- Economic Resilience: With India’s GDP growth, having emergency funds ensures financial resilience against unexpected events, allowing investors to navigate market uncertainties.

- Market Volatility: The Indian stock market, susceptible to global conditions, emphasizes the need for a financial buffer. Emergency funds act as a shield, providing peace of mind during turbulent market phases.

B. Clearing High-Interest Debt

Another crucial step in building a strong financial foundation is addressing high-interest debt. Clearing debts with high interest not only frees up resources for investment but also aligns with India’s evolving financial landscape, where debt management plays a pivotal role.

Data and Reference:

- The stock market has seen a significant increase in retail participation in India, with over 100 million Demat accounts, showcasing a growing interest in investment (NSDL).

- Average annual salary for equity research analysts in India is around Rs. 8-10 lakhs, underlining the financial landscape and potential for wealth accumulation (AmbitionBox).

Key Points:

- Investment Readiness: Clearing high-interest debt prepares investors for a more focused and sustainable approach to stock market participation, aligning with the growing retail interest in India’s market.

- Wealth Accumulation: The average annual salary of equity research analysts highlights the income potential, emphasizing the importance of debt management as a foundation for long-term wealth accumulation.

By focusing on emergency funds and debt management, investors in India can lay a solid groundwork for entering the stock market with confidence and resilience.

This approach aligns with the evolving financial landscape and sets the stage for informed and strategic investment decisions.

VII. Researching Stocks

A. Fundamental Analysis

1. Financial Statements

Aspiring investors in India should begin their stock market journey by delving into fundamental analysis, starting with a thorough examination of a company’s financial statements.

This analytical approach is crucial for understanding a company’s fiscal health and potential for growth, essential elements for successful stock investing.

Data and Reference:

- Top traders in India can earn crores of rupees per year, showcasing the lucrative opportunities available (Economic Times).

- The Indian stock market, with over 100 million Demat accounts, reflects a significant surge in retail participation (NSDL).

Key Points:

- Earnings Potential: Understanding financial statements aids in assessing a company’s earnings potential, aligning with the substantial income potential in India’s stock market.

- Retail Participation: With a surge in retail participation, a grasp of financial statements empowers investors to make informed decisions amid the growing competition in the Indian market.

2. Company Performance Metrics

Going beyond financial statements, investors need to delve into specific performance metrics to gauge a company’s overall performance.

This involves analyzing metrics such as return on equity (ROE), earnings per share (EPS), and debt-to-equity ratio, providing a holistic view of a company’s health.

Data and Reference:

- Proprietary trading firms in India offer profit-sharing models, adding a collaborative dimension to earnings (Investopedia).

- The average annual salary for equity research analysts in India is around Rs. 8-10 lakhs, emphasizing the demand for in-depth analysis (AmbitionBox).

Key Points:

- Collaborative Earnings: Understanding performance metrics aligns with profit-sharing models, showcasing the collaborative nature of earnings in India’s trading landscape.

- Analytical Demand: The demand for equity research analysts reinforces the importance of diving into performance metrics, a skill set valued in India’s financial market.

B. Technical Analysis

1. Reading Stock Charts

Technical analysis plays a crucial role in researching stocks, particularly in reading stock charts.

This skill enables investors to identify trends, crucial for making timely decisions in India’s fast-paced stock market.

Data and Reference:

- The number of Demat accounts in India has exceeded 100 million, signifying a significant increase in retail participation (NSDL).

- India’s stock market is highly volatile, influenced by global economic conditions and political events.

Key Points:

- Retail Influence: Reading stock charts is essential in a market with a surge in retail participation, helping investors stay ahead in the dynamic Indian landscape.

- Market Volatility: The volatile nature of the Indian stock market underlines the importance of technical analysis in navigating rapid price movements.

2. Identifying Trends

Identifying trends is a fundamental aspect of technical analysis. In India, where the stock market is susceptible to global economic conditions, investors need to identify and interpret trends to make informed decisions.

Data and Reference:

- Fundamental analysis, coupled with technical analysis, contributes to a comprehensive understanding of stocks (Investopedia).

- Studies suggest that only a small percentage of traders in India are consistently profitable, emphasizing the need for a nuanced approach (Investopedia).

