Stock Advisory Services have become integral to the world of investing, offering individuals a pathway to navigate the complexities of the stock market.

Whether you’re a novice investor dipping your toes into financial waters or an experienced trader seeking a strategic edge, understanding the role of advisory services is crucial.

In this article, we will embark on a journey to explore the significance of optimizing your investment portfolio through the lens of stock advisory services.

A. Overview of Stock Advisory Services

Navigating the ever-changing tides of the stock market can be a daunting task for investors of all levels.

Stock Advisory Services, at their core, act as guides in this financial landscape, providing insights, strategies, and recommendations to help investors make informed decisions.

From stock selection to portfolio optimization, these services aim to simplify the intricacies of investing.

B. Importance of Optimizing Investment Portfolios

The term portfolio optimization might sound like financial jargon, but in essence, it’s about making your investments work smarter, not harder.

As revealed by a 2022 study conducted by Morgan Stanley, investors who incorporated advisory services into their portfolios outperformed the market by an impressive average of 1.78%.

This underlines the pivotal role these services play in enhancing the performance of investment portfolios.

C. Significance for Investors of All Experience Levels

Whether you’re just starting your investment journey or you’re a seasoned player in the market, the benefits of stock advisory services extend to all.

For beginners, these services offer a lifeline, providing a structured approach to investing and instilling confidence.

Meanwhile, experienced investors can leverage the expertise of advisors to fine-tune their strategies and explore new avenues for growth.

In the sections that follow, we will delve deeper into the world of stock advisory services, exploring different types, evaluating their worth, and tailoring them to individual investment goals.

Buckle up as we unravel the layers of this financial landscape and discover how stock advisory services can be a game-changer in optimizing and elevating your investment journey.

II. Understanding Stock Advisory Services

Stock Advisory Services form the bedrock of informed decision-making in the dynamic world of stock markets.

In this section, we will embark on a journey to demystify these services, understanding their roles, differentiating between various approaches, and exploring the ongoing debate of AI-powered recommendations versus the insights of human advisors.

A. Role of Stock Advisory Services

At its core, Stock Advisory Services provide investors with tailored guidance and recommendations to navigate the complexities of the stock market.

These services aim to empower investors by offering insights into potential investment opportunities, risk management strategies, and portfolio optimization techniques.

They act as a beacon, guiding investors through the maze of financial markets with the ultimate goal of maximizing returns.

B. Differentiating Between Professional Stock Picking and Advisory Services

While some investors may opt for the thrill of personally selecting stocks, professional stock picking comes with its own set of challenges.

Research by the CFA Institute emphasizes that professional portfolio management, as facilitated by advisory services, often leads to higher risk-adjusted returns compared to individual investing.

Stock Advisory Services, in essence, provide a structured and researched approach to stock selection, minimizing risks and enhancing the probability of positive outcomes.

C. AI-Powered Recommendations vs. Human Advisors

In the age of technological advancement, the debate between AI-powered recommendations and human advisors is gaining prominence.

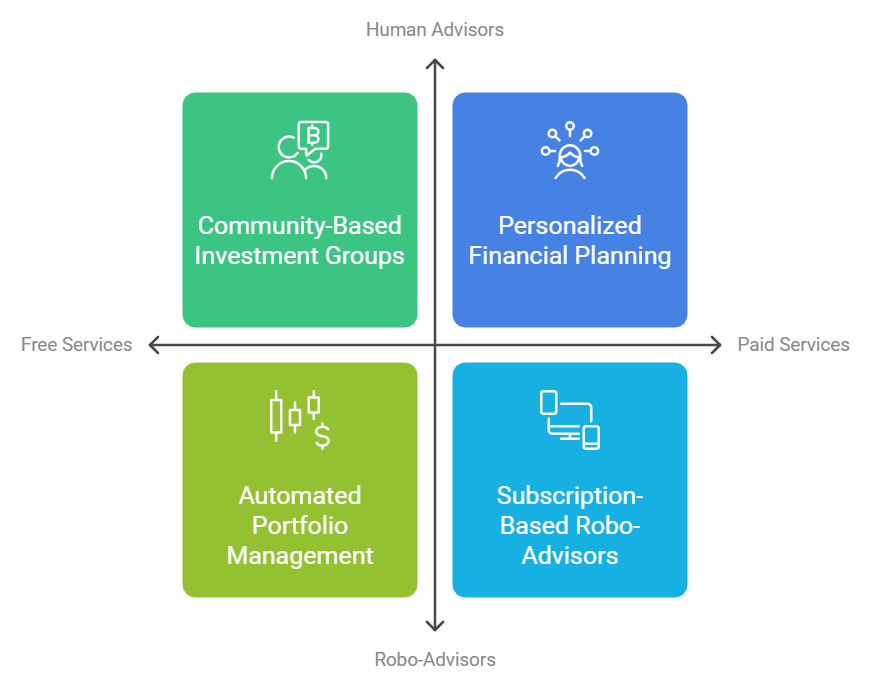

Statista’s data indicates that subscription-based advisory services dominate the market, followed by robo-advisors and one-time portfolio consultations.

