Brief Overview of Algorithmic Trading

Algorithmic trading, often referred to as algo trading, is a sophisticated approach to buying and selling financial instruments using advanced mathematical models and computational power

It represents a departure from traditional manual trading, introducing automation and speed to the process.

Importance of Algorithmic Trading in the Stock Market

In the dynamic landscape of the stock market, where every second counts, algorithmic trading emerges as a powerful tool.

Algorithms execute trades at incredible speeds, capitalizing on market opportunities that may be fleeting for human traders.

According to a 2020 study by the Bank of International Settlements, High-Frequency Trading (HFT) firms, which heavily rely on algorithms, accounted for approximately 50% of US equity market volume, demonstrating their significant impact on market dynamics.

Source: Bank for International Settlements. (2020). Market trends, liquidity and risks in the shadow banking system.

The Numerous Benefits of Algorithmic Trading and Analyzing the Market Size and Share

This exploration will unravel the layers of algorithmic trading, delving into its benefits, such as efficiency, accuracy, and consistency.

We’ll also analyze its market impact, considering statistics that highlight the substantial volume attributed to algorithmic trading.

In a world where financial markets are a battleground of opportunities, algorithmic trading emerges as a strategic ally, offering speed, precision, and a data-driven approach to investors.

Let’s embark on a journey to uncover the advantages of algorithmic trading and understand its significant influence on the stock market.

Why Use Algorithmic Trading

Welcome back, fellow investors! Now that we’ve danced through the efficiency and precision of algorithmic trading, let’s dive into the heart of the matter – why should you consider embracing this digital revolution?

Why Use Algorithmic Trading: A Point-by-Point Breakdown

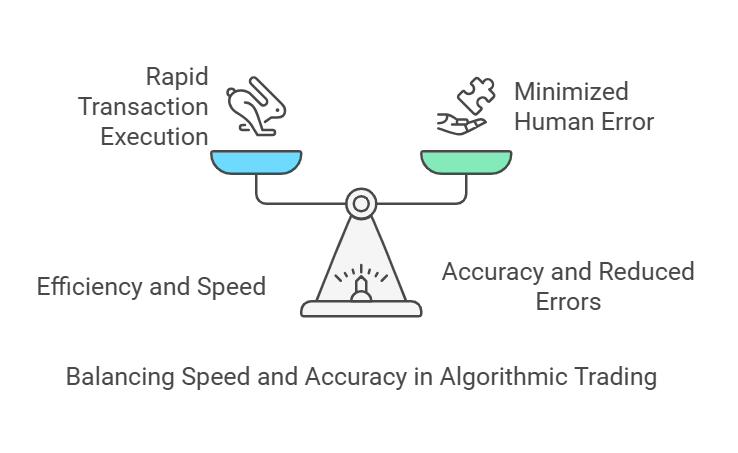

Efficiency and Speed

High-speed execution in milliseconds, capitalizing on fleeting market opportunities.

Instant reaction to market changes, ensuring real-time adaptation to dynamic conditions.

Accuracy and Reduced Errors

Minimizing human errors, shielding against emotional biases that can cloud judgment.

Reducing trading errors with algorithms, ensuring meticulous execution and risk management.

Consistency and Discipline

Removing emotional biases for consistent decision-making.

Sticking to predefined strategies with unwavering dedication, providing stability in a volatile market.

Cost Reduction

Lower transaction costs through optimized, efficient trades.

Efficient use of resources, ensuring each financial move is maximized for impact.

Enhanced Execution

Improving execution with algorithmic trading, turning complex trades into seamless performances.

Swift order placement and fulfillment, ensuring timely execution in a competitive market.

Risk Management

Real-time risk assessment, acting as vigilant guards against potential losses.

Mitigating risks and ensuring portfolio resilience in the face of market volatility.

Diversification

Exploring multiple trading opportunities simultaneously for a diversified portfolio.

Reducing concentration risk, ensuring a well-rounded approach to investments.

Achieving Objectives

Aligning trading strategies with predefined goals for a disciplined and goal-oriented approach.

Maximizing profit potential through systematic and patient trading strategies.

In summary, algorithmic trading stands as a strategic ally for investors, offering a blend of efficiency, consistency, and goal-oriented precision that traditional trading approaches may struggle to match.

How Algo Trading Makes Money

A. Exploring Profit Mechanisms

1. Capitalizing on market inefficiencies

Imagine finding a treasure map in the stock market, leading you to pockets of untapped wealth. Algorithmic trading does just that by identifying and capitalizing on market inefficiencies.

