Navigating the world of stock market investments can be as thrilling as it is daunting. It’s like setting sail on a vast ocean, filled with opportunities and risks. In such turbulent waters, having a reliable guide can make all the difference between smooth sailing and stormy seas. This is where stock market advisory services come into play.

A. Defining Stock Market Advisory Services

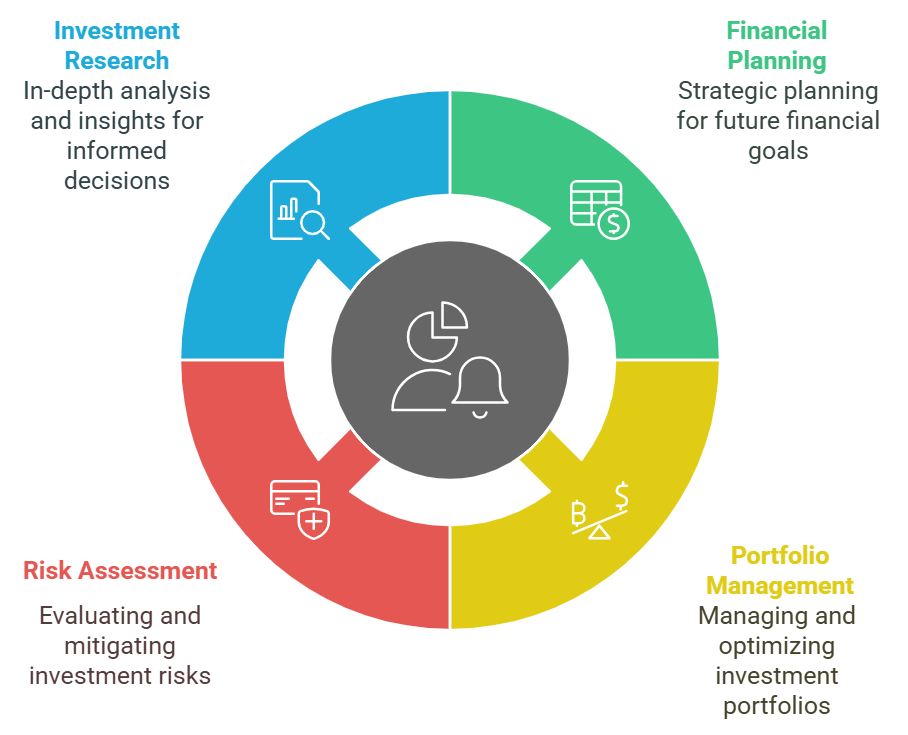

Stock market advisory services are like your trusted navigators in the tumultuous sea of investments. They are the professionals equipped with knowledge, experience, and expertise to help investors chart a course towards their financial goals. These services encompass a wide range of offerings, including financial planning, portfolio management, risk assessment, and investment research.

Imagine you’re planning a journey to a distant land. You wouldn’t embark on such a voyage without a map, a compass, and a seasoned guide, would you? Similarly, in the realm of investments, advisory services in india serve as your compass, guiding you through the complexities of financial markets and helping you make informed decisions along the way.

B. Importance of Choosing the Right Advisory Service in india

Now, you might be wondering, “Why do I need a stock market advisory service? Can’t I navigate the markets on my own?” While it’s true that some investors prefer to go it alone, the reality is that the world of investments can be treacherous for the uninitiated.

Choosing the right advisory service in india is akin to choosing the right captain for your ship. Just as a skilled captain can steer your vessel safely to its destination, a competent advisory service can help you navigate market volatility, mitigate risks, and optimize returns on your investments.

But why is choosing the right advisory service in india so crucial? Well, think of it this way: your financial future is at stake. Whether you’re saving for retirement, planning for your children’s education, or building wealth for the future, the decisions you make today can have a profound impact on your long-term financial well-being.

By entrusting your investments to a reputable and competent advisory service, you gain access to invaluable expertise, insights, and resources that can help you achieve your financial goals with confidence and clarity.

So, how do you go about choosing the right advisory service in india? What factors should you consider? We’ll explore these questions and more in the following sections, but for now, let’s take a moment to appreciate the role that stock market advisory services play in shaping the financial destinies of investors around the world.

II. Understanding Investment Goals

Before embarking on the journey of investing in the stock market, it’s essential to have a clear understanding of your investment goals. And it will help you in finding best stock market advisory services and also help you to find the answer of how to pick a stock market advisor. Think of it as plotting a course on a map before setting sail – you need to know where you’re headed and why you’re heading there.

A. Identifying Personal Financial Objectives

Your investment goals are like destinations on your financial journey – they give you direction and purpose. These goals can vary widely from person to person. For some, it might be saving for retirement so they can enjoy their golden years without financial worries. For others, it could be buying a home, funding their children’s education, or simply building wealth for the future.

When identifying your investment goals, you will get the best stock market advisory services in india but it’s crucial to be specific and realistic. Instead of saying, “I want to be rich,” think about what being “rich” means to you. Is it having a certain amount of money saved up for retirement? Is it being debt-free? By clearly defining your financial objectives, you can tailor your investment strategy to achieve them more effectively.

For example, let’s say your goal is to retire comfortably at the age of 65 with a nest egg of ₹5 crore. This specific target gives you something concrete to work towards and allows you to calculate how much you need to save and invest each year to reach your goal.