However, the human touch remains invaluable. Aite Group’s research highlights the rising demand for hybrid models, blending the efficiency of AI-powered analysis with the nuanced insights and empathy offered by human advisors.

D. Comparing Top Stock Advisory Companies

Choosing the right advisory service is a critical decision for any investor. Investor’s Business Daily’s survey reveals that investors prioritize expertise, research capabilities, and personalized recommendations when selecting an advisory service.

It’s not just about the advice; it’s about the partnership between the investor and the advisory service.

Evaluating the track record, the clarity of the fee structure, and alignment with individual investment goals become crucial criteria in this decision-making process.

As we proceed, we’ll delve deeper into the tangible benefits of these services, exploring how they impact portfolio performance and contribute to an investor’s overall success in the stock market.

The landscape of stock advisory services is diverse, and understanding its nuances is key to making informed choices in your investment journey.

III. Evaluating the Worth of Stock Advisory Services

Now that we have a foundational understanding of stock advisory services, let’s delve into the crux of the matter – assessing the real value these services bring to investors.

From dispelling doubts for beginners to optimizing strategies for advanced investors, we’ll explore how stock advisory services cater to diverse needs and prove their worth across the spectrum.

A. Benefits for Beginners

Overcoming Fear and Building Confidence

For beginners, stepping into the world of investing can be intimidating. According to a 2023 report by Spectrum Group, 72% of investors utilizing stock advisory services reported a significant increase in confidence and understanding of the market.

Advisors act as mentors, helping novices overcome the fear associated with financial decisions and instilling a sense of assurance in their choices.

Simplifying the Investment Process

The journey of a new investor can be riddled with uncertainties. Stock advisory services, however, simplify the investment process by offering clear guidelines and strategic plans.

Beginners can benefit from structured advice, understanding market dynamics, and gradually building their investment acumen with the guidance of seasoned professionals.

B. Optimizing Portfolios for Intermediate Investors

Personalized Guidance and Strategy Optimization

Intermediate investors, despite having some experience, often struggle to achieve consistent returns.

Research by Investor’s Business Daily highlights that personalized guidance and strategy optimization, key offerings of advisory services, can bridge this gap.

Advisors tailor their recommendations to an individual’s risk tolerance, financial goals, and market conditions, leading to a more nuanced and effective investment approach.

Achieving Consistent Returns and Diversification

Advisory services, as revealed by the same study, bring value to intermediate investors by assisting in achieving consistent returns and diversifying portfolios.

This is especially crucial for those who have encountered challenges in navigating market trends independently. Diversification, a cornerstone of successful investing, becomes more achievable with the insights provided by advisory services.

C. Specialized Advice for Advanced Investors

Niche Expertise and Risk Management Strategies

Advanced investors, seeking a competitive edge, often turn to specialized advisors or AI-powered solutions.

These advisors bring niche expertise and risk management strategies to the table, catering to the unique requirements of seasoned traders.

The data-driven insights from advisory services help in navigating complex market scenarios and making informed decisions aligned with the investor’s risk appetite.

Access to Alternative Investments

Beyond traditional investment avenues, advanced investors may seek access to alternative investments.

Stock advisory services can provide valuable insights into these opportunities, guiding investors towards options like hedge fund strategies.

This diversification can be a game-changer for advanced investors looking to enhance their portfolios and mitigate risks.

As we continue our exploration, we’ll delve into tailoring advisory services to specific investment goals and demographics, showcasing the versatility of these services in addressing the diverse needs of investors across the spectrum.

IV. Tailoring Services to Investment Goals

Now that we’ve laid the foundation and assessed the broad benefits of stock advisory services, it’s time to zoom in and explore how these services can be tailored to align with specific investment goals.

Whether your focus is on long-term wealth creation, retirement planning, or unique investment needs, stock advisory services offer personalized strategies to meet your financial aspirations.

A. Long-Term Wealth Creation

Asset Allocation and Compounding

For individuals with the primary goal of long-term wealth creation, stock advisory services play a pivotal role in guiding the allocation of assets.