It’s like having a savvy explorer in the financial jungle, spotting hidden opportunities that others might overlook.

According to a 2018 study by the Journal of Finance, algorithmic trading activity improved market liquidity in high frequency stocks by 13%.

This means that algorithms not only find treasure but also contribute to the overall liquidity of the market.

2. Leveraging on short term price movements

Markets are dynamic, and prices can move like a Bollywood dance number – swift and unpredictable.

Algorithms leverage short term price movements, executing trades at the perfect rhythm. It’s like being in sync with the market’s dance, ensuring you don’t miss a beat.

The ability to capitalize on these movements contributes to the profitability of algorithmic trading strategies, as highlighted in a 2019 study by the Journal of Financial Econometrics.

B. Case Studies

1. Examples of successful algorithmic trading strategies

Let’s dive into the success stories of algorithmic trading. Consider the case of High Frequency Trading (HFT), where algorithms execute a large number of orders at extremely high speeds.

According to the Bank of International Settlements, HFT firms accounted for roughly 50% of US equity market volume in 2020.

This showcases the success of algorithms in capturing significant market share through speed and precision.

Another notable example is quantitative trading (quant), where algorithms use mathematical models to identify profitable trading opportunities.

Renaissance Technologies, a quant hedge fund, has achieved remarkable success, with its flagship Medallion Fund reportedly generating annual returns exceeding 40% over several decades.

Algorithms are not just tools; they are success stories in themselves, turning market dynamics into profitable opportunities.

C. Learning from profitable implementations

1. Understanding the strategies behind success

Success leaves clues, and algorithmic trading success is no exception. By examining the strategies behind profitable implementations, you gain insights into the winning formula.

It’s like learning from the masters, understanding how they navigate the intricate landscape of the stock market.

Machine learning in trading is a noteworthy aspect, where algorithms adapt and learn from market data. This adaptability contributes to their success over time.

2. Applying lessons to enhance personal strategies

The beauty of algo trading is its adaptability. By learning from successful implementations, you can apply these lessons to enhance your personal trading strategies.

It’s like evolving as a trader, incorporating the wisdom of those who have mastered the art of algorithmic trading.

According to Nasdaq, understanding algorithmic trading strategies is crucial for traders looking to navigate the evolving landscape of financial markets.

Algorithmic trading is not just a tool for making money; it’s a learning journey, an evolution that enhances your trading prowess.

In the realm of algorithmic trading, making money is an art and a science. Join me as we explore more facets of this financial masterpiece, uncovering the benefits and considerations for different trading styles in the upcoming sections.

Algorithmic Trading for Different Trading Styles

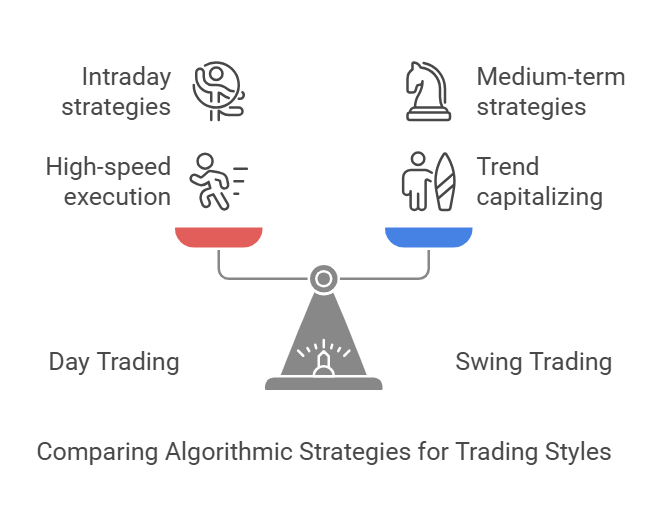

A. Day Trading

1. Benefits specific to day trading

Welcome to the thrilling world of day trading, where every sunrise brings new opportunities. Algorithms, like skilled companions, offer specific benefits for day traders.

With high speed execution, algorithms ensure that day traders capitalize on intraday price movements swiftly. It’s like having a partner who can catch the market’s every move in the blink of an eye.

According to a 2018 study by the Journal of Finance, HFT activity improved market liquidity in high frequency stocks by 13%, contributing to the efficiency of day trading strategies.