B. Time Horizon and Risk Tolerance Assessment

Once you’ve identified your investment goals, the next step is to assess your time horizon and risk tolerance. Your time horizon refers to the length of time you have to achieve your financial objectives. Are you investing for the short term, such as saving for a down payment on a house in the next five years? Or are you investing for the long term, like funding your retirement in 30 years?

Your risk tolerance, on the other hand, is your ability and willingness to endure fluctuations in the value of your investments. Are you comfortable with the possibility of short-term losses in exchange for potentially higher long-term returns? Or do you prefer a more conservative approach with lower volatility and slower growth?

Understanding your time horizon and risk tolerance is critical because it dictates the appropriate investment strategy for your unique circumstances. For example, if you have a long time horizon and a high risk tolerance, you may be more inclined to invest in equities, which have the potential for higher returns but also higher volatility. On the other hand, if you have a short time horizon or a low risk tolerance, you may prefer to focus on more conservative investments like bonds or fixed deposits.

In my own experience, I’ve found that aligning my investment strategy with my time horizon and risk tolerance has been instrumental in achieving my financial goals. By staying disciplined and sticking to my investment plan, I’ve been able to weather market downturns and capitalize on long-term growth opportunities.

III. Evaluating Stock Market Advisory Services

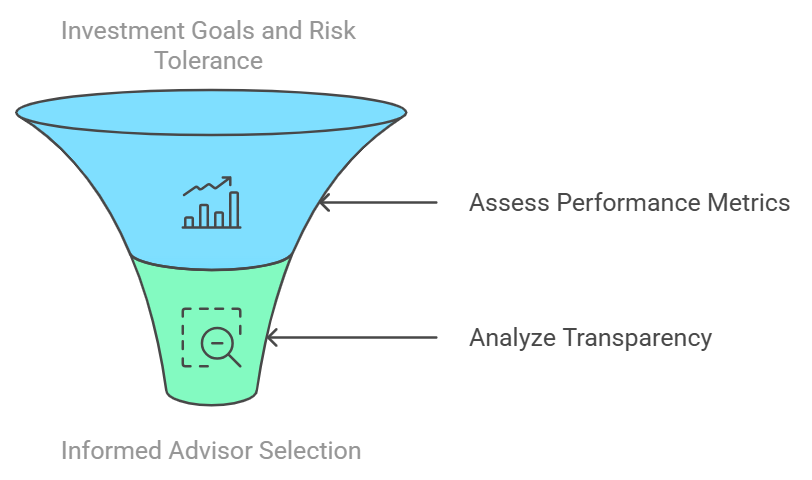

Do you want to know how to pick a stock market advisor? So Once you’ve clarified your investment goals and assessed your risk tolerance, the next step is to evaluate the best stock market advisory services to find the right fit for your needs. With so many options available, it’s essential to take a systematic approach to ensure you choose a service that aligns with your objectives and preferences.

A. Performance Metrics and Track Record

When evaluating advisory services, one of the first things to consider is their performance metrics and track record. After all, you want to entrust your hard-earned money to a service that has a history of delivering solid returns. Look for key performance indicators such as annualized returns, volatility measures, and risk-adjusted metrics like the Sharpe ratio.

Statistics and data can provide valuable insights into the performance of advisory services. For example, according to a study by the Financial Planning Association, investors who work with a financial advisor outperform those who go it alone by an average of 3.74% annually. This statistic underscores the potential benefits of seeking professional advice when it comes to managing your investments.

Nevertheless, it’s imperative to keep in mind that previous achievements do not necessarily foreshadow future outcomes. While a track record of strong performance can be a positive sign, it’s just one piece of the puzzle when evaluating advisory services. Consider factors like consistency of returns, adherence to investment philosophy, and alignment with your investment goals.

B. Transparency and Fee Structure Analysis

Transparency and fee structure are also critical considerations when evaluating advisory services. You want to work with a service that is upfront and transparent about its fees and charges. Look for services that clearly outline their fee structure, including management fees, performance-based fees, and any other costs associated with the service.

According to SEBI regulations, registered investment advisors are required to meet minimum qualifications and pass a certification exam, ensuring a baseline level of competency. This regulatory requirement helps ensure that advisors are qualified to provide investment advice and adhere to ethical standards in their dealings with clients.

In my own experience, transparency and clarity around fees have been essential factors in selecting an advisory service. Knowing exactly what I’m paying for and understanding how fees are calculated gives me confidence that I’m getting value for my money and helps build trust in the advisory relationship.

C. Research and Analysis Methodologies

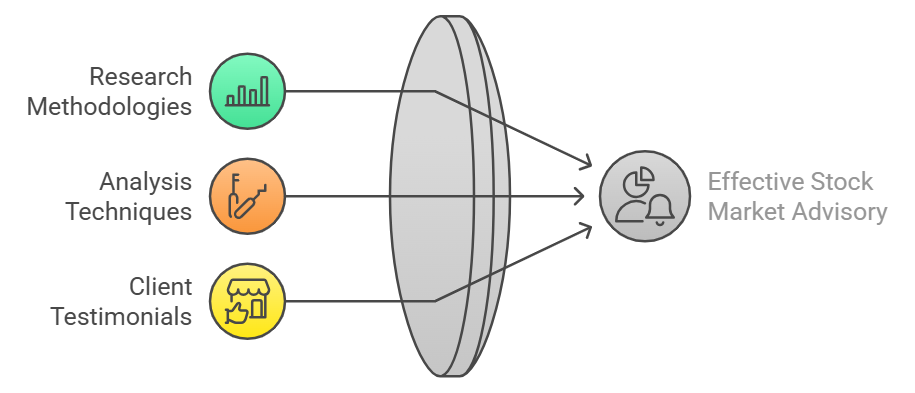

Another important aspect to consider when evaluating advisory services in india is their research and analysis methodologies. You want to work with a service that employs robust research techniques and rigorous analysis to identify investment opportunities and manage risks effectively.