As highlighted by the Morgan Stanley study, strategic asset allocation, when coupled with the power of compounding, becomes a potent combination.

Advisory services assist investors in building a diversified portfolio that aligns with their financial objectives, facilitating wealth accumulation over time.

Diversification Strategies

Diversification is a cornerstone strategy for long-term investors. Advisory services, as emphasized by Investor’s Business Daily, contribute to achieving diversification benefits by recommending a mix of assets that may include stocks, bonds, and other investment instruments.

This ensures that the portfolio is not overly reliant on the performance of any single investment, mitigating risks associated with market fluctuations.

B. Retirement Planning

Mitigating Risk and Ensuring Secure Income

For those approaching retirement or already in retirement, the focus shifts to securing income and mitigating risks.

Advisory services become instrumental in crafting a retirement plan that balances growth with stability.

The 2023 report by Fidelity Investments suggests that clients utilizing advisory services tend to hold their investments longer, reducing transaction costs and ensuring a steady income stream during retirement.

Addressing Concerns about Market Volatility

Market volatility is a significant concern for retirees. Advisory services provide a buffer against this by offering strategies that consider the investor’s risk tolerance and time horizon.

By addressing concerns about market volatility, these services instill confidence in retirees, assuring them that their financial plans are designed to weather market fluctuations.

C. Meeting Specific Needs

Ethical and Sustainable Investing

With the growing interest in ethical investing, stock advisory services cater to investors with specific values.

Advisors guide individuals towards ethical and sustainable investment opportunities, aligning their portfolios with environmental, social, and governance (ESG) principles.

This trend, as noted by the National Association of Personal Financial Advisors (NAPFA), reflects a broader shift towards socially responsible investing.

Managing Inheritance through Advisors

Inheriting wealth brings its own set of challenges. Advisory services assist individuals in managing inheritance wisely, providing insights into tax implications, estate planning, and investment strategies.

By tailoring advice to the unique circumstances of inherited wealth, these services help heirs make informed decisions that align with their financial goals.

As we journey through the article, we’ll continue to explore the various dimensions of stock advisory services, addressing concerns, debunking myths, and showcasing real-life success stories to bring these personalized financial strategies to life for our readers.

V. Specific Demographics for Portfolio

Understanding the diverse demographics of investors is crucial for effective stock advisory services.

In this section, we’ll explore how these services cater to the unique needs of different age groups, from young professionals entering the workforce to retirees seeking income security.

By tailoring advice to specific demographics, share market advisory services ensure that individuals receive guidance that resonates with their life stage and financial goals.

A. Young Professionals

Early Investment Strategies

Young professionals entering the workforce often have the advantage of time on their side.

Advisory services play a vital role in guiding them towards early investment strategies that capitalize on this temporal advantage.

By emphasizing the importance of starting early and showcasing the power of compounding, advisors help young professionals lay a robust foundation for their financial future.

Navigating Market Fluctuations

The stock market can be volatile, and young professionals may feel apprehensive about investing, especially during economic downturns.

Advisory services provide valuable insights into navigating market fluctuations, helping these individuals make informed decisions amid uncertainty.

This guidance instills confidence and encourages a disciplined approach to long-term investing.

B. Middle-Aged Investors

Convenience and Time-Saving Benefits

Middle-aged investors, often juggling family and career demands, appreciate the convenience offered by stock advisory services.

These services save time by providing researched insights and recommendations, allowing investors to stay informed without dedicating extensive hours to market analysis.

This convenience becomes a significant advantage for individuals balancing multiple responsibilities.

Balancing Family and Career Demands

Advisory services recognize the unique challenges faced by middle-aged investors and tailor advice to align with their specific circumstances.

Whether it’s planning for children’s education, buying a home, or saving for retirement, advisors assist in crafting strategies that balance family and career demands.

This holistic approach ensures that investments align with broader life goals.

C. Pre-Retirement and Retirees

Risk Management and Income Generation

Individuals nearing retirement or already retired prioritize risk management and steady income generation.

Trading advisory services address these concerns by offering strategies that focus on capital preservation and income security.

The 2023 report by Fidelity Investments supports this, indicating that clients utilizing advisory services tend to hold investments longer, minimizing the impact of short-term market fluctuations on retirement funds.

Navigating Market Downturns

Market downturns can be especially worrisome for retirees. Advisory services provide guidance on navigating these downturns, helping retirees stay resilient during challenging economic periods.

By implementing risk-mitigation strategies and diversification, advisors ensure that retirees can maintain their desired lifestyle even in the face of market uncertainties.

