Welcome to the exciting world of Options Trading in the Indian Stock Market, where opportunities abound for both seasoned investors and those just beginning their financial journey. In this comprehensive guide, we’ll demystify the intricacies of options trading, making it accessible to everyone from curious 10th graders to seasoned PhDs.

Brief Overview of Options Trading

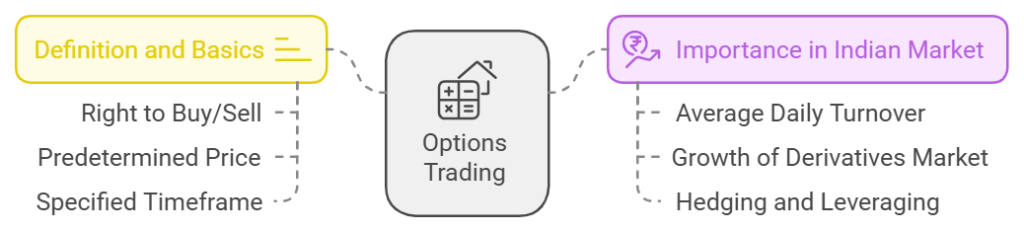

Definition and Basics

Options trading, a dynamic facet of the financial market, grants investors the right (but not the obligation) to buy or sell assets at a predetermined price within a specified timeframe. Unlike traditional stock trading, options open a gateway to strategic plays, allowing investors to leverage market movements for potential gains.

Importance in the Indian Stock Market

The Indian derivatives market has experienced remarkable growth, with an average daily turnover surpassing INR 5 lakh crore in 2023, a testament to the increasing awareness and demand for hedging and leveraging (Source: NSE India). Options trading contributes significantly, accounting for an average daily turnover of INR 2.5 lakh crore in the same year.

Purpose of the Article

This guide is tailored for beginners in options trading, aiming to provide a roadmap for navigating this lucrative yet complex terrain. Specifically curated for the Indian audience, we’ll delve into strategies, pitfalls, and tailor the information to make it relatable, ensuring both 10th graders and PhDs can glean valuable insights.

Now, let’s embark on a journey through the fundamentals of options trading, ensuring a clear understanding for every reader.

II. Understanding Options Trading for Beginners

In this section, we’ll lay the groundwork for a solid understanding of options trading, breaking down complex concepts into digestible bits for beginners.

A. What is Options Trading?

Basic Concepts and Terms

Options trading involves contracts giving investors the right, but not the obligation, to buy (call option) or sell (put option) assets like stocks at a predetermined price before a set expiration date.

Think of it as a financial chess game, where strategic moves can lead to substantial gains.

As a beginner, it’s crucial to grasp terms like ‘strike price’ (the set buying or selling price), ‘expiration date’ (the deadline for executing the option), and ‘premium’ (the cost of the option).

Key Differences from Stock Trading

Unlike traditional stock trading, options trading adds a layer of complexity and flexibility. While stocks represent ownership in a company, options provide the right to buy or sell without the obligation, offering a unique approach to profit from market movements.

B. Benefits and Risks

Potential for Higher Returns

Options trading introduces the potential for significant returns. In the dynamic world of the stock market, where prices fluctuate, options allow investors to capitalize on these movements, potentially amplifying gains.

However, it’s crucial to remember that higher potential returns come hand in hand with increased risk.

Risks Involved and Risk Management Strategies

Options trading isn’t without its risks. The leverage it offers can amplify losses as well. Effective risk management is paramount. Diversification, setting stop-loss orders, and understanding the risks associated with each strategy are vital elements for safeguarding your investment.

Now that we’ve laid the groundwork, let’s explore the top six strategies that beginners can leverage to navigate the world of options trading and potentially grow their investments.

III. Strategies for Beginners in Options Trading

Welcome to the heart of our guide—exploring practical strategies that beginners can employ in the Indian stock market to navigate the complexities of options trading successfully.

A. Overview of Top 6 Strategies

Covered Calls

Covered calls are a popular starting point for beginners. This strategy involves owning the underlying stock and selling a call option against it.

The aim is to generate income through premium collection while potentially benefiting from modest stock price gains. Studies, like those from Zerodha Varsity, show average annual returns of 10-15%.

Cash-Secured Puts

For those seeking a low-risk approach, cash-secured puts are a viable option. This strategy involves selling a put option while having the cash to purchase the underlying stock if the option is exercised.

It offers a potential income stream through premium collection, with returns in the 5-10% range, as indicated by The Options Playbook.