Ask questions about the firm’s research process, investment philosophy, and the depth of analysis conducted before making investment recommendations. Look for services that leverage a combination of fundamental and technical analysis, as well as qualitative and quantitative research methods, to inform their investment decisions.

These process is step by step process to find the answer of how to pick a stock market advisor services in india?

IV. Top 5 Premier Share Market Advisory Services in India.

1. Apna Research Plus: Services, Track Record, and Client Feedback

Apna Research Plus leads the charge in the best stock market advisory services realm, providing a comprehensive suite of services finely tuned to cater to investors’ multifaceted requirements. With a decade-long legacy of distinction, Apna Research Plus has garnered the trust and admiration of its clientele for its dependable guidance and insightful analyses.

Services: Apna Research Plus offers a diverse array of services, encompassing equity research, investment advisory, portfolio management, and personalized trading recommendations. Our seasoned team specializes in technical analysis, fundamental research, and robust risk management strategies, ensuring clients receive precise insights and expert counsel.

Track Record: With a proven track record of success, Apna Research Plus consistently delivers profitable returns for its clients. Our unwavering commitment to ethical practices and transparent communication has cemented our reputation as a reliable advisory service provider. We take pride in maintaining an average accuracy rate that surpasses industry standards, showcasing our dedication to assisting clients in navigating the market complexities with confidence.

Client Feedback: Glowing testimonials from satisfied clients underscore Apna Research Plus’s steadfast dedication to client satisfaction. Clients laud us for our timely recommendations and adept handling of volatile market conditions. Furthermore, our commitment to transparency is evidenced by our provision of free trial periods, enabling prospective clients to experience our services firsthand and witness the value we bring to their investment endeavors.

2. CapitalVia Global Research Limited: Services, Track Record, and Client Testimonials

CapitalVia Global Research Limited emerges as a frontrunner in the stock market advisory services domain, offering a comprehensive suite of services meticulously crafted to cater to investors’ diverse needs. With an impressive track record spanning over a decade, CapitalVia has earned the trust and accolades of clients for its reliable recommendations and insightful analyses.

Services: CapitalVia provides an extensive array of services, including equity research, investment advisory, portfolio management, and customized trading recommendations. Our adept team excels in technical analysis, fundamental research, and risk management, ensuring clients receive accurate insights and guidance.

Track Record: With an average accuracy rate exceeding 80%, CapitalVia consistently delivers profitable returns for its clients. Our commitment to ethical practices and transparent communication further strengthens our reputation as a trustworthy advisory service.

Client Testimonials: Positive client testimonials attest to CapitalVia’s commitment to client satisfaction. Clients praise the company for its timely recommendations and adept navigation of volatile market conditions. Additionally, free trial periods offer prospective clients the opportunity to experience CapitalVia’s services firsthand, further solidifying our credibility.

3. Research and Ranking: Expertise, Unique Strategies, and Client Reviews

Research and Ranking (R&R) epitomizes expertise and innovation in the stock market advisory services landscape. With a team of experienced professionals and advanced technology tools, R&R offers unparalleled investment strategies and personalized solutions to clients.

Expertise: R&R’s team possesses extensive knowledge of equity research techniques and utilizes advanced technology tools such as Big Data Analytics & Artificial Intelligence-based algorithms. This enables them to identify fundamentally strong companies and recommend lucrative investment opportunities.

Unique Strategies: R&R’s distinctive investment strategies are backed by extensive research and analysis, resulting in consistently high-performing portfolios for clients. Their ability to adapt to changing market conditions ensures clients stay ahead in the investment game.

Client Reviews: Satisfied clients attest to R&R’s reliability and effectiveness in helping them achieve their financial goals. Testimonials on R&R’s website showcase how their innovative strategies have delivered exceptional returns and transformed clients’ investment journeys.

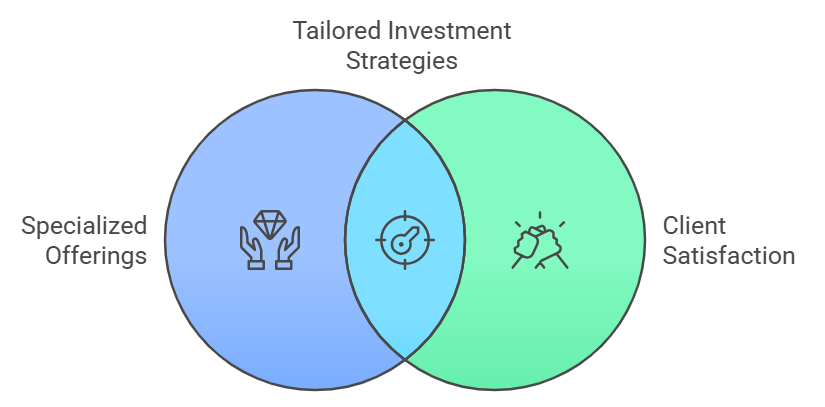

4. AGM Investment: Specialized Offerings, Performance History, and Client Satisfaction

AGM Investment stands as a beacon of reliability and excellence in the stock market advisory services sphere. With specialized offerings, an impressive performance history, and an unwavering commitment to client satisfaction, AGM Investment has earned the trust of investors nationwide.