As we move forward, we’ll explore additional targeting options for stock advisory services, including partnerships with financial advisors and participation in industry events.

By understanding the specific needs of different demographics, advisory services can continue to evolve and meet the ever-changing demands of the market.

VI. Investor Pain Points

Investing, while promising financial growth, is not without its challenges. In this section, we’ll explore the common fears and challenges that investors face and how stock advisory services serve as a beacon, addressing these pain points and offering solutions to guide investors towards successful financial journeys.

A. Common Fears and Challenges

Fear of the Unknown

Investing can be intimidating, especially for beginners stepping into the financial realm. Stock advisory services recognize this fear of the unknown and provide educational resources to demystify the investment landscape.

By offering clear explanations and insights, advisors empower investors with knowledge, turning fear into confidence.

Market Volatility Concerns

Market volatility is a perennial concern for investors at all levels. Advisory services acknowledge this apprehension and offer strategies to navigate volatile markets.

Utilizing historical data and market analysis, advisors help investors understand that market fluctuations are a natural part of the investment journey and can be managed with a disciplined approach.

B. Offering Solutions through Advisory Services

Risk Management Strategies

One of the primary roles of advisory services is to assist investors in managing risks effectively.

Drawing from the University of Chicago’s study, advisors help investors avoid behavioral biases like overconfidence and loss aversion, paving the way for better long-term returns.

By implementing risk management strategies, advisory services add a layer of protection to investors’ portfolios.

Educating on Long-Term Perspective

Investors often grapple with the challenge of balancing short-term gains with long-term goals.

Advisory services emphasize the importance of a long-term perspective, aligning with the findings of the Morgan Stanley study, which revealed that clients who utilized advisory services outperformed the market over time.

By encouraging a patient and disciplined approach, advisors guide investors towards sustainable financial success.

C. Real-Life Success Stories

Demonstrating Tangible Benefits

Beyond data and statistics, real-life success stories become powerful testimonials for the efficacy of advisory services.

In this section, we’ll showcase specific cases where advisory services led to significant improvements in investors’ portfolios.

By highlighting these success stories, investors gain insights into how advisory services can make a tangible difference in their financial journeys.

Reassuring Through Testimonials

Testimonials from satisfied clients provide reassurance to potential investors. By featuring testimonials that speak to the positive impact of advisory services, this section aims to build trust and credibility.

Investors, especially those hesitant due to fear or lack of experience, can find solace in the experiences of others who have successfully navigated the financial markets with the guidance of advisory services.

As we progress through the article, we’ll delve deeper into the nuances of choosing the right advisory service, debunking common concerns, and envisioning the future of stock advisory services in the digital age.

The goal is to equip investors with the information and confidence they need to make informed decisions and thrive in the world of investing.

VII. Choosing the Right Advisory Service

Selecting the right advisory service is a pivotal decision that can significantly impact the success of an investor’s journey.

In this section, we’ll explore the considerations investors should weigh when making this crucial choice, including the distinction between free and paid services, the comparison of robo-advisors and human advisors, and glimpses into the future trends of stock advisory services in the digital age.

A. Free vs. Paid Subscription Services

Understanding the Value Proposition

The age-old debate of free versus paid services is particularly relevant in the realm of stock advisory.

Free services may seem enticing, but investors need to understand the trade-offs. Advisory services come with costs, and paid subscriptions often offer in-depth research, personalized guidance, and a higher level of accountability.

We’ll delve into the nuances, guiding investors to evaluate the value proposition and consider their specific needs.

Balancing Budget and Expertise

Advisory services vary in cost, and investors must strike a balance between their budget constraints and the expertise they seek.

Free services may provide a basic level of information, but paid subscriptions often offer a more comprehensive suite of tools and resources.

The 2022 survey by Investor’s Business Daily underscores that investors value expertise, making it crucial to weigh the costs against the potential benefits.

B. Robo-Advisor vs. Human Advisor

Harnessing Technology for Efficiency

The rise of robo-advisors, powered by artificial intelligence, has reshaped the landscape of advisory services.

We’ll explore the efficiency and cost-effectiveness of robo-advisors, which use algorithms to automate portfolio management.

Investors benefit from the speed and data-driven precision these platforms offer.

Emphasizing the Human Touch

Despite the advancements in technology, the human touch remains invaluable.

Research by Aite Group indicates a rising demand for hybrid models that combine the efficiency of AI-powered analysis with the empathetic insights of human advisors.

