Share Market Advisors

Welcome to the captivating realm of stock market consultants! Here, in this section we’ll delve into exploring the role, importance and influence of stock market advisors in the world of investments.

A. Defining Stock Market Advisors

Imagine this scenario; you’re navigating through a sea of investment options. The waters are murky and the currents are unpredictable.

This is where stock market advisors step in. These financial experts act as captains steering you through the waters of the stock market.

Stock market advisors, also known as investment advisors or financial counselors are professionals who provide expert guidance and recommendations to investors looking to navigate the intricacies of the stock market.

Whether you’re a beginner investor testing the waters for the time or an experienced trader aiming to optimize your portfolio stock market advisors serve as your trusted partners on your path to prosperity.

B. Significance in Investment Landscape

You might be pondering why having a stock market advisor is necessary. Imagine trying to scale Mount Everest without a Sherpa guide beside you. While it’s feasible to go having a seasoned guide, by your side significantly enhances your chances of reaching the summit successfully.

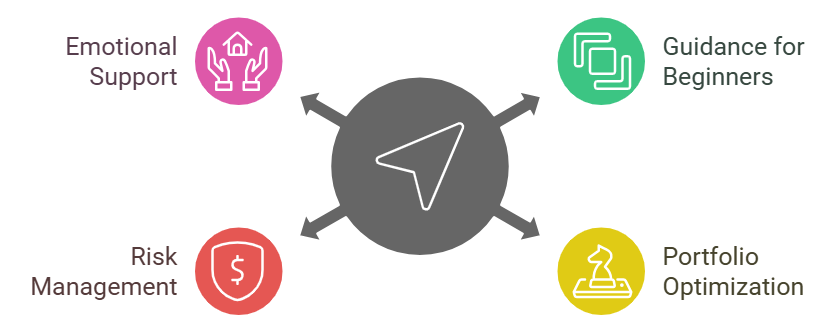

In the realm of investments share market advisors are allies, for investors as they guide them through the nature of the stock market. Leveraging their expertise and insights these professionals assist in making informed decisions managing risks and optimizing investment returns.

Beyond gains share market advisors offer valuable emotional support and guidance during uncertain market conditions helping investors stay focused on their long term financial objectives. They serve as trusted partners committed to securing your future and prosperity.

Embarking on this exploration of share market advisors invites you to uncover the strategies for success in navigating the ever changing stock market environment.

II. Unraveling the Role of a Share Market Advisor

Lets dive into the captivating world of share market advisors! These financial experts play a role in guiding investors through the complexities of the stock market akin to having a companion on a challenging mountain trail to ensure a safe journey, towards your goals.

A. Providing Investment Advice

First things first, share market advisors are like seasoned captains navigating the choppy waters of the stock market.

They provide personalized investment advice tailored to their clients’ goals, risk tolerance, and financial situation.

Whether you’re a risk-averse investor looking for stable returns or a high-risk, high-reward seeker chasing growth opportunities, share market advisors can help you chart the right course.

It’s like having a GPS for your finances, guiding you toward your desired destination with precision and expertise.

B. Analyzing Market Trends

But wait, there’s more! Share market advisors are also like detectives, constantly scouring the financial landscape for clues and insights that could impact your investments. They analyze market trends, economic indicators, and company fundamentals to identify opportunities and mitigate risks.

It’s like reading the signs of nature to predict the weather—you have to pay attention to the subtle cues and patterns to stay ahead of the curve. Share market advisors use their analytical skills and market knowledge to help you stay one step ahead of the game.

C. Managing Risk for Clients

Last but not least, share market advisors are like skilled tightrope walkers, balancing risk and reward to achieve the best possible outcomes for their clients. They help you diversify your investments, manage volatility, and navigate uncertain market conditions with confidence.

It’s like walking a tightrope between risk and reward—there’s always the potential for a misstep, but with the right guidance, you can stay balanced and steady. Share market advisors use a combination of strategies to help you minimize risk while maximizing returns, ensuring a smooth journey to your financial goals.

So, the next time you think of share market advisors, remember that they’re more than just financial experts—they’re trusted allies dedicated to helping you achieve your dreams. With their expertise, insights, and guidance, you can navigate the complex world of investing with confidence and clarity.

III. Qualifications and Skills Required

Now, let’s delve into what it takes to become a share market advisor. It’s not just about crunching numbers and analyzing charts; it’s about possessing a unique blend of skills, qualifications, and traits that set you apart in this competitive landscape.