Specialized Offerings: AGM Investment offers a comprehensive range of services, including portfolio management, equity research, wealth management solutions, and investment banking services. Their team of expert advisors provides personalized guidance tailored to each client’s unique needs.

Performance History: AGM Investment’s disciplined approach to investments has resulted in consistent and impressive returns for clients. Thorough research and analysis drive their investment strategies, generating significant alpha for investors.

Client Satisfaction: At AGM Investment, client satisfaction takes precedence. The firm prioritizes building long-term relationships based on trust and transparency, ensuring open communication and regular updates on portfolio performance.

5. HMA Trading: Noteworthy Features, Customer Feedback, and More

HMA Trading shines as a leading stock market advisory firm, renowned for its exceptional services and personalized approach. With a team of experienced analysts and cutting-edge technology tools, HMA Trading offers comprehensive investment solutions to clients across the board.

Noteworthy Features: HMA Trading’s personalized approach caters to each client’s unique investment needs, ensuring customized strategies aligned with individual goals and risk appetite. Advanced technology tools enable accurate analysis and informed decision-making.

Customer Feedback: Positive feedback from satisfied clients underscores HMA Trading’s commitment to excellence and client satisfaction. Clients appreciate the personalized attention and insightful recommendations provided by the firm’s experienced advisors.

As investors seek reliable guidance in navigating the complexities of the stock market, Apna Research Plus highlights these top share market advisory services in India, each offering unique features and benefits tailored to meet the diverse needs of investors. With a commitment to excellence and a track record of success, these advisory services in india empower investors to make informed decisions and achieve their financial goals.

V. Factors to Consider When Choosing an Advisory Service

Choosing the right stock market advisory service in india is a crucial decision that can significantly impact your financial future. With numerous options available, it’s essential to consider several factors to ensure you select a service that aligns with your investment goals, preferences, and risk tolerance.

A. Investment Philosophy Alignment

One of the most critical factors to consider when choosing an advisory service is the alignment of their investment philosophy with your own beliefs and objectives. Every advisory service has its own approach to investing, whether it’s value investing, growth investing, or a combination of strategies.

For example, if you’re a conservative investor who prioritizes capital preservation and steady income, you may prefer an advisory service that focuses on dividend-paying stocks and fixed-income securities. On the other hand, if you’re comfortable with higher levels of risk and seek maximum capital appreciation, you may gravitate towards a service that specializes in growth-oriented investments.

It’s essential to do your research and understand the investment philosophy of each advisory service you’re considering. Look for services whose approach resonates with your investment goals and risk tolerance, as this alignment will increase the likelihood of a successful and rewarding advisory relationship.

B. Level of Personalization and Customer Support

Another crucial factor to consider is the level of personalization and customer support offered by the advisory service. Every investor is unique, with different financial goals, risk tolerances, and preferences. Therefore, it’s essential to choose a service that takes the time to understand your individual needs and tailor their recommendations accordingly.

For example, some advisory services offer personalized investment plans and one-on-one consultations with financial advisors to discuss your goals and develop a customized strategy. These services provide a high level of support and guidance, ensuring that you feel confident and informed about your investment decisions.

On the other hand, some investors may prefer a more hands-off approach, with minimal interaction with advisors and a focus on automated investment solutions. In this case, it’s essential to choose a service that offers robust online tools and resources for self-directed investors.

Regardless of your preferences, it’s essential to select an advisory service that prioritizes customer support and responsiveness. Look for services with a reputation for excellent service and timely communication, as this will ensure that your needs are met and your questions are answered promptly.