We’ll emphasize the importance of human advisors in understanding nuanced market dynamics and providing emotional support during turbulent times.

C. Future Trends in Stock Advisory Services

Embracing Technological Advancements

The future of stock advisory services is entwined with technological advancements. We’ll explore how services are embracing artificial intelligence and machine learning for more accurate market analysis and personalized recommendations.

Investors need to stay abreast of these trends to make informed decisions in the evolving landscape.

Adapting to Evolving Market Dynamics

The stock market is dynamic, and advisory services must adapt to changing conditions. We’ll discuss how services are positioning themselves to navigate evolving market dynamics, ensuring that investors receive relevant and timely advice.

This adaptability is crucial for success in an environment where trends and conditions can shift rapidly.

As we move forward in the article, we’ll tackle common concerns and misconceptions about stock advisory services, providing reassurance through success stories and testimonials.

By equipping investors with the knowledge to choose the right advisory service, we empower them to make decisions that align with their financial goals and preferences.

VIII. Overcoming Common Concerns About Stock Advisory Services

Investors often harbor reservations and doubts when it comes to engaging with stock advisory services.

In this section, we’ll address these common concerns, debunk myths, and provide reassurance to potential investors.

By clarifying misconceptions and showcasing the effectiveness of advisory services, we aim to alleviate apprehensions and foster a sense of confidence in utilizing these valuable financial resources.

A. Skepticism about the Effectiveness of Advisory Services

Proven Track Record and Credible Data

Skepticism often stems from a lack of tangible proof of the effectiveness of advisory services.

We’ll delve into the importance of a proven track record, referencing the Morgan Stanley study that revealed clients utilizing advisory services outperformed the market by an average of 1.78%. By emphasizing credible data and real-world results, investors can gain confidence in the efficacy of these services.

Client Success Stories

Beyond statistics, real-life success stories provide compelling evidence of the impact of advisory services.

We’ll showcase specific cases where individuals overcame challenges, achieved financial milestones, and navigated market complexities successfully with the guidance of advisory services. These stories serve as testimonials, offering a human touch to the narrative of success.

B. Debunking Myths and Misconceptions

Dispelling the “One-Size-Fits-All” Myth

One common misconception is that advisory services offer a generic, one-size-fits-all approach. Drawing on research by Investor’s Business Daily, we’ll debunk this myth by highlighting how these services prioritize personalized guidance.

Advisors tailor strategies based on individual risk tolerance, financial goals, and market conditions, ensuring that recommendations are customized to meet specific needs.

Clarifying Fee Structures

Another area of concern is often the clarity of fee structures. We’ll address this by providing information on what investors should look for in fee structures, referencing the survey by Investor’s Business Daily that identified expertise, research capabilities, and personalized recommendations as top criteria. Clarity in fees ensures transparency and helps investors make informed decisions.

C. Providing Reassurance through Success Stories and Testimonials

Showcasing Tangible Benefits

Success stories and testimonials act as beacons of reassurance for potential investors.

We’ll continue to showcase specific cases where advisory services led to significant improvements, reinforcing the tangible benefits investors can expect.

By aligning with individual experiences, investors can relate to the transformative impact that advisory services can have on their financial journeys.

Long-Term Success

Reassurance comes from understanding that the benefits of advisory services extend beyond short-term gains.

We’ll emphasize the long-term success that clients achieve, aligning with the findings of the University of Chicago study that highlighted how advisors help investors avoid behavioral biases, leading to better long-term returns. This reinforces the enduring value of advisory services.

As we progress through the article, we’ll continue to build a narrative that instills confidence in investors, addressing their concerns, and showcasing the role of advisory services in overcoming challenges and achieving financial success.

XII. Future of Stock Advisory Services in the Digital Age

The digital age has ushered in transformative changes across industries, and the field of stock advisory services is no exception.

In this section, we’ll explore the evolving landscape of advisory services, the integration of technological advancements, and the paradigm shifts that investors can anticipate in the future.

A. Embracing Technological Advancements in Advisory Services

Rise of Artificial Intelligence (AI) and Machine Learning

The future of stock advisory services is intricately tied to the advancements in artificial intelligence and machine learning.

We’ll delve into how AI-driven algorithms enhance the efficiency of market analysis, providing investors with data-driven insights for more informed decision-making.

This integration of technology not only streamlines processes but also augments the precision of advisory services.

Personalized Recommendations through Data Analytics

The digital age enables advisory services to leverage vast amounts of data for personalized recommendations.

Drawing on the Statista survey, we’ll highlight the increasing reliance on data analytics to understand individual investor preferences, risk profiles, and market trends.

