Indian Stock Market Investing

Welcome to the exciting world of Indian stock market investing! If you’re new to the game or a seasoned player looking to up your ante, you’re in the right place.

The Indian stock market offers a myriad of opportunities for investors to grow their wealth, but it can also be a daunting arena to navigate, especially in today’s fast-paced digital age.

Picture this: You’re eager to dip your toes into the stock market waters, but where do you start? With an overwhelming amount of information available online, it’s easy to feel lost in a sea of financial jargon and conflicting advice.

That’s where we come in – to be your guiding light through the foggy landscape of stock market investing.

Now, let’s address the elephant in the room – why should you bother with Indian stock market investing in the first place?

Well, let me hit you with some hard-hitting facts. According to a report by NASSCOM & Zinnov (2022), the Indian FinTech market is projected to skyrocket to a staggering US$1.2 trillion by 2025.

That’s right, trillion with a “T”! This meteoric rise underscores the increasing reliance on online financial tools, making it more crucial than ever for investors to equip themselves with the right resources.

But here’s the kicker – despite the booming FinTech industry, a startling revelation from the Association of Mutual Funds in India (AMFI) Investor Education Report (2023) shows that only 38% of Indian investors reported conducting thorough research before investing.

Let that sink in for a moment. With less than half of investors doing their due diligence, it’s no wonder that many end up swimming against the tide, struggling to stay afloat in the tumultuous waters of the stock market.

But fear not, dear reader, for knowledge is power, and we’re here to arm you with the tools you need to thrive in the Indian stock market. From understanding the basics of stock selection to deciphering market trends and everything in between, consider us your trusty co-pilots on this exhilarating investment journey.

So buckle up, grab a cup of chai, and get ready to embark on an adventure through the dynamic world of Indian stock market investing.

With our expert guidance and a bit of savvy know-how, you’ll be navigating the markets like a seasoned pro in no time. Let’s dive in and uncover the secrets to success together!

Stay tuned as we delve deeper into the intricacies of stock market investing and unveil the top 7 websites that every Indian investor should have in their arsenal. It’s time to take your financial future into your own hands – let’s make some magic happen!

II. Understanding Stock Market Basics

Alright, buckle up, folks! Before we dive headfirst into the wild and wonderful world of Indian stock market investing, let’s lay down some groundwork.

Picture this section as our crash course in Stock Market 101 – consider me your friendly neighborhood stock market guru here to break it down for you.

So, what the heck is the stock market anyway? Well, think of it as a bustling marketplace where buyers and sellers come together to trade shares of ownership in companies.

Yep, you heard me right – when you buy a stock, you’re essentially buying a tiny piece of a company. It’s like owning a slice of your favorite pizza joint, except instead of cheesy goodness, you’re investing in potential profits.

But hold your horses – before you start splurging on stocks left and right, it’s crucial to understand how this whole shebang works. Let’s break it down Barney-style, shall we?

First up, we’ve got the basics. We’re talking about things like stock prices, market trends, and supply and demand.

Picture this: Imagine you’re at a lemonade stand (we’re keeping it simple here, folks). If there’s a high demand for lemonade on a scorching hot day, you can bet your bottom dollar that the price of lemonade is gonna skyrocket. It’s all about supply and demand, baby!

Next on the agenda, we’ve got market indices. Now, I know what you’re thinking – “What the heck are market indices, and why should I care?”

Well, my friend, market indices are like the report cards of the stock market.

They give you a snapshot of how well (or not-so-well) the market is doing at any given time. Think of indices like the Sensex of Nifty as your trusty sidekicks, helping you gauge the overall health of the market.

Now, let’s talk about the big players – bulls and bears. No, I’m not talking about zoo animals here (although that would be pretty cool).

In the stock market, bulls and bears are like two sides of the same coin. Bulls are optimistic folks who believe that the market is on the up and up, while bears are, well, bearish – they think the market is headed for a tumble.

It’s like a never-ending game of tug-of-war between the bulls and the bears, with investors caught in the middle.

And last but not least, we’ve got the golden rule of investing – diversification. Repeat after me: “Thou shalt not put all thy eggs in one basket.”

