Introduction

In the dynamic landscape of the Indian stock market, where fortunes are made and lost in the blink of an eye, the role of share market advisory services cannot be overstated.

Picture this: as the market ebbs and flows, the right guidance can be the compass steering investors through uncertainty.

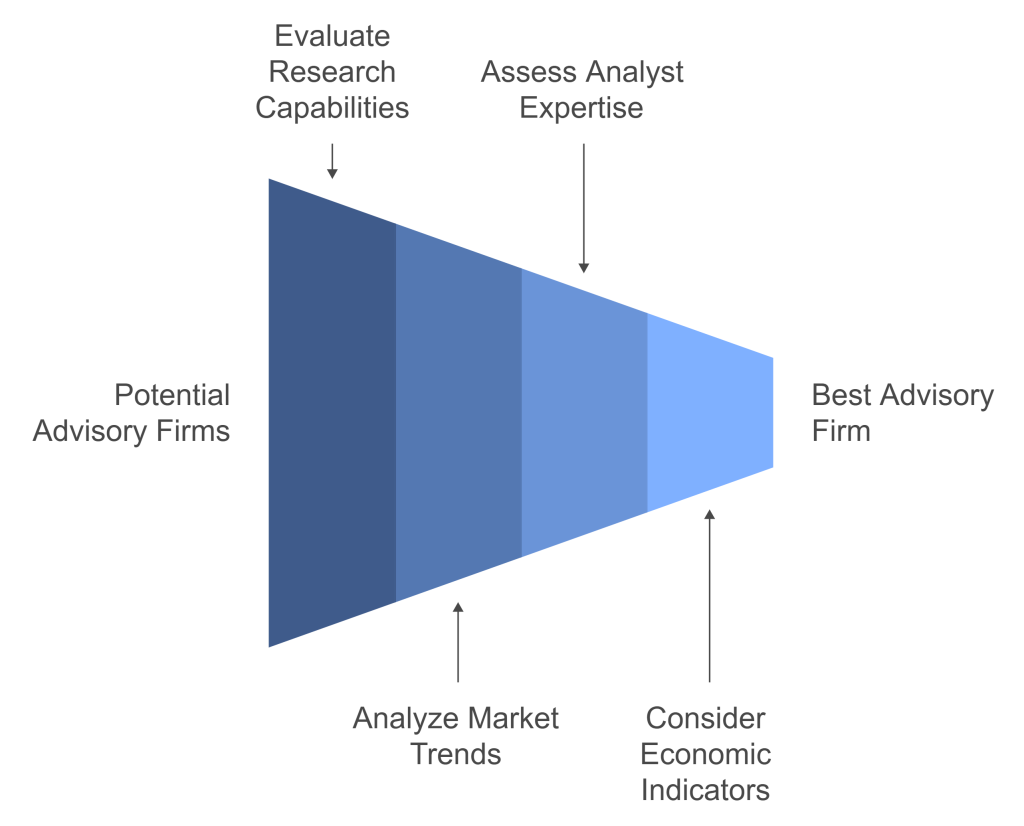

2. How to Choose the Best Stock Market Advisory Company in India

Navigating the vast sea of stock market advisory services in India requires a discerning eye.

As you set out on your quest to find the right financial partner for your investment journey, consider the following key factors:

Research Process:

- Look for a company that places a paramount emphasis on in-depth research.

- A reliable advisory firm should have a team of seasoned analysts dedicated to studying market trends, company performances, and economic indicators.

Proven Track Record:

- Assess the historical performance of the advisory company.

- A track record of consistent returns over different market conditions is a strong indicator of their expertise and reliability.

Comprehensive Analysis:

- A top-notch advisory service will provide more than just stock recommendations.

- They should offer comprehensive market analyses, helping you understand the rationale behind their suggestions and empowering you with knowledge.

Risk Management Strategies

Transparency and Communication:

- Gauge the company’s approach to risk management. The best advisory firms have robust strategies in place to mitigate risks, ensuring that your investments are safeguarded in the face of market volatility.

- Transparent communication is key. Choose a company that keeps you informed about your investments, providing regular updates and reports.

- This transparency fosters trust and allows you to stay in control of your financial decisions.

Client Testimonials and Reviews:

- Explore client testimonials and reviews. Real-life experiences of other investors can provide valuable insights into the efficacy of the advisory service.

- Platforms like social media and review websites are excellent resources for this.