A. Financial Knowledge and Expertise

First and foremost, share market advisors must possess a deep understanding of financial markets, investment products, and economic trends. This entails staying abreast of the latest market developments, regulatory changes, and industry news. A solid foundation in finance, economics, or a related field is essential to navigate the complexities of the stock market effectively.

B. Analytical Skills

In the fast-paced world of investments, the ability to analyze data, identify trends, and interpret market signals is paramount. Share market advisors must possess strong analytical skills to sift through vast amounts of information and distill actionable insights for their clients. This involves conducting thorough research, performing risk assessments, and devising investment strategies tailored to each client’s unique needs and objectives.

C. Communication and Interpersonal Skills

Last but certainly not least, effective communication and interpersonal skills are vital for share market advisors. Building trust and rapport with clients, articulating complex financial concepts in simple terms, and providing clear and concise recommendations are all essential aspects of the job. Share market advisors must be adept at listening to their clients’ needs, addressing their concerns, and guiding them through the investment process with confidence and clarity.

In conclusion, becoming a successful share market advisor requires a combination of financial expertise, analytical prowess, and excellent communication skills. By honing these qualities and continuously expanding your knowledge and experience, you can carve out a rewarding career in the dynamic and ever-evolving world of stock market advisory.

IV. Different Types of Share Market Advisors

Now that we’ve laid the groundwork for understanding share market advisors, let’s delve into the diverse landscape of professionals who offer their expertise in the realm of investments.

A. Traditional Financial Advisors

First up, we have the tried-and-true traditional financial advisors. These are the folks you might envision when you think of seeking investment advice—a seasoned professional sitting across from you at a desk adorned with charts and graphs.

Traditional financial advisors typically work for established financial firms or operate independently. They offer personalized investment guidance tailored to your unique financial situation, goals, and risk tolerance. Whether you’re planning for retirement, saving for a big purchase, or simply looking to grow your wealth, traditional financial advisors provide comprehensive financial planning services to help you achieve your objectives.

B. Robo-Advisors

Next on our list are the tech-savvy robo-advisors. As the name suggests, these advisors harness the power of technology, using algorithms and automation to manage your investments.

Robo-advisors are a popular choice for investors seeking low-cost, hands-off investment solutions. With just a few clicks, you can set up an account, answer a few questions about your financial goals and risk tolerance, and let the robo-advisor handle the rest. These digital advisors offer diversified investment portfolios tailored to your individual needs and preferences, all without the hefty fees typically associated with traditional financial advisors.

C. Specialized Market Analysts

Last but not least, we have the specialized market analysts. These are the experts who dive deep into specific sectors or asset classes, offering targeted insights and recommendations to investors looking to capitalize on niche opportunities.

Specialized market analysts come in various forms, from equity research analysts covering specific industries to technical analysts who focus on chart patterns and market trends. Whether you’re interested in technology stocks, healthcare companies, or commodities trading, specialized market analysts provide in-depth analysis and recommendations to help you make informed investment decisions in your chosen area of interest.

So, whether you prefer the personal touch of a traditional financial advisor, the convenience of a robo-advisor, or the specialized expertise of a market analyst, there’s a share market advisor out there to suit your unique investment needs and preferences.

V. How Share Market Advisors Work

Alright, let’s pull back the curtain and take a peek into the inner workings of share market advisors. Ever wondered how these financial wizards operate their magic? Well, wonder no more!

A. Initial Client Consultation

It all begins with a chat. When you first engage the services of a share market advisor, you’ll typically have an initial consultation. Think of it as a getting-to-know-you session where you and the advisor can discuss your financial goals, investment preferences, and risk tolerance.

During this consultation, you’ll have the chance to ask questions, share any concerns or apprehensions you might have, and get a feel for whether the advisor is the right fit for you. It’s like going on a first date—except instead of romance, you’re looking for someone to help you grow your wealth!

B. Portfolio Assessment and Goal Setting

Once you’ve decided to work with a share market advisor, the next step is to assess your existing investment portfolio (if you have one) and set some goals. Your advisor will take a deep dive into your current holdings, analyzing their performance, risk level, and alignment with your financial objectives.

Based on this assessment, you and your advisor will collaborate to set clear, achievable goals for your investment journey. Whether you’re saving for retirement, planning for your child’s education, or aiming to buy your dream home, your advisor will help you map out a roadmap to get there.