Diversification is like your financial safety net, helping you spread out your investments across different assets to minimize risk. It’s all about playing it smart and not putting all your moolah into one risky venture.

So there you have it, folks – the ABCs of stock market basics. Consider yourself officially initiated into the world of Indian stock market investing!

But remember, this is just the tip of the iceberg – there’s a whole world of knowledge out there waiting for you to explore.

So strap in, stay curious, and get ready to ride the rollercoaster of the stock market like a seasoned pro. Let’s do this!

III. The Importance of Information in Stock Market Investing

Alright, folks, let’s talk about the bread and butter of stock market investing – information. Picture this: You’re gearing up for a big hike in the mountains. Would you head out into the wilderness without a map, compass, or a clue about the terrain ahead?

Heck no! The same goes for the stock market – you wouldn’t dare venture into the wild world of investing without arming yourself with the right information.

Now, let me hit you with some hard-hitting stats. According to the Association of Mutual Funds in India (AMFI) Investor Education Report (2023), a whopping 62% of Indian investors admitted to not conducting thorough research before investing.

Yikes, talk about flying blind! It’s like trying to navigate a maze with a blindfold on – you’re bound to hit a few dead ends along the way.

But fear not, my fellow investors, for knowledge is power, and in the world of stock market investing, information is your best friend.

Whether you’re a seasoned pro or a greenhorn just dipping your toes in the water, having access to reliable, up-to-date information can make all the difference between striking gold and striking out.

So, why is information so darn important in the world of stock market investing? Well, for starters, it’s all about making informed decisions.

Think of information as your trusty compass, guiding you through the treacherous terrain of the stock market and helping you steer clear of potential pitfalls.

But here’s the kicker – not all information is created equal. With a plethora of news outlets, financial websites, and social media platforms vying for your attention, it can be tough to separate the wheat from the chaff.

That’s where credibility comes into play – you want to make sure you’re getting your information from reliable, trustworthy sources.

Take it from me – I’ve seen my fair share of investors get burned by following the wrong advice or falling victim to misinformation.

It’s like trying to build a house without a solid foundation – sooner or later, it’s bound to come crashing down around you.

Don’t worry, my friends, because I’m here to guide you in the right direction. When it comes to stock market investing, knowledge is your most valuable asset.

So do your homework, stay informed, and remember – with great information comes great responsibility. Now go forth and conquer the stock market like the savvy investor you were born to be!

IV. Criteria for Evaluating Stock Market Websites

Alright, folks, let’s get down to brass tacks – how do you separate the wheat from the chaff when it comes to stock market websites?

With a bazillion options out there, it can feel like trying to find a needle in a haystack. But fear not, my fellow investors, for I’m here to break it down for you.

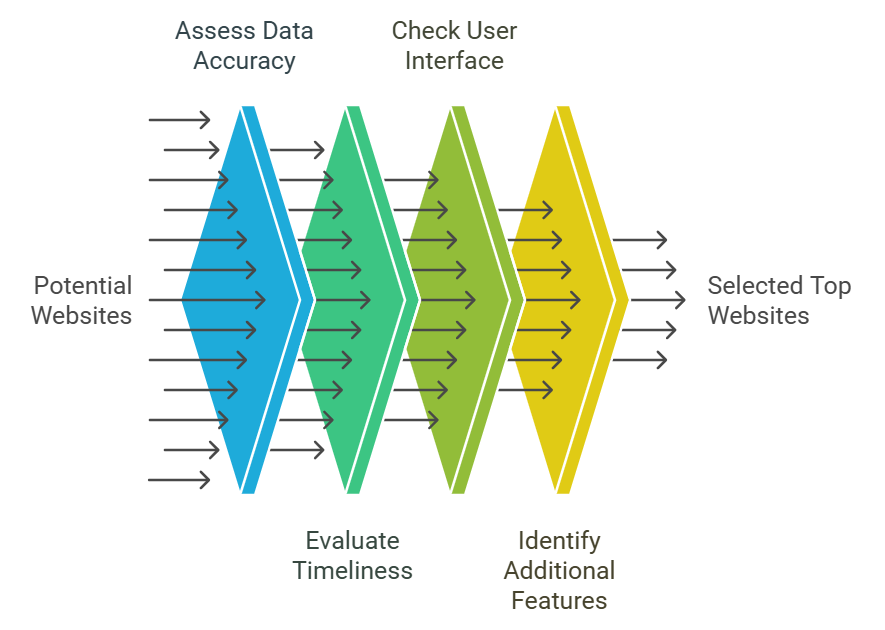

Now, when it comes to evaluating stock market websites, there are a few key criteria you’ll want to keep in mind.