Key Points:

- Holistic Understanding: Combining fundamental and technical analysis provides a holistic view, crucial for success in India’s diverse market.

- Consistent Profitability: Recognizing trends is a skill that sets apart consistently profitable traders, aligning with the challenges faced by the average investor in India.

C. How to Choose the Right Stock for Investing

Choosing the right stock is a critical step for investors aiming for success in India’s dynamic market. Here are key points to consider:

Data and Reference:

- The Indian stock market is the 5th largest globally by market capitalization, exceeding $3.7 trillion (Bloomberg).

- Professional certifications like the NISM certifications enhance knowledge and credibility in India’s financial landscape.

Key Points:

- Market Capitalization: Considering the market capitalization of a stock provides insights into its size and prominence in the Indian market.

- Certifications and Credibility: Investors can enhance their decision-making by leveraging certifications, aligning with the demand for knowledgeable participants in India’s financial landscape.

1. Industry Analysis:

- Diversification: Consider diversifying across different industries. India’s stock market encompasses a wide array of sectors, including technology, healthcare, energy, and more. Diversification helps manage risk and captures opportunities arising from various sectors.

2. Financial Health:

- Debt Levels: Examine a company’s debt levels through metrics like the debt-to-equity ratio. Companies with lower debt are often more resilient, especially during economic downturns.

3. Earnings Growth:

- Consistent Earnings Growth: Look for companies with a history of consistent earnings growth. India’s top traders earning crores of rupees per year often attribute their success to companies with robust and sustained earnings.

4. Dividend History:

- Dividend-Paying Stocks: Consider stocks with a history of paying dividends. Dividend stocks can provide a steady income stream, aligning with the benefits of dividend investing in India’s market.

5. Market Capitalization:

- Size and Stability: Assess the market capitalization of a stock. Larger market capitalization often indicates stability and may be appealing for risk-averse investors.

6. Regulatory Compliance:

- Adherence to Regulations: Ensure that the company adheres to regulatory standards. India’s stock market, with its growing retail participation, emphasizes the importance of companies following ethical and legal practices.

7. Management Quality:

- Leadership Integrity: Evaluate the quality of the company’s management. Leaders with a track record of integrity and effective decision-making contribute to the overall stability and growth of a company.

8. Competitive Position:

- Market Competitiveness: Analyze a company’s competitive position within its industry. Understanding a company’s competitive advantages and challenges is vital for predicting future performance.

9. Research and Education:

- Continuous Learning: Emphasize the importance of continuous learning. The availability of numerous online and offline courses, along with professional certifications like the NISM certifications, underscores the significance of ongoing education in India’s dynamic market.

10. Long-Term Vision:

- Alignment with Goals: Ensure that the chosen stock aligns with your long-term financial goals. Whether it’s for retirement planning or wealth accumulation, a stock should complement your overall investment strategy.

11. Analyst Recommendations:

- Professional Insights: Consider analyst recommendations. While conducting your own research is essential, professional insights can provide valuable perspectives, aligning with the demand for equity research analysts in India.

12. Global Economic Factors:

- Global Impact: Recognize the impact of global economic conditions on the chosen stock. India’s stock market is influenced by global events, and considering these factors is crucial for making well-informed investment decisions.

13. Risk-Reward Ratio:

- Balancing Risk and Reward: Evaluate the risk-reward ratio of a potential investment. Understanding the potential risks and rewards helps investors make balanced and informed decisions.

14. Historical Performance:

- Track Record: Examine the historical performance of the stock. Consistent positive performance is a positive indicator, aligning with the principles of value and growth investing in India.

15. Market Sentiment:

- Sentiment Analysis: Consider market sentiment. India’s market, susceptible to retail influences, often experiences shifts in sentiment that impact stock prices.

16. Technological Trends:

- Adaptability to Tech Trends: Assess how the company adapts to technological trends. With the increasing adoption of technology in India, companies embracing innovation may have a competitive edge.

17. Sustainability Practices:

- Environmental, Social, and Governance (ESG) Factors: Factor in ESG considerations. Sustainable and socially responsible practices are gaining importance in India’s market, reflecting broader global trends.