Regulatory Compliance:

- Every investor is unique, with distinct financial goals and risk tolerances. Opt for an trading advisory service that offers personalized solutions, taking into account your specific needs and tailoring their advice accordingly.

- Ensure that the advisory company is registered with SEBI (Securities and Exchange Board of India).

- SEBI registration is a mark of credibility and adherence to regulatory standards.

Fee Structure:

- Understand the fee structure. Different advisory services may have varying fee models.

- Be clear about the charges involved and ensure they align with your budget and expectations.

Accessibility and Support:

- Consider the accessibility and support provided by the advisory firm.

- A responsive customer support team and easy access to your advisors can make a significant difference in your overall experience.

Armed with these considerations, you can make an informed decision when selecting the best stock market advisory company in India. Remember, the right choice can be the catalyst for your financial success.

3. Benefits of a Stock Market Advisory Company

Engaging the services of a stock market advisory firm is a strategic move that can yield a multitude of benefits for investors.

Here’s a detailed breakdown of why partnering with such a firm can be instrumental in enhancing your investment journey:

Expert Investment Tips:

- One of the primary advantages is gaining access to expert investment tips.

- Advisory services employ seasoned professionals who stay abreast of market trends, enabling them to provide timely and informed recommendations tailored to your investment goals.

Diversification Strategies:

- A reliable advisory company will guide you in building a diversified investment portfolio.

- Diversification is crucial for spreading risk and ensuring that your investments are not overly concentrated in a single sector or asset class.

Risk Mitigation:

- Effective risk management is a hallmark of quality advisory services. Professionals in these firms utilize sophisticated tools and analysis to identify and mitigate risks, safeguarding your investments against market fluctuations.

Timely Market Updates:

- Stay informed with timely market updates. Advisory services keep you in the loop with the latest developments, ensuring you can make well-informed decisions based on real-time information.

Education and Empowerment:

- Beyond mere stock recommendations, a good advisory service educates investors. Learn about market dynamics, investment strategies, and the rationale behind their suggestions.

- This knowledge empowers you to make independent and informed financial decisions.

Personalized Advice:

- Enjoy the luxury of personalized advice. Advisory services take into account your unique financial situation, risk tolerance, and investment objectives to tailor their recommendations specifically to your needs.

Efficient Portfolio Management

Long-Term Wealth Creation

Quick Adaptation to Market Changes:

- Professional portfolio management is a forte of stock market advisory companies. Benefit from a well-managed portfolio that aligns with your financial goals and evolves according to market conditions.

- Position yourself for long-term wealth creation. Advisory services often focus on strategies that go beyond short-term gains, aiming to build sustainable wealth over the years.

- Markets can be unpredictable, and swift adaptation is crucial. Advisory services, with their constant analysis and monitoring, enable quick adjustments to your portfolio in response to changing market conditions.

Peace of Mind:

- Perhaps one of the most valuable benefits is the peace of mind that comes with professional guidance.

- Knowing that experts are diligently managing and overseeing your investments allows you to navigate the market with confidence.

Access to Advanced Tools and Research:

- Advisory services often have access to advanced financial tools and in-depth research resources.

- This enables them to conduct thorough analyses and make data-driven recommendations, giving your investments a strategic edge.

In summary, the benefits of engaging a stock market advisory company extend far beyond mere financial gains. It’s about equipping yourself with the knowledge, strategies, and support needed to navigate the complexities of the market successfully.

4. Best Stock Market Sebi registered Advisory Company in India – Apna Research Plus Pvt Ltd.

Embarking on a journey to find the pinnacle of stock market advisor services in India inevitably leads us to Apna Research Plus Pvt Ltd.

Apna research plus is a sebi registered advisory company who follow all the guidelines of sebi.

Here, we delve into the distinctive qualities that position Apna Research Plus as the top-rated share market advisory service provider in the country.

Introduction to Apna Research Plus: best stock market advisory company in india

- Apna Research Plus Pvt Ltd. emerges as a beacon in the intricate realm of stock market advisory services.

Their reputation precedes them, and investors gravitate towards the firm’s commitment to excellence.

Apna Research Plus Best Properties: best Advisory Company in india

- Let’s dissect what makes Apna Research Plus the best in the business. This involves exploring their core properties and values that set them apart from the competition.

These may include a dedication to research, a client-centric approach, and a focus on long-term wealth creation.

Unique Approach to Stock Market Advisory:

- Apna Research Plus stands out with its unique approach to stock market advisory.