Think of it like shopping for a new car – you wouldn’t just waltz into the dealership and pick the first shiny vehicle you lay eyes on, right? You’d do your homework, kick the tires, and make sure it’s got all the bells and whistles you’re looking for.

The same goes for stock market websites – you want to make sure you’re getting the most bang for your buck.

First up, we’ve got accuracy and timeliness of data. Ain’t nobody got time for stale information, am I right?

When you’re making split-second decisions in the fast-paced world of stock market investing, you need data that’s as fresh as a daisy.

Look for websites that pride themselves on delivering real-time updates and accurate information – trust me, your portfolio will thank you later.

Next on the chopping block, we’ve got a user-friendly interface. Now, I don’t know about you, but I’ve got zero patience for clunky websites that look like they were designed by a tech-illiterate grandma (no offense, Grandma).

You want a website that’s sleek, intuitive, and easy on the eyes – none of this eye-straining, hair-pulling nonsense.

But wait, there’s more! You’ll also want to consider additional features and tools. I’m talking about things like stock screeners, educational resources, and interactive charts – the more bells and whistles, the better! After all, why settle for a plain ol’ website when you could have one that’s chock-full of nifty tools to help you crush the competition?

Now, I know what you’re thinking – “But how do I know which websites are the cream of the crop?” Well, fear not, my friend, for I’ve got you covered.

From tried-and-true favorites like Moneycontrol and Ticker Tape to up-and-coming contenders like MarketsMojo and Value Research, I’ve scoured the web to bring you the best of the best.

So there you have it, folks – the lowdown on evaluating stock market websites like a seasoned pro. Remember, when it comes to your investment journey, knowledge is power.

So do your homework, shop around, and find the website that’s the perfect fit for your investing style. Happy hunting!

V. Top 7 Websites for Indian Stock Market Investors

Alrighty, folks, drumroll please – it’s time to unveil the cream of the crop, the creme de la creme, the top 7 websites that every Indian stock market investor should have in their arsenal. I’ve scoured the interwebs, sifted through mountains of data, and consulted with the investing gods themselves to bring you this epic lineup. So, without wasting any more time, let’s jump straight into it!

Moneycontrol :

Overview: A comprehensive financial portal offering news, analysis reports, and company financials.

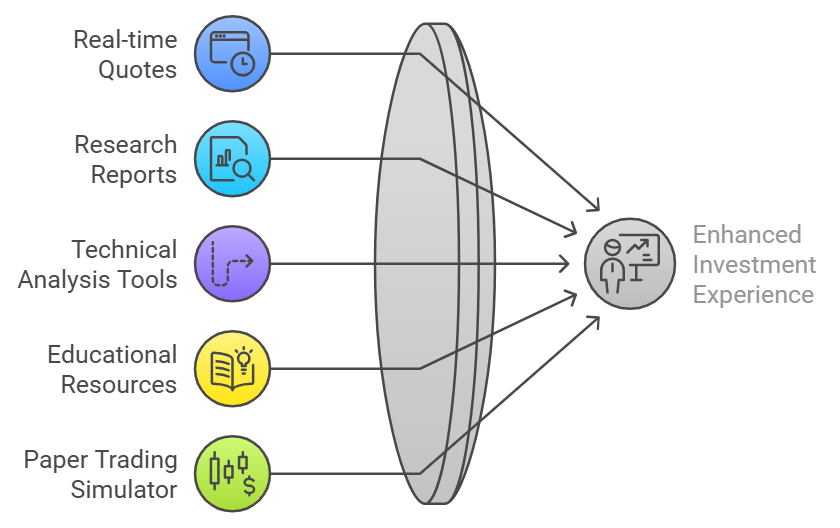

Oh, Moneycontrol, how do I love thee? Let me count the ways. This bad boy is like the Swiss Army knife of stock market websites – it’s got everything and the kitchen sink. Real-time stock quotes? Check. In-depth research reports from analysts? You betcha. Company financials, news, and screener tools? You better believe it. And don’t even get me started on the educational resources and investment calculators – it’s like a stock market nerd’s paradise!