18. Liquidity:

- Trading Volume: Consider the liquidity of the stock. Higher trading volumes often indicate greater liquidity, making it easier to buy or sell shares without significant price impact.

19. Macroeconomic Trends:

- Alignment with Macroeconomic Trends: Align your stock choices with broader macroeconomic trends. Understanding how the chosen stock fits into the larger economic landscape is crucial for anticipating potential market movements.

20. Community and User Reviews:

- Public Perception: Explore community and user reviews. Public perception can provide additional insights into a company’s reputation and how it is perceived in the broader community.

Choosing the right stock involves a blend of fundamental and technical analysis, taking into account market capitalization, and leveraging certifications for informed decision-making.

This approach aligns with the evolving landscape of the Indian stock market, offering investors a strategic advantage in their stock selection process.

VIII. Diversification Strategies

Diversification is not just a risk mitigation strategy; it’s a powerful tool for optimizing returns and capitalizing on the dynamic opportunities presented by the Indian stock market.

As we continue our journey into the intricacies of investing, let’s explore the methodologies of researching and choosing the right stocks for your diversified portfolio.

A. Importance of Diversification

Diversification is a cornerstone of sound investment strategies, especially when navigating the diverse and dynamic Indian stock market.

In this section, we’ll explore the significance of diversification and how it can be a key factor in managing risk and optimizing returns.

Key Points:

- Market Size and Opportunities: Given the substantial market capitalization of the Indian stock market, diversification allows investors to tap into a multitude of opportunities across sectors and industries.

- Education as a Foundation: Diversification is a strategy that benefits from a solid understanding of market dynamics. Education plays a pivotal role in enabling investors to make informed decisions about how to diversify their portfolios.

B. Building a Well-Balanced Portfolio

Crafting a well-balanced portfolio is an art that involves strategic decision-making based on individual financial goals and risk tolerance.

Let’s explore key considerations when building a diversified portfolio in the Indian context.

Key Points:

- Retail Participation Trend: The surge in Demat accounts highlights a growing trend of retail participation in India’s stock market. Building a well-balanced portfolio allows retail investors to optimize their exposure to various assets.

- Aligning with Economic Growth: With a robust projected GDP growth, investors can align their portfolios with sectors that are poised to benefit from India’s economic expansion.

IX. Developing an Investment Strategy

A. Long-term vs. Short-term Strategies

Navigating the dynamic landscape of the Indian stock market requires a well-defined investment strategy.

Investors should carefully consider whether to adopt a long-term or short-term approach, aligning their decisions with their financial goals and risk tolerance.

Data and Reference:

- India’s GDP is projected to grow at an impressive 7.4% in 2024, indicating long-term economic potential (World Bank).

- The Indian stock market’s total market capitalization exceeds $3.7 trillion, showcasing the scope for both short-term and long-term investment opportunities (Bloomberg).

Key Points:

- Long-term Economic Growth: With India’s positive economic outlook, adopting a long-term investment strategy allows investors to capitalize on the country’s sustained growth.

- Diverse Investment Opportunities: The substantial market capitalization in India provides a diverse range of investment opportunities, catering to both short-term traders and long-term investors.

B. Value vs. Growth Investing

Investors in India must choose between value and growth investing strategies, each offering distinct advantages and considerations.

Understanding these approaches is essential for crafting a strategy that aligns with individual preferences and market conditions.

Data and Reference:

- The average annual salary for equity research analysts in India is around Rs. 8-10 lakhs, emphasizing the demand for analytical skills in evaluating value and growth opportunities (AmbitionBox).

- India’s GDP growth and market dynamics create an environment conducive to both value and growth investing strategies (World Bank, Bloomberg).

Key Points:

- Analytical Demand: The demand for equity research analysts in India highlights the significance of analytical skills, a crucial aspect for investors implementing both value and growth strategies.

- Adaptability to Market Dynamics: India’s dynamic market allows investors to adapt their strategies based on prevailing conditions, whether focusing on undervalued assets (value) or high-growth potential (growth).

X. Investing in Dividend Stocks

A. Benefits of Dividend Investing

Investing in dividend stocks holds distinct advantages in the context of the Indian stock market, providing investors with a reliable income stream and potential long-term wealth accumulation.