Emphasizing a blend of rigorous research, comprehensive analysis, and proactive risk management, the firm consistently delivers superior results.

This approach provides clients with a robust foundation for making informed investment decisions.

Impressive Track Record:

- A crucial aspect of any top-tier advisory service is a proven track record. Apna Research Plus takes pride in a history of delivering consistent returns across various market conditions.

- This stellar performance is a testament to their expertise and commitment to client success.

Empowering Investors with Tailored Advisory Services: Apna Research Plus

- Apna Research Plus goes beyond mere stock recommendations. The firm is dedicated to empowering investors through personalized advisory services.

- Whether you’re a seasoned investor or a newcomer to the market, Apna Research Plus tailors its guidance to suit your unique financial goals and risk tolerance.

Investment Education and Portfolio Management:

- The commitment to client empowerment extends to investment education and portfolio management.

- Apna Research Plus not only guides your investments but also imparts knowledge, ensuring you understand the rationale behind their recommendations and are equipped to make informed decisions.

Empowering Investors with Tailored & Sebi Registered Advisory Services

What sets Apna Research Plus apart? Dive into their commitment to providing personalized and customized advisory services.

Apna research plus a sebi registered company who follow all the sebi guidelines.

It’s not just about stock market guidance; it’s a holistic approach that extends to investment education and portfolio management.

Apna Research Plus doesn’t just guide your investments; they empower you with the knowledge and tools to make informed financial decisions.

Conclusion

As we wrap up our exploration, it’s evident that Apna Research Plus stands as the unequivocal choice for those seeking the best stock market advisory services in India.

Take a step towards financial success by exploring the services offered by Apna Research Plus. Your journey to informed and prosperous investing begins here. Connect with them today, and let your investments thrive under the guidance of the industry’s best.

FAQs

1. Why is choosing the right stock market advisory company important?

- In the dynamic Indian stock market, the right advisory company provides crucial guidance, steering investors through uncertainty and helping them achieve financial goals.

2. What factors should I consider when selecting a stock market advisory company?

- Key factors include research prowess, a proven track record, comprehensive analysis, risk management strategies, transparency, client testimonials, customization options, regulatory compliance, fee structure, and accessibility/support.

3. How can I assess a company’s research prowess?

- Look for a company with a dedicated team of seasoned analysts focusing on in-depth research of market trends, company performances, and economic indicators.

4. Why is a proven track record important?

- A track record of consistent returns over different market conditions is a strong indicator of an advisory company’s expertise and reliability.

5. What does comprehensive analysis entail?

- A top-notch advisory service should provide more than just stock recommendations, offering comprehensive market analyses to empower investors with knowledge.

6. Why is risk management crucial in top stock market advisory services?

- The best advisory firms have robust risk management strategies to mitigate risks and safeguard investments in the face of market volatility.

7. How important is transparency and communication in choosing an advisory company?

- Transparent communication is key for informed decision-making. Choose a company that provides regular updates and reports to foster trust and control.

8. Why should I explore client testimonials and reviews?

- Real-life experiences of other investors provide valuable insights into the efficacy of the advisory service, accessible through platforms like social media and review websites.

9. Why is regulatory compliance essential?

- Ensuring the advisory company is registered with SEBI (Securities and Exchange Board of India) is crucial for credibility and adherence to regulatory standards.

10. What should I consider in the fee structure of an advisory service?

- Understand the charges involved, ensuring they align with your budget and expectations for a transparent financial arrangement.

11. Why is accessibility and support important in an advisory firm?

- Responsive customer support and easy access to advisors can significantly enhance your overall experience with the advisory firm.

12. What are the benefits of engaging a stock market advisory company?

- Benefits include expert investment tips, diversification strategies, risk mitigation, timely market updates, education and empowerment, personalized advice, efficient portfolio management, long-term wealth creation, quick adaptation to market changes, and peace of mind.

13. How does Apna Research Plus differentiate itself in the stock market advisory space?

- Apna Research Plus stands out with its unique approach, impressive track record, dedication to empowering investors through tailored advisory services, and a commitment to investment education and portfolio management.

14. What makes Apna Research Plus the best stock market advisory company in India?

- Apna Research Plus is distinguished by its commitment to excellence, unique approach, impressive track record, and dedication to empowering investors with personalized services and education.

15. How can I connect with Apna Research Plus for stock market advisory services?

- Explore the services offered by Apna Research Plus for informed and prosperous investing. Connect with them today to let your investments thrive under the guidance of the industry’s best.