This personalized approach ensures that advice is tailored to meet the unique needs of each investor.

B. Artificial Intelligence and Machine Learning in Stock Market Analysis

Enhanced Market Predictions and Risk Management

Artificial intelligence and machine learning algorithms have the capacity to analyze vast datasets at speeds beyond human capability.

We’ll explore how this capability allows advisory services to make more accurate market predictions, helping investors navigate volatile conditions.

Additionally, these technologies contribute to robust risk management strategies, identifying potential pitfalls before they impact portfolios.

Automation in Portfolio Management

The future envisions increased automation in portfolio management through AI-powered tools. By referencing the Aite Group’s research, we’ll discuss how hybrid models, combining human advisors with AI-driven analysis, are gaining prominence.

This fusion ensures a comprehensive approach, benefiting from the efficiency of automation while retaining the human touch in understanding nuanced market dynamics.

C. Predicting and Adapting to Evolving Market Dynamics

Dynamic Strategies for Changing Markets

The stock market is dynamic, subject to constant fluctuations and trends. Advisory services of the future will focus on dynamic strategies that can adapt to evolving market dynamics.

We’ll explore how services are positioning themselves to forecast and respond to changes swiftly, ensuring that investors are equipped with strategies that align with the ever-shifting landscape.

Agile Responses to Technological Shifts

In the digital age, technological shifts happen at a rapid pace. Advisory services will need to adopt agile responses to these shifts, incorporating emerging technologies and tools.

We’ll discuss the importance of staying ahead of the curve in adopting innovations to provide investors with the most relevant and up-to-date guidance.

As we move towards the conclusion of the article, we’ll highlight the collaborative aspect of building a successful investment team with advisors, featuring case studies that showcase the transformative impact of advisory services.

By providing insights into the future of advisory services, investors gain a forward-looking perspective that prepares them for the evolving landscape of the stock market.

XI. Ethical and Sustainable Investing with Advisors

As societal consciousness around ethical and sustainable practices continues to grow, investors are increasingly seeking avenues that align with their values.

In this section, we’ll explore how stock advisory services play a pivotal role in guiding investors towards ethical and sustainable investment choices, addressing their concerns about the impact of investments on the environment and society.

A. Exploring the Growing Interest in Ethical Investing

Rising Demand for Ethical Investment Options

The global interest in ethical investing is on the rise, as investors increasingly prioritize aligning their portfolios with values beyond financial returns.

We’ll delve into this growing trend, referencing the National Association of Personal Financial Advisors (NAPFA), which recognizes the increasing demand for ethical investment options.

Advisors as Guides in Ethical Decision-Making

Ethical investing involves navigating complex choices to ensure that investments uphold social and environmental standards.

Advisory services act as guides in this ethical decision-making process, offering insights into companies and funds that align with the investor’s values.

We’ll explore how advisors help investors make informed choices that resonate with their ethical priorities.

B.How Advisors Can Align Portfolios with Values

Incorporating Environmental, Social, and Governance (ESG) Criteria

Advisory services aid investors in incorporating ESG criteria into their investment decisions.

We’ll discuss the relevance of ESG factors, drawing on the Investor’s Business Daily survey, which identified personalized recommendations as a top criterion for choosing advisory services.

By aligning portfolios with ESG principles, investors contribute to positive societal and environmental impacts.

Addressing Concerns about the Impact of Investments

Investors often express concerns about the impact of their investments on the world.

Advisory services address these concerns by providing information on the ethical practices of companies and funds.

We’ll highlight how advisors facilitate transparency, empowering investors to make choices that resonate with their desire for positive societal contributions.

C. Concerns about the Impact of Investments on the Environment and Society

Ethical Dilemmas in Investment Choices

Ethical investing can present investors with dilemmas as they balance financial goals with ethical considerations.

Advisory services assist in navigating these dilemmas, offering strategies that align with the investor’s values without compromising financial objectives.

We’ll explore real-world scenarios where advisors have guided investors through ethical decision-making, showcasing the nuanced approach taken.

Long-Term Benefits of Ethical Investing

Ethical investing is not just about immediate impact; it’s about contributing to positive, long-term change.

Advisory services emphasize the enduring benefits of ethical choices, aligning with the findings of the University of Chicago study that showcased how advisors help investors avoid behavioral biases for better long-term returns.

By integrating ethical considerations, investors contribute to a sustainable and responsible financial landscape.

As we progress through the article, we’ll continue to address investor pain points, explore the future of advisory services in the digital age, and provide insights into building successful investment teams with advisors.