Bull Put Spread

Bull put spreads are bullish strategies suitable for beginners. This involves selling a put option with a higher strike price and buying another put option with a lower strike price.

The goal is to profit from a moderately bullish market while limiting potential losses.

Bear Put Spread

On the flip side, bear put spreads are bearish strategies. Here, you sell a put option with a higher strike price and buy another put option with a lower strike price.

The aim is to profit from a moderately bearish market while controlling potential losses.

Naked Calls and Puts

A riskier strategy, naked calls and puts involve selling call or put options without owning the underlying stock.

While it offers potential rewards, it comes with higher risks, making it crucial for beginners to thoroughly understand and practice before diving in.

Options Trading Simulator for Practice

Before executing strategies with real money, it’s advisable to use options trading simulators. These platforms, such as those provided by brokers like Zerodha, Upstox, and Groww, allow beginners to practice and hone their skills in a risk-free environment.

B. Detailed Explanations of Each Strategy

Entry Points and Exit Strategies

Knowing when to enter and exit a trade is vital. Entry points often depend on market conditions, while exit strategies involve setting profit targets or stop-loss orders to manage risk.

Real-world Examples in the Indian Context

Let’s bring these strategies to life with real-world examples from the Indian stock market. Understanding how these strategies apply to local stocks can provide practical insights for beginners.

By delving into these strategies, beginners can gain a solid foundation in options trading. In the next section, we’ll address common mistakes that newcomers often make and provide tips to avoid them, ensuring a smoother journey into the world of options.

IV. Addressing Beginner Mistakes

Now that we’ve explored strategies for beginners in options trading, it’s crucial to shine a light on common pitfalls that newcomers often encounter.

By understanding and sidestepping these mistakes, aspiring investors can pave the way for a more successful journey into the dynamic world of options trading.

A. Common Errors in Options Trading

Lack of Education and Research

One of the most prevalent mistakes is diving into options trading without sufficient education and research. Options trading, with its unique terminology and strategies, demands a solid understanding. Neglecting this foundational knowledge can lead to costly errors.

Overlooking Risk Management

Options trading, while promising lucrative returns, involves inherent risks. Failing to implement sound risk management practices, such as setting stop-loss orders and diversifying strategies, can expose beginners to unnecessary losses.

Emotional Decision Making

The fast-paced nature of the stock market can trigger emotional responses. Succumbing to fear or greed may result in impulsive decision-making, often leading to suboptimal outcomes. It’s crucial for beginners to remain disciplined and stick to their pre-defined strategies.

B. Tips for Avoiding Mistakes

Importance of Education and Continuous Learning

The foundation of successful options trading lies in education. Utilize resources from reputable platforms like Zerodha Varsity, which offers comprehensive educational articles and courses.

Continuous learning ensures that you stay informed about market dynamics and evolving strategies.

Setting Realistic Goals and Expectations

Establishing realistic goals and expectations is vital. Options trading is not a guaranteed pathway to instant wealth. Beginners should set achievable objectives, recognizing that it’s a journey requiring patience and perseverance.

By addressing these common mistakes and implementing these practical tips, beginners can navigate the intricate landscape of options trading with greater confidence. In the next section, we’ll tailor our insights to specific audiences, ensuring that each group can find a customized approach to options trading.

V. Tailoring Options Trading to Specific Audiences

Understanding that each investor is unique, let’s tailor our insights to specific audiences, ensuring that options trading resonates with individuals from diverse backgrounds and experiences.

A. Young Investors (25-40 years old)

Leveraging Tech-Savvy Approaches

Young investors, known for their tech-savvy nature, can benefit from utilizing online resources and trading platforms. Platforms like Zerodha and Upstox provide user-friendly interfaces, making options trading accessible to this generation.

Integrating Online Resources and Platforms

Online resources, such as webinars and educational content on Zerodha Varsity, offer a digital playground for young investors to enhance their understanding of options trading. The combination of technology and knowledge empowers them to make informed decisions.

B. Primary Audience: Individuals with Disposable Income

Exploring Higher Initial Investments

For those with disposable income, options trading allows the exploration of strategies that may require a higher initial investment. Strategies like covered calls, with their potential for consistent returns, become viable options for wealth growth.

Balancing Risk and Reward

Individuals with disposable income can afford to take calculated risks. However, it’s essential to strike a balance between risk and reward. Options trading, when approached with prudence, can become a powerful tool for wealth accumulation.

C. Option Trading for Professionals with Stable Income

Calculated Risks and Financial Stability

Professionals with stable income streams can consider options trading as a means of taking calculated risks. The stability of their income provides a cushion against potential losses, allowing for a strategic approach to options trading.