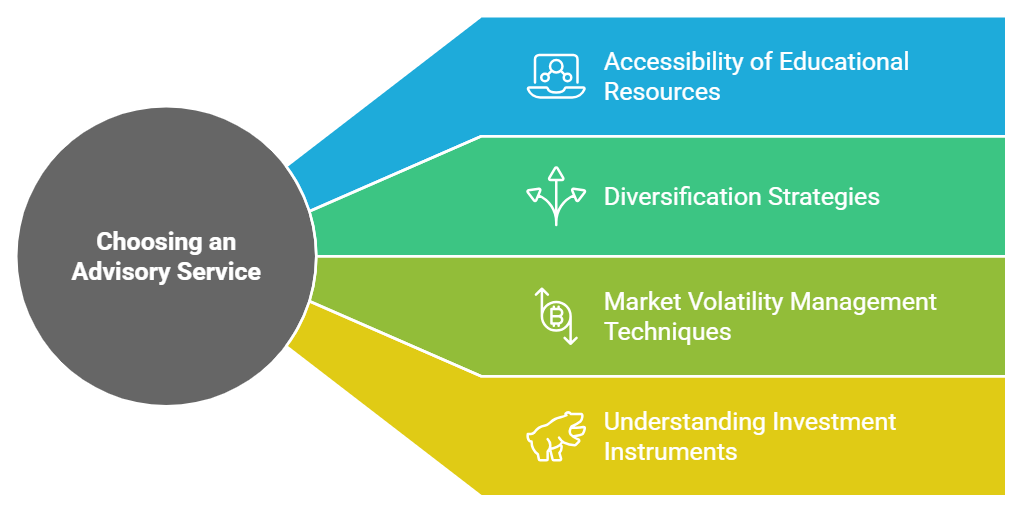

C. Accessibility of Educational Resources

Finally, when choosing an advisory service, consider the accessibility of educational resources available to clients. Investing can be complex and intimidating, especially for beginners, so it’s essential to choose a service that empowers you with the knowledge and tools you need to make informed decisions.

For example, some advisory services in india offer a wealth of educational materials, including articles, webinars, and tutorials, to help clients understand key investment concepts, market trends, and strategies. These resources can be invaluable for investors looking to expand their knowledge and become more confident in their investment decisions.

Additionally, consider the availability of research reports, market analysis, and other informational resources provided by the advisory service. Access to timely and relevant information can help you stay informed about market developments and make strategic investment decisions that align with your goals.

VI. Tips for Assessing Investment Risks

Investing in the stock market comes with inherent risks, but with careful assessment and risk management strategies, investors can navigate these challenges effectively. Here are some tips for assessing investment risks to help you make informed decisions and protect your financial assets:

A. Diversification Strategies

Among the prime strategies for minimizing investment vulnerabilities lies in diversification. This approach entails dispersing your investments across varied asset classes, industries, and geographical areas, thereby lessening the influence of any individual investment on your overall portfolio.

For example, instead of putting all your money into a single stock, consider investing in a mix of stocks, bonds, real estate, and other asset classes. This way, if one sector or asset class experiences a downturn, your portfolio will be less vulnerable to significant losses.

Studies have shown that diversification can help improve risk-adjusted returns and reduce portfolio volatility over time. According to research by Modern Portfolio Theory, a well-diversified portfolio can potentially achieve higher returns with lower risk compared to a concentrated portfolio.

B. Market Volatility Management Techniques

Market volatility is an inherent feature of the stock market, but there are strategies investors can employ to manage its impact on their portfolios. One such technique is dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of market conditions.

For example, instead of trying to time the market and invest all your money at once, you could invest a portion of your savings every month or quarter. This strategy helps smooth out the impact of market fluctuations over time and can result in lower average purchase prices, especially during periods of market volatility.

Another technique for managing market volatility is setting stop-loss orders, which automatically sell a security when its price falls below a predetermined level. While stop-loss orders can help protect against steep losses, it’s essential to set them at appropriate levels to avoid triggering unnecessary selling during short-term market fluctuations.

Additionally, investors can consider allocating a portion of their portfolio to defensive assets, such as bonds or gold, which tend to perform well during periods of market turmoil. By incorporating these assets into their portfolios, investors can reduce overall portfolio volatility and enhance risk-adjusted returns.

C. Understanding Investment Instruments

Finally, when assessing investment risks, it’s essential to have a thorough understanding of the investment instruments you’re considering. Different asset classes and investment products carry varying levels of risk, so it’s crucial to evaluate their risk-return profiles and suitability for your investment objectives.

For example, stocks are typically considered higher-risk investments due to their potential for volatility, but they also offer the potential for higher returns over the long term. On the other hand, bonds are generally considered lower-risk investments, but they may offer lower returns compared to stocks.

VII. The Role of Technology in Advisory Services

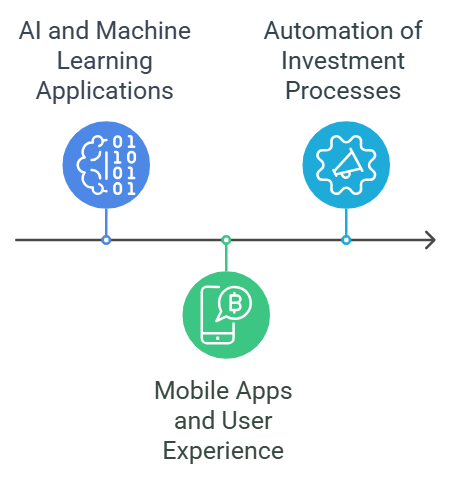

In the contemporary digital era, technology holds a central position in molding the terrain of share market advisory services. From advanced data analytics to user-friendly mobile apps, technology has revolutionized how investors access information, make investment decisions, and manage their portfolios. Let’s delve into the various ways technology is transforming advisory services:

A. AI and Machine Learning Applications

Artificial intelligence (AI) and machine learning are revolutionizing the way advisory services analyze market data, identify trends, and make investment recommendations. These technologies can sift through vast amounts of data in real-time, uncovering hidden patterns and insights that human analysts may overlook.

For example, AI-powered algorithms can analyze historical market data, economic indicators, and news sentiment to predict future market movements and identify investment opportunities. By leveraging machine learning models, advisory services in india can develop more accurate and personalized investment strategies tailored to each client’s unique needs and preferences.