C. Ongoing Monitoring and Adjustments

But the work doesn’t stop there! Once your investment strategy is in place, your share market advisor will continue to monitor your portfolio closely, keeping a vigilant eye on market trends, economic developments, and any changes in your personal circumstances.

If adjustments are needed to keep your portfolio on track with your goals, your advisor will make recommendations and work with you to implement them. It’s like having a co-pilot on your investment journey, ensuring that you stay on course and navigate any turbulence along the way.

So, whether you’re just starting out on your investment journey or you’re a seasoned investor looking to fine-tune your strategy, share market advisors are here to guide you every step of the way. With their expertise, insights, and personalized approach, they’ll help you navigate the complexities of the stock market and achieve your financial goals.

VI. Duties and Responsibilities

Now that we’ve got a glimpse into how share market advisors operate, let’s zoom in on their day-to-day tasks and responsibilities. Spoiler alert: it’s not all about picking stocks and watching the market!

A. Conducting Market Research

Picture this: your share market advisor is like a detective, scouring the financial landscape for clues and insights that could impact your investments. They spend hours poring over market data, analyzing economic indicators, and staying up-to-date on the latest news and developments.

From tracking company earnings reports to monitoring geopolitical events, share market advisors leave no stone unturned in their quest for valuable information. After all, knowledge is power in the world of investing, and staying informed is key to making smart decisions.

B. Developing Investment Strategies

Once they’ve gathered all the necessary intel, share market advisors roll up their sleeves and get down to business: crafting investment strategies tailored to their clients’ goals and risk tolerance.

Whether it’s building a diversified portfolio of stocks and bonds, implementing a dollar-cost averaging strategy for regular investments, or hedging against market volatility with options and derivatives, share market advisors use their expertise to design a roadmap for success.

C. Providing Timely Updates to Clients

But the work doesn’t stop there! Share market advisors understand the importance of keeping their clients in the loop, which is why they provide regular updates and communication.

Whether it’s a quarterly performance report, a market commentary on recent developments, or a quick check-in to discuss any changes to your investment strategy, your share market advisor is always just a phone call or email away.

So, next time you think of share market advisors, remember that they’re more than just financial experts—they’re trusted partners dedicated to helping you navigate the ups and downs of the stock market and achieve your financial goals.

VII. Compliance and Regulation

Ah, regulations and compliance—two words that might make your eyes glaze over, but trust me, they’re crucial when it comes to share market advisors. Let’s break it down in a way that won’t put you to sleep, shall we?

A. Legal Obligations

First things first, share market advisors have to play by the rules. That means adhering to a slew of regulations set forth by governing bodies like the Securities and Exchange Board of India (SEBI) or the Securities and Exchange Commission (SEC) in the U.S.

These regulations are designed to protect investors and ensure that share market advisors operate ethically and transparently. From licensing requirements to disclosure obligations, share market advisors have to dot their i’s and cross their t’s to stay on the right side of the law.

B. Industry Standards and Best Practices

But it’s not just about following the letter of the law—share market advisors also have to uphold industry standards and best practices. That means staying abreast of the latest developments in the field, engaging in continuing education, and adhering to codes of conduct set forth by professional organizations.

Think of it like driving a car. Sure, you have to obey traffic laws to avoid getting a ticket, but you also have to follow the rules of the road to keep yourself and others safe. Similarly, share market advisors have to follow both legal regulations and industry standards to ensure the well-being of their clients and the integrity of the market.

So, the next time you hear about compliance and regulation, remember that they’re not just buzzwords—they’re the foundation upon which the trust and credibility of share market advisors are built.

VIII. Benefits of Hiring a Share Market Advisor

Alright, let’s talk about the perks of having a share market advisor by your side. Trust me, it’s like having a financial superhero in your corner!

A. Professional Guidance and Expertise

First and foremost, share market advisors bring a wealth of knowledge and expertise to the table. They’ve spent years studying the ins and outs of the stock market, honing their skills, and staying abreast of the latest trends and developments.

Think of it like hiring a personal trainer for your finances. Just as a trainer can help you achieve your fitness goals more effectively than going it alone, a share market advisor can guide you toward your financial objectives with precision and confidence.

B. Diversification of Investments

But wait, there’s more! Share market advisors can also help you diversify your investments, spreading your money across a range of asset classes and sectors to minimize risk.