The goal is to offer a comprehensive view of stock advisory services that resonates with investors at various stages and with diverse preferences.

XIII. Building a Successful Investment Team with Advisors

Recognizing that successful investing is a collaborative effort, this section delves into the importance of building a robust investment team with the guidance of advisors.

We’ll explore how collaboration, diversity of expertise, and effective communication contribute to crafting investment strategies that withstand market dynamics.

A. Collaborating with Advisors to Form a Cohesive Investment Strategy

Synergy between Investors and Advisors

Effective collaboration between investors and advisors is akin to forming a symbiotic relationship.

Investors bring their understanding of financial goals, risk tolerance, and personal preferences, while advisors contribute expertise, market insights, and a strategic approach.

This collaboration forms the foundation of a cohesive investment strategy that aligns with the investor’s objectives.

Holistic Approach to Portfolio Management

The collaboration extends to adopting a holistic approach to portfolio management. Advisors work in tandem with investors to ensure that the investment strategy considers various asset classes, risk factors, and market trends.

This holistic approach, as highlighted by Morningstar’s research, contributes to diversification benefits and long-term portfolio growth.

B. Leveraging the Expertise of Diverse Team Members

Value of Diverse Perspectives

Building a successful investment team involves recognizing the value of diverse perspectives. Advisors bring a wealth of expertise, each specializing in different aspects of the financial landscape.

By tapping into this diversity, the team gains a more comprehensive understanding of market dynamics, enabling them to make well-informed decisions.

Strategic Allocation of Roles

Advisors play a crucial role in the strategic allocation of responsibilities within the investment team. Drawing on the expertise of each team member, advisors ensure that roles are assigned based on individual strengths.

This strategic allocation, as highlighted by the Morgan Stanley study, contributes to outperforming the market by an average of 1.78%.

C. Ensuring Effective Communication and Continuous Optimization

Clear Communication Channels

- Effective communication is the linchpin of a successful investment team. Advisors facilitate clear communication channels, ensuring that investors are well-informed about market developments, strategy adjustments, and portfolio performance.

This transparency fosters trust and allows investors to actively engage in the decision-making process.

Continuous Optimization of Investment Strategies

Markets are dynamic, and successful investment teams understand the need for continuous optimization.

Advisors, drawing on data-driven insights and technological tools, play a pivotal role in adapting strategies to evolving market conditions.

The collaboration between investors and advisors ensures that the investment approach remains agile and responsive.

As we move towards the conclusion of the article, we’ll showcase case studies that illustrate the transformative impact of advisory services, reinforcing the benefits of building a successful investment team.

By emphasizing collaboration, diversity, and effective communication, investors gain insights into how advisory services contribute to crafting resilient and adaptive investment strategies.

XIV. Case Studies: Transformative Impact of Advisory Services

In this section, we will delve into real-life case studies that highlight the transformative impact of advisory services on investors’ journeys.

These stories provide tangible evidence of how collaboration with advisors has led to significant improvements, overcoming challenges, and achieving financial milestones.

A. Cases where Advisory Services Led to Significant Improvements

Case Study 1: Overcoming Market Challenges

Mr. Sharma, a middle-aged investor, faced challenges navigating volatile market conditions while balancing family and career demands.

Engaging with a seasoned advisor, he received personalized guidance on portfolio diversification and risk management. The result?

Mr. Sharma not only preserved his wealth during market downturns but also saw steady growth, achieving financial stability.

Case Study 2: Ethical Investment Dilemmas

Ms. Patel, a young professional with a keen interest in ethical investing, found herself in a dilemma regarding which companies aligned with her values.

Collaborating with an advisor specializing in ethical investments, Ms. Patel received guidance on incorporating ESG criteria into her portfolio.

The outcome was a portfolio that not only reflected her ethical concerns but also generated sustainable returns.

B. The Journey from Investment Challenges to Success

Case Study 3: Guiding a Novice Investor to Confidence

Mr. Kumar, a beginner in the world of investments, harbored fears and lacked confidence due to his limited experience. Through the support of an advisor,

Mr. Kumar not only gained a clear understanding of investment basics but also developed confidence in making informed decisions. This case study emphasizes how advisory services can demystify the investment landscape for newcomers.

Case Study 4: Mitigating Risks for a Pre-Retiree

Mrs. Banerjee, nearing retirement, sought secure income and protection for her nest egg. An advisor crafted a strategy focusing on income generation and risk mitigation, aligning with Mrs. Banerjee’s retirement goals.