Key Features:

- Real-time stock quotes and market updates.

- In-depth research reports from analysts.

- Company financials, news, and screener tools.

- Educational resources and investment calculators.

Ticker Tape :

Overview: Focuses on empowering investors with research tools, particularly for technical analysis.

Ticker Tape, This little gem is all about empowering investors with research tools, particularly for technical analysis. I’m talking about advanced charting functionalities, educational resources on technical analysis concepts, stock screeners based on technical parameters – you name it, they’ve got it. And let’s not forget about the paper trading simulator – it’s like having your very own virtual stock market playground!

Key Features:

- Advanced charting functionalities with technical indicators.

- Educational resources on technical analysis concepts.

- Stock screeners based on technical parameters.

- Paper trading simulator to practice trading strategies.

Trendlyne :

Overview: Caters to both fundamental and technical analysis enthusiasts.

Trendlyne, This platform is like the holy grail for both fundamental and technical analysis enthusiasts. From detailed company financials and valuation ratios to company news and screener tools, Trendlyne has got it all. And let’s not forget about the portfolio tracking and analysis tools – it’s like having your own personal finance guru at your fingertips!

Key Features:

- Detailed company financials, valuation ratios, and technical charts.

- Company news and screener tools for filtering stocks.

- Portfolio tracking and analysis tools.

- Fundamental and technical research reports.

Markets Mojo :

Overview: Leverages data and algorithms to provide actionable insights for value investors.

MarketsMojo, undervalued stocks.” This leverages data and algorithms to provide actionable insights for value investors.

I’m talking about identifying potentially undervalued stocks based on intrinsic value calculations, offering portfolio health checks and performance analysis, and providing company news and fundamental data.

It’s like having your very own investment genie granting all your wishes!

Key Features:

- Identifies potentially undervalued stocks based on intrinsic value calculations.

- Offers portfolio health checks and performance analysis.

- Provides company news and fundamental data.

- Stock screener based on value investing criteria.

Value Research :

Overview: Renowned for mutual fund analysis, they also offer insightful stock research reports.

Value Research, This platform is renowned for its in-depth research reports covering financials, valuations, and growth potential. From stock recommendations and portfolio analysis tools to mutual fund ratings and performance comparisons, Value Research has got you covered. It’s like having your own personal finance professor guiding you through the murky waters of investing!

Key Features:

- In-depth research reports covering financials, valuations, and growth potential.

- Stock recommendations and portfolio analysis tools.

- Mutual fund ratings and performance comparisons.

Economic Times Market :

Overview: Provides real-time market updates, breaking news, and expert analysis.

Economic Times Markets, you had me at “real-time updates.” This platform provides real-time market updates, breaking news, and expert analysis – it’s like having your own personal finance newsroom at your fingertips.

And let’s not forget about the expert opinions and market commentary – it’s like having your own team of financial gurus whispering sweet nothings in your ear!

Key Features:

- Live market data with news and analysis articles.

- Expert opinions and market commentary.

- Stock recommendations and portfolio tracking tools.

NSE India & BSE India :

Overview: Official websites of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE).

