The Indian rupee recently hit a historic low of 84.7050 against the U.S. dollar, a milestone that has sparked widespread concern among economists, policymakers, and businesses.

This record depreciation underscores the vulnerability of emerging market currencies in the face of global uncertainties and domestic economic challenges.

With geopolitical tensions on the rise, economic growth slowing, and the U.S. dollar surging in strength, the rupee’s tumble offers critical insights into the intersection of global and domestic factors shaping currency markets today.

In this article, we’ll delve into the key drivers behind the rupee’s decline, the role of the Reserve Bank of India (RBI), and the broader implications for investors, businesses, and policymakers.

We’ll also explore expert predictions and outline strategies to navigate the turbulence ahead.

Key Factors Behind the Rupee’s Decline

1. Geopolitical Tensions

One of the most significant factors influencing the rupee’s fall is the growing geopolitical friction.

Recently, Donald Trump, in his capacity as U.S. president-elect, threatened to impose 100% tariffs on BRICS nations (Brazil, Russia, India, China, and South Africa) if they pursue a new currency to rival the dollar.

This bold stance has injected fresh uncertainties into global markets, leading to investor anxiety and outflows from emerging markets like India.

BRICS nations, particularly India and China, have been vocal advocates for reducing dependency on the dollar. However, such ambitions, combined with the prospect of aggressive U.S. trade policies, have exacerbated capital flight, further pressuring the rupee.

2. Economic Growth Slowdown

India’s economic growth figures for Q2 2024 have disappointed expectations, with GDP expanding by only 5.4% year-on-year.

This slowdown reflects weak industrial output, declining exports, and sluggish domestic demand—all of which contribute to eroding market confidence in the rupee.

As businesses and investors brace for prolonged economic challenges, the currency has come under greater strain.

Weaker economic performance not only deters foreign investment but also magnifies vulnerabilities during periods of global instability.

3. Global Dollar Strength

The U.S. dollar continues to outperform as a “safe-haven” currency amid global political and economic instability. Factors driving this trend include:

Europe’s Political Instability: Ongoing political challenges in the European Union have weakened the euro.

China’s Economic Struggles: A faltering yuan has reinforced the dollar’s dominance.

Aggressive U.S. Federal Reserve Rate Hikes: Persistently high interest rates in the U.S. have made dollar-denominated assets more attractive, intensifying pressure on currencies like the rupee.

As a result, the rupee has suffered under the combined weight of global market trends and domestic challenges.

The Role of RBI and Domestic Interventions

To curb the rupee’s decline, the Reserve Bank of India (RBI) has taken proactive measures, including:

Selling Dollars: The RBI has intervened in currency markets to stabilize the rupee, though this approach risks depleting foreign reserves.

Adjusting Liquidity: Speculation suggests that the RBI may reduce the cash reserve ratio (CRR) to inject more liquidity into the system and stimulate economic activity.

Interest Rate Strategy: Balancing inflation control with growth support remains a challenging tightrope for the central bank.

While these interventions have provided short-term relief, the long-term effectiveness of such measures depends on sustained improvements in economic fundamentals.

Broader Geopolitical Landscape

Responses from BRICS Nations

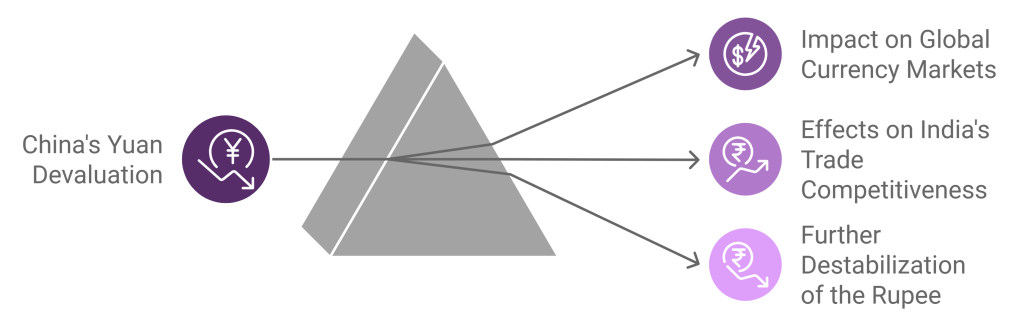

As geopolitical tensions escalate, BRICS countries are exploring alternatives to the dollar. For instance, China’s potential yuan devaluation could have far-reaching consequences for global currency markets, impacting India’s trade competitiveness and further destabilizing the rupee.

Rising Crude Oil Prices

The recovery of global crude oil prices has added another layer of complexity. As a major oil importer, India is particularly vulnerable to rising energy costs, which exacerbate inflation and widen the current account deficit. This dynamic directly affects the rupee by increasing demand for dollars to settle oil imports.

U.S. Fiscal Policies

Uncertainty surrounding the fiscal policies of the incoming U.S. administration continues to loom large. Any aggressive fiscal tightening or protectionist trade measures could disrupt global economic balances, amplifying volatility in emerging markets.

Market Predictions and Expert Opinions

Experts forecast that the rupee will trade within the 84.50 to 85.00 range in the near term, reflecting heightened volatility. Economists warn that further depreciation is possible if geopolitical tensions persist or domestic economic challenges worsen. Additionally, the potential for further Foreign Institutional Investor (FII) outflows remains a significant concern, as it could exacerbate currency weakness and destabilize markets.

Implications for Investors and Businesses

1. Impact of Rupee Depreciation

The rupee’s decline has wide-ranging effects on various sectors:

Imports: Increased costs for imported goods, particularly crude oil and electronic components.

Exports: A weaker rupee can benefit exporters by making Indian goods more competitively priced in international markets.

Inflation: Currency depreciation contributes to rising inflation, squeezing household budgets and increasing borrowing costs.

Sectors Most Affected

Industries that rely heavily on imports, such as technology and pharmaceuticals, face significant challenges. Conversely, export-driven sectors like IT services and textiles may benefit from the weaker rupee.

Strategic Advice

To mitigate risks, businesses and investors should:

Hedge Currency Risks: Utilize forward contracts and other financial instruments to protect against currency fluctuations.

Diversify Portfolios: Spread investments across geographies and asset classes to minimize exposure to rupee volatility.

The Way Forward

1. Policy Clarity

A consistent and transparent approach from the U.S. administration and other global leaders is essential to reduce uncertainties and restore market confidence.

2. Strengthening Economic Resilience

India must focus on structural reforms, such as improving ease of doing business, fostering innovation, and enhancing productivity, to build a more resilient economy capable of withstanding external shocks.

3. Geopolitical Cooperation

Collaborative efforts among nations are crucial to mitigate long-term risks. Forums like the G20 and BRICS can play a pivotal role in addressing global economic challenges and stabilizing financial markets.

Conclusion

The rupee’s decline to historic lows reflects a complex interplay of global and domestic factors. Geopolitical tensions, slowing economic growth, and the relentless strength of the U.S. dollar have created a challenging environment for emerging markets like India. However, by staying informed, adopting adaptive strategies, and fostering global cooperation, stakeholders can navigate these turbulent times effectively.