One notable statistic is that AI and machine learning applications in finance are projected to grow at a compound annual growth rate (CAGR) of over 40% from 2021 to 2028, according to a report by Grand View Research. This exponential growth underscores the increasing importance of AI and machine learning in shaping the future of advisory services.

B. Mobile Apps and User Experience

Another crucial aspect of technology in advisory services is the development of user-friendly mobile apps that empower investors to manage their portfolios on the go. Mobile apps provide clients with instant access to their investment accounts, real-time market data, and research reports, allowing them to stay informed and make informed decisions from anywhere, at any time.

For example, investors can use mobile apps to track their portfolio performance, execute trades, and access educational resources such as articles, videos, and webinars. These apps often feature intuitive interfaces, personalized dashboards, and interactive tools that enhance the user experience and make investing more accessible and convenient for clients.

According to a survey by Statista, the number of smartphone users worldwide is projected to reach over 3.8 billion by 2021, highlighting the widespread adoption of mobile technology. Advisory services that prioritize mobile app development and user experience are well-positioned to meet the needs of today’s tech-savvy investors and differentiate themselves in a competitive market.

C. Automation of Investment Processes

Lastly, technology is streamlining and automating various investment processes, making advisory services more efficient, scalable, and cost-effective. Automation can help advisors eliminate manual tasks, reduce human error, and focus their time and energy on higher-value activities such as portfolio analysis and client communication.

For example, automated portfolio rebalancing tools can automatically adjust asset allocations to maintain desired risk levels and investment objectives. Robo-advisors, powered by algorithms and AI, can provide automated investment advice and portfolio management services at a fraction of the cost of traditional advisory services.

According to a report by Deloitte, automation is expected to transform the wealth management industry, with automated advisory services projected to manage over $16 trillion in assets globally by 2025. This seismic shift underscores the growing demand for technology-driven solutions that deliver value and efficiency to investors.

IX. Regulatory Considerations and Compliance

Navigating the regulatory landscape is a crucial aspect of selecting a stock market advisory service. Compliance with regulations ensures investor protection, ethical conduct, and transparency in the financial industry. Let’s explore the key regulatory considerations and compliance measures that investors should keep in mind:

A. Regulatory Bodies and Oversight

Within India, the Securities and Exchange Board of India (SEBI) stands as the principal regulatory body governing both the securities market and the realm of reliable investment advisory services. SEBI plays a vital role in regulating and supervising advisory firms to ensure they adhere to ethical standards, maintain investor protection, and promote market integrity.

SEBI’s regulations require reliable investment advisory services firms to register with the authority and comply with stringent eligibility criteria, including minimum qualifications for advisors and robust compliance procedures. By regulating advisory services, SEBI aims to safeguard the interests of investors and maintain the credibility of the financial markets.

For example, SEBI’s Investment Advisers Regulations, 2013, outline the regulatory framework for reliable investment advisory services, including registration requirements, conduct of business rules, and obligations towards clients. These regulations help ensure that advisory services operate with integrity, competence, and transparency.

In my personal experience, I’ve found SEBI’s regulatory oversight to be instrumental in instilling confidence in the financial services industry. Knowing that advisory firms are subject to rigorous regulatory scrutiny and oversight gives investors peace of mind and reassurance that their interests are protected.

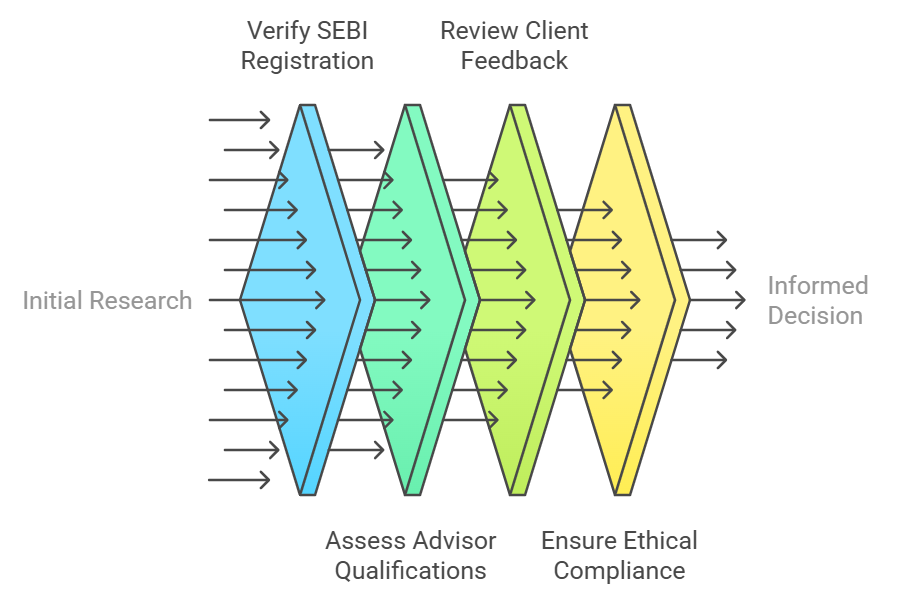

B. Importance of Due Diligence

When selecting an advisory service, investors should conduct thorough due diligence to ensure compliance with regulatory requirements and ethical standards. This includes verifying the firm’s SEBI registration status, qualifications of advisors, and adherence to SEBI’s code of conduct.