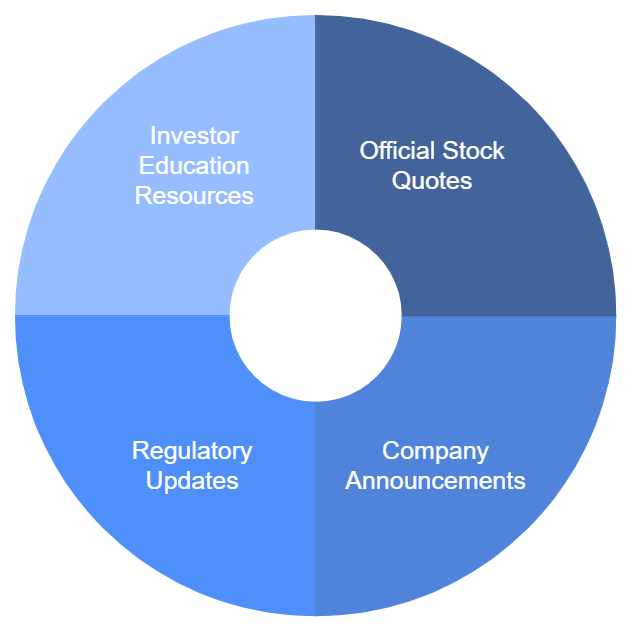

NSE India and BSE India, you are the OGs of the stock market. These official websites of the National Stock Exchange (NSE) and the Bombay Stock Exchange (BSE) are like the holy grail for official market data and announcements.

From access to official stock quotes and company announcements to regulatory updates and investor education resources, NSE India and BSE India have got it all. It’s like having the keys to the kingdom of the stock market!

Key Features:

- Access to official stock quotes, company announcements, and listing information.

- Regulatory updates and market data directly from the source.

- Investor education resources and downloadable reports.

And there you have it, folks – the top 7 websites for Indian stock market investors, handpicked and curated just for you. So what are you waiting for? Dive in, explore, and may the stock market gods smile upon you!

VI. Case Studies: Success Stories with the Help of These Websites

Alright, folks, get ready to be inspired – it’s time for some real-life success stories straight from the trenches of the stock market!

Today, I’m gonna share with you some juicy case studies of investors who’ve hit it big with the help of these top-notch websites. So, grab yourself a snack, get comfortable, and let’s dive into it!

Case Study 1: Meet Priya, the Tech Wiz

Our first success story comes from Priya, a young tech enthusiast with a passion for all things digital.

Priya had been dabbling in the stock market for a while but struggled to find reliable resources to help her navigate the complex world of investing. That is until she stumbled upon Ticker Tape – her knight in shining armor!

Tickertape’s advanced charting tools and technical analysis resources were just what Priya needed to take her investing game to the next level.

Armed with real-time market data and actionable insights, Priya was able to identify lucrative investment opportunities in the tech sector and make some killer trades.

Fast forward a few months, and Priya’s portfolio had grown by leaps and bounds – all thanks to Ticker Tape!

Case Study 2: Say Hello to Raj, the Value Hunter

Next up, we’ve got Raj, a seasoned investor with a keen eye for value. Raj had been on the hunt for undervalued stocks that had the potential for explosive growth, but finding them was like searching for a needle in a haystack. That is until he discovered MarketsMojo – his secret weapon in the world of value investing!

MarketsMojo’s proprietary algorithms and data-driven insights helped Raj identify hidden gems in the market that other investors had overlooked.

Armed with this newfound knowledge, Raj dove headfirst into the world of value investing and never looked back.

Before long, he was reaping the rewards of his savvy investment decisions, with his portfolio outperforming the market by a mile.

Raj credits MarketsMojo for giving him the edge he needed to succeed in the cutthroat world of stock market investing.

Case Study 3: Introducing Anu, the Fundamental Guru

Last but certainly not least, we’ve got Anu, a finance whiz with a knack for fundamental analysis. Anu had been searching high and low for a platform that could provide her with in-depth research reports and company financials to help her make informed investment decisions.

That’s when she stumbled upon Value Research – her saving grace in the world of fundamental analysis!

Value Research’s comprehensive research reports and valuation tools were just what Anu needed to analyze stocks with surgical precision.

Armed with this arsenal of financial data, Anu was able to build a rock-solid portfolio of high-quality stocks that stood the test of time.

Today, Anu is living her best life, basking in the glow of her investment success – all thanks to Value Research!

And there you have it, folks – three epic success stories of investors who’ve conquered the stock market with the help of these top-notch websites.