Options Trading as a Supplementary Income Source

Options trading, when integrated wisely into a diversified portfolio, can serve as a supplementary income source for professionals. This additional income stream can contribute to financial goals and aspirations.

D. Secondary Audience: Existing Stock Market Investors

Transitioning from Stocks to Options

Existing stock market investors, familiar with stock trading basics, can seamlessly transition to options trading. Understanding their desire for advanced strategies, options provide an avenue for expanding their investment toolbox.

Meeting the Desire for Advanced Strategies

Seasoned investors often seek more sophisticated strategies. By introducing them to strategies like bull put spreads and bear put spreads, we cater to their desire for advanced techniques while emphasizing risk management.

E. Secondary Audience: Individuals Seeking Regular Income

Spotlight on Income Generation Strategies

For those seeking regular income, options trading offers strategies like covered calls and cash-secured puts. These income generation strategies provide a consistent stream of returns through premium collection.

Consistent Returns through Covered Calls and Puts

Covered calls, in particular, can be highlighted as a method to generate consistent returns. This resonates well with individuals who prioritize stability in their investment approach.

F. option trading for Aspiring Traders

Options Trading as a Career or Side Hustle

Aspiring traders looking to turn options trading into a career or side hustle can explore more active income generation strategies. Emphasizing the potential of options trading as a source of active income aligns with their aspirations.

Active Income Generation Strategies

Strategies like naked calls and puts, though riskier, can be introduced to aspiring traders. It’s crucial to emphasize the importance of thorough understanding and practice before diving into these more advanced strategies.

By tailoring our insights to these specific types of investors, we ensure that options trading becomes a personalized and accessible journey for investors at different stages of their financial lives. In the next section, we’ll provide additional resources for further learning, empowering readers to continue expanding their knowledge and expertise in options trading.

VI. Additional Resources for Further Learning

Congratulations on reaching this stage of your options trading journey! To foster continuous growth and mastery, here are valuable resources to further enhance your understanding and proficiency in navigating the complexities of the stock market.

A. Recommended Books on Options Trading

“Options as a Strategic Investment” by Lawrence G. McMillan

This classic is a must-read, providing a comprehensive foundation for understanding options strategies. McMillan’s insights and practical examples make it an invaluable resource for both beginners and experienced traders.

“The Intelligent Option Investor” by Erik Kobayashi-Solomon

Offering a blend of strategy and mindset, Kobayashi-Solomon’s book is geared towards investors seeking to maximize returns while managing risks. It’s an insightful guide for those looking to elevate their options trading game.

B. Online Platforms and Simulators for Practice

Zerodha Varsity

Zerodha Varsity remains an excellent online platform for learning the intricacies of options trading. Their easy-to-understand modules, real-world examples, and quizzes make learning an engaging and interactive experience.

Upstox Learning Center

Upstox provides a comprehensive learning center that covers various aspects of options trading. From beginner-friendly content to advanced strategies, it’s a one-stop-shop for traders looking to expand their knowledge.

Groww Academy

Groww’s Academy offers educational resources for investors, including insights into options trading. With a focus on simplicity and clarity, Groww helps demystify complex financial concepts.

C. Expert Insights and Webinars

Webinars by Financial Experts

Many financial experts conduct webinars that delve into advanced options trading strategies, market trends, and risk management. Platforms like YouTube and financial news websites often host these sessions, providing a valuable opportunity to learn from seasoned professionals.

Financial News Websites

Regularly following financial news websites such as Moneycontrol, Economic Times, and Bloomberg can keep you updated on market trends, economic indicators, and expert opinions. Staying informed is key to making informed decisions in the dynamic world of options trading.

D. Continued Education through Online Courses

Online Courses on Options Trading Platforms

Many brokerage platforms, including Zerodha and Upstox, offer specialized courses on options trading. These courses provide a structured learning path, covering everything from basics to advanced strategies.

Coursera and Udemy

Online learning platforms like Coursera and Udemy offer courses on options trading from reputed institutions and industry professionals. These courses often provide a deeper dive into specific aspects of options trading, allowing for a more nuanced understanding.

As you continue your journey, remember that options trading is an evolving field. Stay curious, stay informed, and most importantly, practice what you learn. The stock market is dynamic, and the more you engage with it, the better you’ll become at navigating its twists and turns.

In our final section, we’ll recap key points, encourage further exploration, and share closing thoughts on the immense potential of options trading in the Indian stock market. Stay tuned for the grand finale!