For example, investors can use SEBI’s website to verify the registration status of advisory firms and check for any disciplinary actions or complaints against them. Additionally, investors can request information about the qualifications and credentials of the advisors managing their investments to ensure they meet SEBI’s requirements.

By performing due diligence, investors can mitigate the risk of fraud, misconduct, and unethical practices in the financial industry. It’s essential to choose advisory services with a proven track record of compliance and ethical conduct to safeguard your investments and financial well-being.

In my own investment journey, I’ve learned the importance of due diligence in selecting advisory services. By researching regulatory compliance, credentials of advisors, and client reviews, I’ve been able to make informed decisions and choose services that prioritize transparency and integrity.

C. Legal Obligations and Investor Protection

SEBI’s regulations impose legal obligations on advisory firms to protect investor interests and ensure fair and transparent dealings. These obligations include providing disclosure of fees and charges, maintaining confidentiality of client information, and adhering to fiduciary duties towards clients.

For example, advisory firms are required to provide clients with a written agreement outlining the scope of services, fees, and any conflicts of interest that may arise. This ensures transparency and clarity in the advisory relationship and helps investors make informed decisions about their investments.

Furthermore, SEBI provides mechanisms for investor protection and redressal of grievances against advisory firms. Investors can file complaints with SEBI’s Investor Complaints Cell if they have concerns about the conduct or services of a registered advisor. This provides investors with recourse in case of any disputes or misconduct.

X. Monitoring and Reviewing Advisory Performance

After selecting a share market advisory service, it’s crucial to regularly monitor and review its performance to ensure it continues to meet your investment goals and expectations. Here’s how you can effectively monitor and review the performance of your advisory service:

A. Regular Portfolio Evaluations

Regular portfolio evaluations are essential to assess the performance of your investments and make any necessary adjustments. Set a schedule for reviewing your portfolio, whether it’s monthly, quarterly, or annually, and track key performance metrics such as returns, volatility, and asset allocation.

For example, compare the performance of your portfolio against relevant benchmarks, such as stock market indices or peer group averages, to gauge how well your investments are performing relative to the broader market. Look for trends or patterns in your portfolio’s performance and consider whether any changes are needed to align with your investment objectives.

In my own experience, I’ve found that conducting regular portfolio evaluations helps me stay informed about the performance of my investments and identify any areas for improvement. By monitoring key metrics and trends over time, I can make informed decisions about rebalancing my portfolio or adjusting my investment strategy as needed.

B. Rebalancing Strategies

As market conditions change and asset prices fluctuate, your portfolio’s asset allocation may drift from your target allocation. Rebalancing involves realigning your portfolio to maintain the desired mix of assets and risk levels. Establish criteria for when to rebalance your portfolio, such as when asset allocations deviate by a certain percentage from your target allocation.

For example, if your target allocation is 60% stocks and 40% bonds, but due to market movements, your portfolio now consists of 70% stocks and 30% bonds, it may be time to rebalance by selling some stocks and buying more bonds to restore the desired allocation.

Maintaining a regular rebalancing routine guarantees that your portfolio stays varied and in sync with both your risk tolerance level and investment goals. By adhering to a disciplined rebalancing strategy, you can avoid overexposure to any single asset class and maintain a well-balanced portfolio over time.

C. Exit Strategies for Underperforming Services

Despite careful selection and monitoring, there may be instances where your advisory service underperforms or fails to meet your expectations. In such cases, it’s essential to have exit strategies in place to protect your investments and minimize potential losses.

Consider establishing clear criteria for when to terminate your relationship with the advisory service, such as persistent underperformance relative to benchmarks, changes in key personnel or investment philosophy, or breaches of trust or ethical conduct.

For example, if your advisory service consistently fails to deliver returns in line with market benchmarks or exhibits a pattern of poor communication or responsiveness, it may be time to consider switching to a different service that better aligns with your needs and expectations.

In my personal experience, I’ve encountered situations where advisory services failed to meet my expectations or adhere to their stated investment philosophy. By having clear exit strategies in place and being prepared to take action when necessary, I’ve been able to protect my investments and find alternative solutions that better suit my needs.

XI. Expert Opinions and Industry Insights

Seeking expert opinions and industry insights can provide valuable guidance and perspective when making investment decisions. Whether through interviews with financial analysts, staying informed about emerging trends, or understanding the future of investment strategies, leveraging expert insights can help investors navigate the complexities of the stock market. Here’s how you can benefit from expert opinions and industry insights:

A. Interviews with Financial Analysts

One way to gain expert insights is by seeking interviews with financial analysts who specialize in the stock market. Financial analysts possess in-depth knowledge and expertise in analyzing market trends, evaluating investment opportunities, and providing actionable recommendations to investors.

For example, conducting interviews with leading financial analysts can provide valuable insights into current market conditions, sector-specific trends, and macroeconomic factors that may impact investment decisions. By asking informed questions and listening to expert opinions, investors can gain a deeper understanding of market dynamics and potential investment opportunities.

In my own experience, I’ve found that interviews with financial analysts have been instrumental in shaping my investment strategy and decision-making process. By learning from experts in the field, I’ve been able to identify emerging trends, assess market risks, and make more informed investment decisions that align with my financial goals.

B. Trends in Advisory Services

Staying informed about trends in advisory services can also provide valuable insights into the evolving landscape of the stock market. As technology advances and investor preferences change, advisory services must adapt and innovate to meet the needs of clients effectively.