Whether you’re a tech enthusiast like Priya, a value hunter like Raj, or a fundamental guru like Anu, there’s a website out there waiting to help you achieve your investment dreams.

So what are you waiting for? Dive in, explore, and let these success stories inspire you to reach new heights in the world of stock market investing!

VII. Tips for Maximizing the Use of Stock Market Websites

Alright, my fellow investors, buckle up because I’m about to drop some serious knowledge bombs on how to squeeze every last drop of juice out of these stock market websites.

Think of this as your insider’s guide to unlocking the full potential of these bad boys and taking your investing game to the next level. So grab a pen, take some notes, and let’s dive right in!

Tip 1: Set Alerts and Notifications

First things first, let’s talk about setting alerts and notifications. Picture this – you’re chilling on the couch, binge-watching your favorite Netflix series, when suddenly, your phone buzzes with a juicy stock market update.

That’s the power of alerts and notifications, my friends – they keep you in the loop without having to lift a finger. Whether it’s price alerts, news updates, or market trends, make sure to set up alerts for the stocks and sectors you’re interested in to stay one step ahead of the game.

Tip 2: Utilize Analytical Tools

Next up, let’s talk about analytical tools. Now, I know what you’re thinking – “Analytical tools? Ain’t nobody got time for that!”

But trust me, my friend, these bad boys are worth their weight in gold. From advanced charting functionalities to stock screeners and technical indicators, analytical tools can help you analyze stocks with surgical precision and identify lucrative investment opportunities.

So don’t sleep on these tools – embrace them, learn them, and watch your portfolio soar to new heights.

Tip 3: Stay Updated with Market Trends

Last but certainly not least, let’s talk about staying updated with market trends. Now, I’m not talking about obsessively refreshing your Twitter feed every five seconds (although guilty as charged, am I right?).

I’m talking about keeping a finger on the pulse of the market and staying informed about the latest trends, news, and developments.

Whether it’s reading up on market analysis reports, tuning in to financial podcasts, or joining online investor communities, staying updated with market trends is key to making informed investment decisions.

And there you have it, folks – three epic tips for maximizing the use of stock market websites like a seasoned pro.

Whether you’re setting alerts and notifications, utilizing analytical tools, or staying updated with market trends, these tips will help you navigate the murky waters of the stock market with confidence and ease.

So what are you waiting for? Put these tips into action, unleash the full potential of these stock market websites, and watch your investment journey take flight!

VIII. Summary: Empowering Your Investment Journey

Alright, folks, it’s time to wrap things up and put a nice, shiny bow on our investment journey. We’ve covered a lot of ground today, from understanding the basics of the stock market to diving deep into the top websites that every Indian investor should have in their arsenal.

So let’s take a moment to reflect on what we’ve learned and how we can use this knowledge to supercharge our investment journey.

First and foremost, we’ve learned that the stock market isn’t just some mysterious, intimidating beast – it’s a vibrant ecosystem filled with opportunities waiting to be seized. By understanding the basics of how the stock market works and the importance of reliable resources, we can navigate this wild terrain with confidence and ease.

We’ve also discovered the power of information in driving investment decisions. Whether it’s conducting thorough research before investing or utilizing a variety of resources for well-rounded analysis, having access to reliable, up-to-date information is key to success in the stock market.

But it’s not just about the quantity of information – it’s also about the quality. By evaluating stock market websites based on criteria like accuracy of data, user-friendly interface, and additional features and tools, we can ensure that we’re getting the most bang for our buck.

And let’s not forget about the success stories we’ve heard along the way. From tech enthusiasts like Priya to value hunters like Raj and fundamental gurus like Anu, these real-life examples serve as a reminder that with the right tools and resources, anything is possible in the world of stock market investing.

So as we embark on our investment journey, armed with the knowledge and insights we’ve gained today, let’s remember to set alerts and notifications, utilize analytical tools, and stay updated with market trends.

By putting these tips into action and unleashing the full potential of the top stock market websites, we can take our investment journey to new heights and achieve our financial goals.

And remember, my fellow investors – the stock market may be unpredictable at times, but with the right mindset, strategy, and resources, we have the power to turn our investment dreams into reality. So here’s to empowering our investment journey, one trade at a time. Cheers to the journey ahead!