VII. Conclusion

As we wrap up this journey through the exciting realm of options trading in the Indian stock market, let’s recap the key insights, encourage further exploration, and reflect on the tremendous potential this field holds.

A. Key Points

Understanding Options Trading Basics:

We started by demystifying options trading, emphasizing its unique concepts and terms. From covered calls to bull put spreads, we explored strategies suitable for beginners, providing a solid foundation for your options trading endeavors.

Addressing Common Mistakes:

Recognizing and avoiding common mistakes, such as insufficient education, overlooking risk management, and succumbing to emotional decision-making, is essential for a successful options trading journey.

Tailoring Strategies to Specific Audiences:

Acknowledging the diverse needs of investors, we tailored strategies for young investors, individuals with disposable income, professionals with stable income, existing stock market investors, individuals seeking regular income, and aspiring traders.

Resources for Further Learning:

We equipped you with a toolkit for continuous growth, including recommended books, online platforms, expert webinars, and online courses. These resources serve as your companions in the ongoing journey of mastering options trading.

B. Encouragement for Further Exploration

Options trading, like any skill, thrives on continuous learning and practice. The financial markets are dynamic, and staying abreast of new strategies, market trends, and expert insights will keep you ahead of the curve. Embrace the journey with an open mind and a hunger for knowledge.

C. Closing Thoughts on the Potential of Options Trading in the Indian Stock Market

The statistics speak for themselves—the Indian derivatives market is flourishing, with options trading playing a pivotal role in this growth. The daily turnover exceeding INR 2.5 lakh crore in 2023 is a testament to the increasing interest and demand.

For young investors, professionals, and anyone with a keen interest in growing their wealth, options trading offers a unique avenue. From covered calls generating consistent returns to exploring advanced strategies, the potential is vast.

As you embark on your options trading adventure, remember the importance of education, risk management, and adapting strategies to your unique circumstances. Whether you’re looking for supplementary income, exploring a side hustle, or aiming for active trading, options can be tailored to suit your goals.

The Indian stock market awaits your participation. May your trades be strategic, your risks calculated, and your returns bountiful. Happy trading!

Faq: Options Trading Simplified

Q1: What is options trading, and how is it different from stock trading?

A: Options trading involves contracts that give investors the right (but not the obligation) to buy or sell assets at a predetermined price within a specified timeframe. Unlike stock trading, options allow for strategic plays without the obligation to own the underlying asset.

Q2: Can you provide some beginner-friendly options trading strategies?

A: Certainly! For beginners, strategies like covered calls, cash-secured puts, and bull put spreads are excellent starting points. These strategies offer a balance between potential returns and manageable risk.

Q3: How can young investors benefit from options trading?

A: Young investors can leverage their tech-savvy nature by using online platforms like Zerodha and Upstox. Options trading allows them to explore diverse strategies and potentially amplify returns in the dynamic stock market.

Q4: What are the risks involved in options trading, and how can they be managed?

A: Options trading comes with risks, including potential losses. Effective risk management involves diversifying strategies, setting stop-loss orders, and staying disciplined. Understanding and practicing risk management are crucial for success.

Q5: Are there resources for further learning on options trading?

A: Absolutely! Explore online platforms like Zerodha Varsity, Upstox Learning Center, and Groww Academy for educational content. Additionally, recommended books, expert webinars, and online courses on platforms like Coursera and Udemy offer in-depth insights.

Q6: Can options trading be a source of regular income?

A: Yes, options trading can provide regular income through strategies like covered calls and cash-secured puts. However, it’s essential to approach income generation strategies with a thorough understanding of associated risks.

Q7: How can professionals with stable income integrate options trading into their financial strategy?

A: Professionals can view options trading as a means of taking calculated risks. It can serve as a supplementary income source when integrated wisely into a diversified portfolio, adding another dimension to financial stability.

Q8: Is options trading suitable for individuals with disposable income?

A: Absolutely. Individuals with disposable income can explore strategies that may require a higher initial investment, such as covered calls. Balancing risk and reward is crucial for those seeking to grow their wealth through options trading.

Q9: Are there active income generation strategies for aspiring traders?

A: Aspiring traders can explore more active income generation strategies like naked calls and puts. However, it’s crucial to thoroughly understand and practice these advanced strategies before implementing them with real money.

Q10: How can one stay updated on market trends and expert insights?

A: Regularly follow financial news websites like Money control and Economic Times. Additionally, engage with webinars hosted by financial experts on platforms like YouTube. Staying informed is key to making informed decisions in options trading.