For example, trends such as the rise of robo-advisors, increased use of artificial intelligence in investment analysis, and the growing demand for sustainable and socially responsible investing (SRI) are shaping the future of advisory services. By staying abreast of these trends, investors can identify opportunities and challenges in the market and adjust their investment strategies accordingly.

According to a report by McKinsey & Company, the adoption of digital technologies in wealth management is accelerating, with digital channels expected to account for over 60% of client interactions by 2025. This shift towards digitalization underscores the importance of staying informed about technological trends and innovations in advisory services.

In my personal experience, I’ve witnessed the impact of technological trends on advisory services firsthand. By embracing digital tools and platforms, advisory firms can enhance the client experience, improve operational efficiency, and deliver more personalized investment solutions to clients.

C. Future of Investment Strategies

Finally, gaining insights into the future of investment strategies can help investors anticipate market trends and position their portfolios for long-term success. As the investment landscape evolves, new strategies and approaches may emerge that offer unique opportunities for investors.

For example, trends such as factor investing, thematic investing, and alternative investments are gaining traction as investors seek to diversify their portfolios and capture alpha in a changing market environment. By understanding these emerging trends and their potential impact on investment returns, investors can make strategic decisions to optimize their portfolios.

According to a survey by PwC, over 80% of asset managers believe that alternative investments will play a more significant role in portfolios over the next five years, highlighting the growing importance of diversification and risk management in investment strategies.

XII. Summary: Choosing Wisely for Financial Success

In the journey of selecting the right stock market advisory service, wisdom and diligence play pivotal roles. Here’s a recap of the key considerations and steps to ensure financial success:

A. Understand Your Goals and Risk Tolerance

Before diving into the world of investing, take the time to understand your financial goals, whether it’s saving for retirement, purchasing a home, or funding your children’s education. Assess your risk tolerance, considering factors such as your age, financial obligations, and comfort level with market volatility.

B. Research and Evaluate Advisory Services

Conduct thorough research on different advisory services, considering factors such as performance track record, transparency, fee structure, and regulatory compliance. Leverage resources such as SEBI’s registered advisor list and client reviews to evaluate the credibility and reputation of each service.

C. Align with Your Investment Philosophy

Choose an advisory service whose investment philosophy aligns with your own beliefs and objectives. Whether you prefer a conservative approach focused on capital preservation or a more aggressive strategy aimed at maximizing returns, select a service that resonates with your investment style and preferences.

D. Monitor Performance and Stay Informed

Once you’ve selected an advisory service, regularly monitor its performance and review your portfolio to ensure it remains aligned with your goals. Stay informed about market trends, regulatory changes, and emerging investment strategies to make informed decisions and adapt to changing market conditions.

E. Be Prepared to Adapt and Adjust

Investing is not a set-it-and-forget-it endeavor; it requires constant monitoring, evaluation, and adjustment. Be prepared to adapt your investment strategy as needed, whether it’s rebalancing your portfolio, switching advisory services, or exploring new investment opportunities.

In my personal journey, I’ve learned the importance of diligence, research, and adaptability in achieving financial success. By carefully selecting advisory services, staying informed about market developments, and being willing to adjust my investment strategy when necessary, I’ve been able to navigate the ups and downs of the stock market and work towards my long-term financial goals.

XIII. Frequently Asked Questions (FAQs)

A. How do I determine my risk tolerance?

Determining your risk tolerance involves assessing your comfort level with market fluctuations and potential losses. Consider factors such as your investment goals, time horizon, and financial obligations. If you’re uncomfortable with the idea of losing money in the short term, you may have a lower risk tolerance and prefer more conservative investments. On the other hand, if you’re willing to accept higher volatility in pursuit of potentially higher returns, you may have a higher risk tolerance.

B. What are the typical fees associated with advisory services?

Advisory service fees can vary depending on the provider and the level of service offered. Common fee structures include asset-based fees, where the advisor charges a percentage of the assets under management, and flat fees or hourly rates. Additionally, some advisors may charge performance-based fees, where they receive a percentage of investment gains. It’s essential to understand the fee structure upfront and evaluate whether it aligns with the value you expect to receive from the service.

C. Can I switch advisory services easily?

Switching advisory services is possible but may involve some considerations, such as potential tax implications, transfer fees, and differences in investment strategies. Before switching, evaluate your current advisory service’s performance, fees, and level of service compared to alternatives. Consider consulting with a financial advisor or tax professional to understand the implications of switching and ensure a smooth transition.

D. How often should I review my investment portfolio?

The frequency of portfolio reviews depends on your investment goals, risk tolerance, and market conditions. Some investors prefer to review their portfolios quarterly or annually, while others may monitor them more frequently. Regardless of the frequency, it’s essential to conduct regular portfolio reviews to assess performance, rebalance asset allocations, and make any necessary adjustments to stay on track towards your goals.

E. Are there any tax implications to consider?

Yes, there can be tax implications associated with investing, such as capital gains taxes on investment profits, dividend taxes, and taxes on interest income. Additionally, certain investment strategies, such as buying and selling securities frequently (known as “churning”), may trigger higher taxes and transaction costs. It’s essential to consider the tax implications of your investment decisions and consult with a tax professional to optimize your tax strategy and minimize tax liabilities.