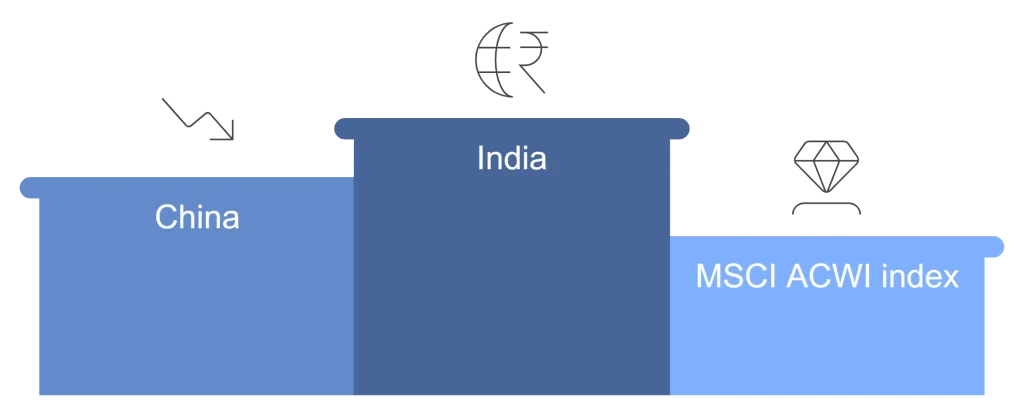

India has achieved a historic milestone by surpassing China in the MSCI All-Country World Investable Market Index (ACWI), signaling a paradigm shift in global financial markets.

With a weighting of 22.27% compared to China’s 21.58%, India now holds the sixth-largest position in this benchmark.

This development underscores India’s growing economic strength, increasing appeal to foreign investors, and a resilient market structure. Let’s delve into the factors driving this achievement, its implications for global investors, and what lies ahead for Indian markets.

Introduction: Why India’s MSCI Milestone Matters

For the first time, India has overtaken China in a global stock benchmark, cementing its position as the leader in emerging markets. This historic shift reflects India’s rapid economic growth, investor-friendly reforms, and record-breaking foreign direct investment (FDI) inflows.

Did you know that India’s stock market is now worth over $5 trillion, making it one of the most robust financial ecosystems globally?

For global investors, this marks a pivotal opportunity to capitalize on India’s growth story and diversify portfolios in a dynamic emerging market.

Understanding the MSCI Index and India’s Growing Role in Global Finance

The MSCI All-Country World Investable Market Index (ACWI) tracks the performance of equity markets across 23 developed and 24 emerging economies. It serves as a vital benchmark for institutional and retail investors seeking exposure to global markets.

Key Insights:

- Weighting Dynamics: India’s increased weighting reflects its economic resilience and market stability.

- Global Impact: Investors use the MSCI index to guide portfolio allocations, making India’s rise significant for emerging market exposure.

India’s ascent in the index underscores a growing confidence among global investors in its financial markets, bolstered by robust reforms and a stable macroeconomic environment.

Why India is Outpacing China in Global Stock Benchmarks

Several factors have propelled India ahead of China in the MSCI index:

a. Economic Resilience

India’s GDP grew by 6.7% year-over-year in the first quarter of fiscal 2024–2025, demonstrating its ability to withstand global economic uncertainties.

b. Record-Breaking FDI

India attracted unprecedented foreign investment in 2024, particularly in sectors like technology, renewable energy, and infrastructure.

c. Market Liquidity and Reforms

Regulatory measures aimed at improving transparency, protecting investor interests, and promoting ease of doing business have made India’s markets more accessible.

Pro Tip: The National Stock Exchange (NSE) reported a market capitalization exceeding $5 trillion in 2024, further highlighting its financial strength.

Why China’s Influence is Waning

China’s reduced weighting in the MSCI index is driven by several challenges:

a. Regulatory Crackdowns

Aggressive regulatory actions targeting technology and education sectors have created uncertainty and deterred foreign investors.

b. Slower Economic Growth

China’s growth has decelerated due to domestic economic challenges and geopolitical tensions.

c. Declining Foreign Investment

Restrictive policies and reduced market transparency have led to a significant drop in foreign capital inflows.

What India’s MSCI Milestone Means for Global Investors

India’s rise in the MSCI index has far-reaching implications for portfolio management and investment strategies:

a. Enhanced Portfolio Diversification

Investors can diversify their portfolios by increasing exposure to India’s high-growth sectors, balancing risks associated with other regions.

b. Strategic Emerging Market Exposure

India’s prominence provides global investors with a stable entry point into emerging markets.

c. Growing Investor Confidence

The milestone reinforces India’s status as a reliable and attractive investment destination, encouraging institutional and retail investors alike.

Opportunities in India’s Thriving Markets

India’s economic growth presents compelling opportunities across various sectors:

a. Technology

India’s tech sector, supported by a vibrant startup ecosystem, is attracting significant global investments.

Example: India is now home to over 100 unicorns, reflecting its global technology dominance.

b. Green Energy

Government initiatives aim to achieve 50% renewable energy capacity by 2030, creating substantial opportunities in solar, wind, and electric vehicles.

c. Infrastructure

Projects under the National Infrastructure Pipeline (NIP) are driving long-term investments in transportation, logistics, and urban development.

Stat: The BSE SENSEX Index grew by 6.80% in 2024, reflecting strong market performance across sectors.

Challenges India Must Overcome

Despite its success, India faces challenges that could impact its growth trajectory:

a. Economic Inequality

Disparities in income and access to resources may hinder inclusive growth.

b. Global Dependencies

India’s reliance on foreign markets for trade and investment makes it vulnerable to global shocks.

c. Sustaining Reforms

Continued regulatory improvements are essential to maintaining investor confidence and attracting long-term capital.

How Investors Can Capitalize on India’s Growth Story

Global investors can take advantage of India’s rising prominence with these strategies:

a. Explore Indian ETFs

Exchange-traded funds (ETFs) focused on Indian markets offer diversified exposure to high-growth sectors.

b. Invest in Key Sectors

Focus on technology, renewable energy, and infrastructure to align with India’s growth trajectory.

c. Stay Updated on Policy Changes

Monitor regulatory reforms and macroeconomic indicators to make informed investment decisions.

FAQs and Quick Takeaways

- What does India’s rise in the MSCI index mean for investors? India’s growing weighting highlights its economic resilience and presents new opportunities for portfolio diversification.

- How should investors respond to this milestone? Investors should consider increasing exposure to India’s markets, focusing on ETFs and high-growth sectors like tech and green energy.

Key Takeaways:

- India’s weighting of 22.27% in the MSCI index underscores its financial stability and growth potential.

- Challenges like economic inequality and external dependencies must be addressed to sustain momentum.

- Global investors should actively monitor India’s evolving market dynamics for strategic opportunities.

Conclusion: A Transformative Milestone in Global Markets

India’s rise in the MSCI All-Country World Index is a testament to its robust economic policies, investor-friendly reforms, and growing global influence. For investors, this milestone signals an unparalleled opportunity to capitalize on India’s thriving sectors and resilient market structure.

Are you ready to tap into India’s growth story? Explore Indian ETFs or consult a financial advisor to diversify your portfolio with emerging market opportunities.