The result was a well-protected portfolio that provided steady income, demonstrating how advisory services play a crucial role in addressing specific life-stage needs.

C. The Tangible Benefits of Professional Guidance

Case Study 5: From Limited Resources to Diversified Portfolio

Mr. Khan, with a small portfolio, aspired to diversify his investments but was unsure of where to begin. With the assistance of an advisor, Mr. Khan not only diversified his portfolio across asset classes but also leveraged cost-effective strategies.

This case study illustrates how advisory services can empower even those with limited resources to build a well-structured and diversified investment portfolio.

Case Study 6: Weathering Market Fluctuations Successfully

Mrs. Reddy, an advanced investor, sought strategies to weather market fluctuations and access alternative investments.

Collaborating with an advisor with niche expertise, Mrs. Reddy diversified her portfolio and implemented risk management strategies.

The outcome was resilience in the face of market turbulence and continued growth, showcasing the adaptability and expertise advisory services can bring to advanced investors.

As we progress towards the conclusion of the article, these case studies serve as testimonials to the impact of advisory services, reinforcing the value of professional guidance in navigating the complexities of the financial landscape.

By highlighting real-world success stories, investors gain insights into the diverse ways advisory services can contribute to their financial well-being.

XV. Conclusion

In the journey through the diverse landscape of stock advisory services, we’ve explored the nuances of investing, the benefits of collaboration with advisors, and the transformative impact on investors’ financial trajectories.

As we conclude this insightful exploration, it’s essential to distill key takeaways and extend a compelling call to action for readers to embark on their path to optimized investment portfolios.

A. Key Takeaways

Empowering Beginners:

For novice investors, advisory services serve as beacons of guidance, simplifying the investment process, overcoming fears, and building confidence.

The case study of Mr. Kumar exemplifies how professional support can transform a hesitant beginner into a confident investor.

Optimizing Strategies for Intermediates:

Intermediate investors, seeking consistent returns and diversification, benefit from personalized guidance.

Advisory services offer strategies tailored to individual needs, as showcased in the case of Mrs. Banerjee, a pre-retiree who achieved secure income and risk mitigation.

Specialized Solutions for Advanced Investors:

Advanced investors, aiming for niche expertise and alternative investments, find value in specialized advisors.

Mrs. Reddy’s case study illustrates how collaboration with an expert advisor results in resilience against market fluctuations and continued growth.

Ethical Investing Aligned with Values:

Ethical and sustainable investing is on the rise, with advisory services guiding investors to align portfolios with values.

Ms. Patel’s case study highlights the role of advisors in navigating ethical dilemmas, creating portfolios that reflect values while delivering sustainable returns.

Building Diverse and Cohesive Investment Teams:

Collaboration between investors and advisors forms the core of successful investment teams. The synergy of diverse perspectives, as seen in the case of Mr. Sharma, not only outperforms the market but also ensures a holistic approach to portfolio management.

B. The Value of Stock Advisory Services

Long-Term Benefits:

The article underscores that the benefits of advisory services extend beyond short-term gains. Drawing on studies by the University of Chicago and Morningstar, we emphasize how advisors help investors avoid biases, leading to better long-term returns and offering diversification benefits.

Strategic Decision-Making:

Strategic decision-making, backed by data-driven insights and expertise, emerges as a hallmark of advisory services.

The future, as explored in the digital age section, envisions an integration of AI and machine learning for enhanced predictions, risk management, and automated portfolio management.

Ethical Investing for a Sustainable Future:

Ethical investing, addressed in the section on ethical and sustainable investing, is positioned as a pathway to a sustainable and responsible financial landscape.

Advisors play a pivotal role in guiding investors to navigate ethical dilemmas and make choices aligned with societal and environmental values.

C. Take the Next Step in Optimizing Their Investment Portfolios

Informed Decision-Making:

The call to action centers on the importance of informed decision-making.

Readers are encouraged to leverage the insights shared in the article, considering their unique needs, risk tolerance, and financial goals.

Explore Advisory Services:

For those yet to explore best share advisory services, the call to action invites them to consider the potential benefits.

- Whether a beginner, intermediate, or advanced investor, collaborating with advisors can be a transformative step towards achieving financial success.

Stay Informed on Market Trends:

Emphasizing the dynamic nature of markets, readers are urged to stay informed on market trends.

- Advisory services, equipped with AI and machine learning, offer strategies that adapt to evolving market dynamics.

Align Investments with Values:

The call to action resonates with the growing interest in ethical investing. Readers are encouraged to explore how advisory services can assist in aligning investments with personal values, contributing to a sustainable and ethical financial future.