Imagine you’re building a house. Instead of putting all your eggs in one basket (or, in this case, all your money in one stock), a share market advisor helps you lay a solid foundation by diversifying your investments. That way, if one sector takes a hit, your entire portfolio won’t come crashing down.

C. Peace of Mind for Investors

Last but not least, hiring a share market advisor can provide invaluable peace of mind. Instead of constantly second-guessing your investment decisions or losing sleep over market fluctuations, you can rest easy knowing that you have a trusted expert overseeing your portfolio.

It’s like having a financial guardian angel watching over your money, ready to swoop in and make adjustments whenever necessary. With a share market advisor by your side, you can navigate the ups and downs of the stock market with confidence and clarity.

So, whether you’re a seasoned investor looking to take your portfolio to the next level or a newbie just dipping your toes into the world of investing, hiring a share market advisor could be one of the smartest decisions you’ll ever make.

IX. Challenges Faced by Share Market Advisors

Alright, let’s dive into the nitty-gritty and talk about the hurdles that share market advisors face on a daily basis. Spoiler alert: it’s not all smooth sailing in the world of investments!

A. Market Volatility

First up, we’ve got market volatility. Picture this: you’re cruising along, and suddenly, the market takes a nosedive. It’s like riding a rollercoaster—you’re exhilarated one moment and terrified the next.

Share market advisors have to navigate these ups and downs with finesse, helping their clients stay calm and focused on the long term. It’s like being a Zen master in the midst of chaos, maintaining a sense of balance and perspective no matter how turbulent the market gets.

B. Client Expectations

But wait, there’s more! Share market advisors also have to contend with client expectations. It’s like being a mind reader—you have to anticipate what your clients want and need before they even say it.

Whether it’s unrealistic return expectations, a fear of missing out on the latest hot stock, or a desire for instant gratification, share market advisors have to manage their clients’ expectations and help them stay disciplined in the face of temptation.

C. Regulatory Changes

Last but not least, we’ve got regulatory changes. Just when you think you’ve got everything figured out, along comes a new set of rules and regulations to shake things up.

Share market advisors have to stay on top of these changes, ensuring that they’re compliant with the latest regulations and providing their clients with accurate and up-to-date information. It’s like playing a never-ending game of regulatory whack-a-mole, but with much higher stakes.

So, the next time you see a share market advisor, remember that they’re not just financial experts—they’re also master jugglers, balancing the demands of the market, their clients, and the regulators with skill and finesse.

XI. Tips for Choosing the Right Share Market Advisor

Alright, let’s talk about finding the perfect share market advisor for you. It’s like finding the Robin to your Batman or the peanut butter to your jelly—essential for success!

A. Assessing Track Record and Performance

First things first, you’ll want to do your homework. Take a look at the advisor’s track record and performance. It’s like checking the reviews before trying a new restaurant—you want to make sure they’ve got a solid track record of success.

Ask for references, look for testimonials from satisfied clients, and inquire about their investment philosophy and approach. You want an advisor who’s not only knowledgeable and experienced but also aligned with your own financial goals and values.

B. Understanding Fee Structures

Next up, let’s talk money. Before you commit to working with a share market advisor, make sure you understand their fee structure. It’s like reading the fine print before signing a contract—you don’t want any surprises down the road.

Certain advisors may charge a fixed fee, while others operate on a commission basis or take a percentage of your managed assets. Make sure you’re clear on how much you’ll be paying and what services are included. Remember, you get what you pay for, so don’t be afraid to invest in quality advice.

C. Compatibility with Investment Goals

Last but not least, consider your compatibility with the advisor’s investment goals. It’s like finding a workout buddy who shares your fitness goals and motivation—you want someone who’s on the same page as you.

Discuss your investment objectives, risk tolerance, and time horizon with the advisor to ensure they understand your needs and can tailor their recommendations accordingly. Communication is crucial, so ensure that you feel at ease asking questions and sharing your concerns.

So, whether you’re a seasoned investor or a newbie just starting out, finding the right share market advisor is essential for achieving your financial goals. By following these tips, you’ll be well on your way to finding the perfect advisor to guide you on your investment journey.

XII. Common Misconceptions about Share Market Advisors

Alright, let’s clear up some misconceptions about stock market advisors. Trust me, there are plenty of myths floating around out there, but we’re here to set the record straight!