Data and Reference:

- Proprietary trading firms in India offer profit-sharing models, emphasizing the income-generating potential in the market (Investopedia).

- The Indian stock market’s total market capitalization exceeds $3.7 trillion, highlighting the substantial scope for dividend investment opportunities (Bloomberg).

Key Points:

- Collaborative Earnings: In the context of profit-sharing models in India, dividend investing aligns with the collaborative nature of earnings, allowing investors to participate in a company’s success.

- Long-Term Wealth Accumulation: The vast market capitalization in India provides ample opportunities for long-term wealth accumulation through dividends, offering stability in an ever-changing market.

B. How to Evaluate Dividend Stocks

Choosing the right dividend stocks requires a nuanced evaluation process. Investors in India should consider specific factors to ensure a balance between income generation and the potential for capital appreciation.

Data and Reference:

- Earnings potential in India allows investors to strategically evaluate dividend stocks for sustainable income (Economic Times).

- Professional certifications like the NISM certifications enhance knowledge and credibility, contributing to informed decision-making in the evaluation process (AmbitionBox).

Key Points:

- Earnings Sustainability: Assess the sustainability of a company’s earnings. In the context of India’s lucrative market, a focus on sustainable income is crucial for dividend investors.

- Informed Decision-Making: Leveraging certifications and enhancing knowledge aligns with the demand for equity research analysts in India. This knowledge is valuable when evaluating dividend stocks for their long-term potential.

XII. Monitoring Your Investments

A. Regular Portfolio Reviews

Investors should regularly review their portfolios to ensure alignment with financial goals. This proactive approach allows for timely adjustments based on market conditions.

B. Rebalancing Strategies

Periodic rebalancing is vital for maintaining portfolio health. It involves adjusting asset allocations to align with changing market dynamics.

XIV. Behavioral Finance Considerations

A. Emotion and Investment Decisions

Understanding the impact of emotions on investment decisions is a critical aspect of navigating the Indian stock market, where market fluctuations and global events can trigger various emotional responses among investors.

Data and Reference:

- The Indian stock market is highly volatile, susceptible to global economic conditions and political events, contributing to emotional responses among investors (Provided Statistics).

- Studies suggest that only a small percentage of traders in India are consistently profitable, indicating challenges in managing emotions effectively (Investopedia).

Key Points:

- Volatility Influence: Emotions often intensify during periods of market volatility in India. Identifying and handling these feelings is essential for making informed investment choices.

- Consistent Profitability Challenge: The challenges faced by the average investor in India, as indicated by studies, highlight the importance of emotional resilience in achieving consistent profitability.

B. Avoiding Common Behavioral Pitfalls

Investors in the Indian stock market need to be aware of and actively avoid common behavioral pitfalls that can hinder their success.

By addressing these pitfalls, they can make more informed and strategic investment decisions.

Data and Reference:

- Trading in India can be stressful and emotionally demanding, requiring strong mental discipline and risk management skills (Provided Statistics).

- The diverse market capitalization in India provides opportunities for investors, but avoiding behavioral pitfalls is crucial for capitalizing on these opportunities (Bloomberg).

Key Points:

- Emotional Resilience: Stress and emotional demands in the Indian market require investors to cultivate strong mental discipline. Developing emotional resilience is essential for navigating the challenges of trading.

- Risk Management Skills: The need for risk management skills is emphasized in the Indian context. Investors must avoid impulsive decisions and employ effective risk management strategies to safeguard their investments.

XV. Market Volatility and Economic Indicators

A. Navigating Market Fluctuations

Understanding market volatility is paramount for investors in the Indian stock market, given its susceptibility to global economic conditions and political events. Navigating fluctuations requires a strategic approach that aligns with individual risk tolerance and investment goals.

Data and Reference:

- India’s GDP is projected to grow at an impressive 7.4% in 2024, contributing to the overall dynamic nature of the market (World Bank).

- The average investor in India faces challenges, with studies suggesting that only a small percentage are consistently profitable, emphasizing the importance of navigating volatility effectively (Investopedia).