Frequently Asked Questions (FAQs)

Alright, folks, it’s time to tackle some burning questions that may be lingering in the back of your mind. Whether you’re a seasoned investor or a greenhorn just getting started, these FAQs are here to clear up any confusion and set you on the path to investing success. Alright, let’s dive in and get those questions answered!

Q1: What are the risks associated with investing in the stock market?

A: Ah, the age-old question – what are the risks of investing in the stock market? Well, let me explain it to you, my friend. Investing in the stock market comes with its fair share of risks, including market volatility, economic downturns, and company-specific risks. But remember, with great risk comes great reward – and by diversifying your portfolio, doing your homework, and staying informed, you can mitigate these risks and come out on top.

Q2: How do I choose the best website for my investment needs?

A: Ah, the million-dollar question – how do you choose the best website for your investment needs? Well, my friend, it all comes down to what you’re looking for. Are you a technical analysis whiz looking for advanced charting tools? Or maybe you’re a fundamental analysis aficionado in search of in-depth research reports? Whatever your investment style, there’s a website out there waiting to meet your needs – so do your homework, shop around, and find the one that’s the perfect fit for you.

Q3: Can these websites guarantee success in the stock market?

A: Ah, the age-old question – can these websites guarantee success in the stock market? Well, my friend, let me level with you – there are no guarantees when it comes to investing. The stock market is a wild and unpredictable beast, and even the best-laid plans can go awry. But with the right resources, the right mindset, and a healthy dose of determination, you can stack the odds in your favor and increase your chances of success. So dive in, explore, and may the stock market gods smile upon you!

Q4: What are some common mistakes to avoid while using stock market websites?

A: Ah, the pitfalls of investing – what are some common mistakes to avoid while using stock market websites? Well, my friend, let me share a few pearls of wisdom with you. First off, don’t believe everything you read – always double-check your sources and do your own research. Second, don’t let emotions cloud your judgment – stick to your investment strategy and stay disciplined. And finally, don’t put all your eggs in one basket – diversify your portfolio and spread out your risk. Follow these tips, my friend, and you’ll be well on your way to investment success!

Q5: How can I stay updated with market trends and news?

A: Ah, staying updated with market trends and news is key to staying ahead of the curve. Luckily, in today’s digital age, there are plenty of ways to keep your finger on the pulse of the market. You can subscribe to financial news websites, follow influential investors and analysts on social media, or even set up Google Alerts for specific keywords related to your interests. The key is to find a few reliable sources that you trust and make a habit of checking them regularly to stay informed.

Q6: Are there any free resources available for learning about stock market investing?

A: Absolutely! There’s a wealth of free resources available for learning about stock market investing, from educational websites and blogs to YouTube channels and podcasts. Many brokerage firms also offer free educational resources for their clients, including webinars, tutorials, and research reports. And don’t forget about online forums and communities, where you can connect with fellow investors and share knowledge and experiences. The key is to take advantage of these resources and never stop learning.

Q7: How can I avoid making emotional decisions while investing?

A: Ah, the age-old struggle – how to avoid making emotional decisions while investing. It’s easier said than done, but there are a few strategies you can employ to keep your emotions in check. First off, stick to your investment plan and avoid making impulsive decisions based on fear or greed. Second, take a long-term perspective and focus on the big picture rather than getting caught up in short-term fluctuations. And finally, consider automating your investments through strategies like dollar-cost averaging, which can help remove the temptation to tinker with your portfolio based on emotions. Remember, investing is a marathon, not a sprint – so stay disciplined and keep your emotions in check.

Q8: How can I evaluate the credibility of a stock market website?

A: Ah, evaluating the credibility of a stock market website is crucial to ensuring you’re getting reliable information. There are a few factors to consider when assessing a website’s credibility, including the reputation of the website and its creators, the quality of the content and research reports, and the transparency of the sources cited. You can also look for independent reviews and testimonials from other users to get a sense of the website’s reputation. And don’t forget to trust your gut – if something seems too good to be true, it probably is.