A. Only for High Net Worth Individuals

One of the biggest misconceptions about share market advisors is that they’re only for the wealthy elite. It’s like thinking you need to be a celebrity to have a personal chef—totally not true!

Sure, some share market advisors cater to high-net-worth individuals, but many also work with everyday folks like you and me. Whether you’re just starting out with a small investment portfolio or you’re a seasoned investor looking to grow your wealth, there’s a share market advisor out there for you.

B. Guarantees of Investment Returns

Another common misconception is that share market advisors can guarantee investment returns. It’s like expecting your favorite team to win every game—they might have a winning record, but there are no guarantees in the world of investments.

Share market advisors can certainly help you make informed decisions and optimize your portfolio, but they can’t predict the future or guarantee returns. Investing always carries some level of risk, and it’s important to approach it with a realistic mindset.

C. All Advisors Offer the Same Services

Last but not least, there’s the misconception that all share market advisors offer the same services. It’s like assuming all restaurants serve the same menu—each advisor has their own unique approach and expertise.

Some advisors specialize in certain investment strategies or asset classes, while others offer a broader range of services. It’s important to do your research and find an advisor who aligns with your investment goals and values.

So, the next time you hear someone spouting off one of these misconceptions about share market advisors, you’ll be armed with the facts. Share market advisors are valuable partners in your investment journey, but like any profession, it’s important to separate fact from fiction.

XIII. Summary of Key Points

Alright, let’s wrap things up and summarize the key points we’ve covered about share market advisors. It’s like putting the cherry on top of a delicious sundae—bringing everything together for a satisfying conclusion!

A. Importance of Share Market Advisors

First and foremost, share market advisors play a crucial role in helping investors navigate the complex world of the stock market. From providing expert guidance to offering personalized investment strategies, they’re like the guiding light in a sea of uncertainty.

B. Roles and Responsibilities Defined

We’ve delved into the duties and responsibilities of share market advisors, from conducting market research to providing timely updates to clients. It’s like wearing multiple hats—analyst, strategist, and communicator—all in one!

C. Considerations for Choosing an Advisor

When it comes to choosing the right share market advisor, we’ve discussed the importance of assessing track record and performance, understanding fee structures, and ensuring compatibility with your investment goals. It’s similar to finding the perfect puzzle piece that fits just right.

D. Debunking Common Misconceptions

Finally, we’ve debunked some common misconceptions about share market advisors, from the belief that they’re only for the wealthy elite to the misconception that they can guarantee investment returns. It’s like separating fact from fiction and setting the record straight.

So, whether you’re a new investor dipping your toes into the stock market or a seasoned pro looking to fine-tune your investment strategy, share market advisors are here to help you every step of the way. With their expertise, insights, and personalized approach, they’re like the secret weapon in your financial arsenal.

Stay tuned as we continue to explore the fascinating world of share market advisors and uncover more insights to help you make the most of your investment journey!

XIV. FAQs about Share Market Advisors

A. What qualifications should I look for in a share market advisor?

Ah, qualifications! It’s like trying to decipher a cryptic crossword puzzle—there are so many letters and numbers to sift through. When it comes to share market advisors, look for credentials like certifications from recognized institutions or affiliations with reputable industry organizations.

You’ll also want to consider factors like experience, track record, and areas of specialization. Think of it like hiring a plumber—you want someone who’s not only qualified but also has a proven track record of fixing leaks and unclogging drains.

B. How do share market advisors mitigate risk for their clients?

Ah, risk mitigation—the holy grail of investing! Share market advisors use a variety of strategies to help minimize risk for their clients, from diversifying their investment portfolios to implementing stop-loss orders and hedging against market volatility.

It’s like playing a game of chess—anticipating your opponent’s moves and protecting your king from potential threats. By carefully balancing risk and reward, share market advisors help their clients navigate the ups and downs of the stock market with confidence.

C. Can share market advisors guarantee returns on investments?

Ah, the age-old question: can share market advisors guarantee returns? The short answer is no. It’s like trying to predict the weather—you might have a general idea of what’s coming, but there are no guarantees.

Investing always carries some level of risk, and share market advisors can’t control external factors like market fluctuations or economic downturns. What they can do is help you make informed decisions, optimize your portfolio, and stay disciplined in the face of uncertainty.

So, there you have it—answers to some of the most common questions about share market advisors. Remember, investing is a journey, not a destination, and having a knowledgeable guide by your side can make all the difference.