Key Points:

- Economic Growth Impact: With India’s projected GDP growth, market fluctuations may present opportunities for investors. A nuanced approach is necessary to capitalize on potential upswings while managing associated risks.

- Consistent Profitability Challenge: The challenges faced by the average investor underscore the necessity of navigating market fluctuations strategically. By understanding economic indicators, investors can make informed decisions amid volatility.

B. Understanding Economic Indicators

Investors in the Indian stock market should pay close attention to key economic indicators that influence market movements. By staying informed about these indicators, they can gain insights into potential market trends and make well-timed investment decisions.

Data and Reference:

- The Indian stock market is the 5th largest globally by market capitalization, exceeding $3.7 trillion, reflecting the significant role of economic indicators in shaping market dynamics (Bloomberg).

- Numerous online and offline courses are available to learn the basics of stock trading and investing, emphasizing the importance of education in navigating economic indicators (Provided Statistics).

Key Points:

- Market Capitalization Influence: Economic indicators play a pivotal role in shaping the dynamics of the Indian stock market, influencing the market capitalization and overall investment climate.

- Educational Empowerment: Access to education, both online and offline, provides investors with the tools to interpret economic indicators. In a market driven by information, continuous learning contributes to informed decision-making.

XVI. Exit Strategies

A. Knowing When to Sell

Investors need a clear exit strategy. This involves knowing when to sell to lock in profits or cut losses, a crucial aspect of successful stock market participation.

B. Strategies for Exiting Positions

Having well-defined strategies for exiting positions is vital. India’s market, marked by increased retail participation (NSDL), requires investors to be proactive in their decision-making.

XVII. Reinvesting Profits

A. Compounding Returns

Reinvesting profits is a powerful strategy for compounding returns over time. India’s top traders, earning significant incomes (Economic Times), often attribute their success to smart reinvestment practices.

B. Reinvestment Strategies

Investors should devise reinvestment strategies aligned with their financial goals. This approach ensures continuous wealth accumulation and financial growth.

XX. Conclusion

A. Recap of Key Points

As we conclude this comprehensive guide on investing in the Indian stock market, let’s recap key insights that can empower investors to navigate this dynamic financial landscape successfully.

Data and Reference:

- The number of Demat accounts in India has exceeded 100 million, signifying a significant increase in retail participation (NSDL).

- India’s GDP is projected to grow at 7.4% in 2024, making it one of the fastest-growing economies globally (World Bank).

- The Indian stock market is the 5th largest in the world by market capitalization, exceeding $3.7 trillion, providing diverse investment opportunities (Bloomberg).

Key Points:

- Retail Participation Surge: The surge in Demat accounts highlights the growing interest and participation of retail investors in India’s stock market. This influx of new investors brings both opportunities and challenges, emphasizing the need for informed decision-making.

- Economic Growth Potential: With a projected GDP growth of 7.4%, India offers a robust economic backdrop for investors. Understanding the correlation between economic growth and market dynamics is crucial for crafting effective investment strategies.

- Market Capitalization Significance: The substantial market capitalization positions India as a major player in the global stock market. Investors can leverage this diverse market to build well-balanced portfolios and explore a variety of investment avenues.

B. Final Words of Advice

In the journey of investing in Indian stocks, it’s essential to embrace a proactive and educated approach. Here are some final words of advice to guide investors on their financial endeavors:

Data and Reference:

- Professional certifications like the NISM certifications enhance knowledge and credibility, contributing to informed decision-making in the evaluation process (AmbitionBox).

- Numerous online and offline courses are available to learn the basics of stock trading and investing, emphasizing the importance of education in navigating economic indicators (Provided Statistics).

Key Points:

- Continuous Learning: The availability of professional certifications and educational resources underscores the importance of continuous learning. Staying informed about market trends, investment strategies, and economic indicators is vital for success.

- Strategic Evaluation: Whether evaluating dividend stocks, choosing the right investments, or developing an investment strategy, a strategic and well-researched approach is key. Leverage available data, statistics, and educational resources to make informed decisions aligned with your financial goals.

- Emotional Resilience: Acknowledge the role of emotions in investment decisions and cultivate emotional resilience. The volatile nature of the market and the challenges highlighted by studies emphasize the need for a disciplined and resilient mindset.