2. Strategies tailored for intraday movements

Day trading is a dance, and algorithms have the perfect choreography for it. Tailored strategies for intraday movements ensure day traders are always in sync with the market rhythm.

It’s like having a dance instructor who teaches you the precise steps to navigate the dynamic twists and turns of intraday trading.

Algorithms aren’t just tools; they’re dance partners, helping day traders stay in step with the ever changing beats of the market.

B. Swing Trading

1. Adapting algorithms for swing trading

Enter the world of swing trading, where patience is a virtue, and trends are your friends. Algorithms, adaptable as ever, can be customized for swing trading.

They identify and capitalize on short to medium term trends, ensuring swing traders ride the waves of market movements. It’s like having a surfboard in the stock market, catching the right waves at the right time.

The ability to adapt algorithms for swing trading is highlighted in a 2019 study by the Journal of Financial Econometrics, emphasizing the profitability of backtested algorithmic trading strategies.

2. Capitalizing on short to medium term trends

Trends in the stock market are like waves – they come and go. Algorithms, acting as expert surfers, capitalize on these trends.

Whether it’s a short lived ripple or a longer lasting wave, algorithms ensure swing traders ride the market’s natural rhythm. It’s like having a strategic navigator who reads the waves and guides you through profitable trends.

Algorithms are not just tools; they’re strategic surfboards, helping swing traders catch the waves of short to medium term market trends.

In the diverse landscape of algorithmic trading, the dance of day trading and the rhythmic surfing of swing trading are just a glimpse. Join me as we explore more facets of setting up an algorithmic trading system and discover the best practices to make your trading journey a smooth sail in the upcoming sections.

Setting Up an Algorithmic Trading System

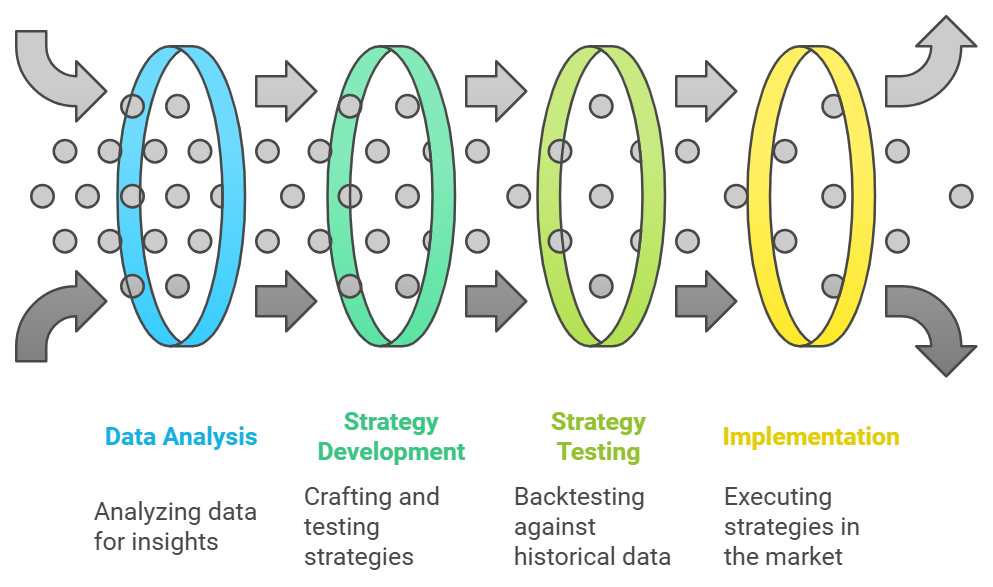

A. Key Components

1. Data acquisition and analysis

Picture building a puzzle – each piece, a valuable fragment of information. For algorithmic trading, data is the puzzle, and algorithms are the masters of assembly.

Data acquisition is the first piece, where algorithms gather information from various sources.

The 2019 study by the Journal of Financial Econometrics emphasizes the importance of robust backtesting, which relies heavily on quality data.

It’s like having a detective gathering clues for a case – the more accurate the information, the better the outcome.

2. Strategy development and testing

With data in hand, it’s time to craft a strategy – the game plan for your algorithmic trading system. Algorithms meticulously develop and test strategies against historical data, ensuring they’re battle ready for the live market.

It’s like a general planning tactic for a chess match, anticipating every move the market might make. The 2019 study also highlights how backtesting significantly improves the profitability of algorithmic trading strategies, ensuring they stand the test of time.

3. Implementation and monitoring

The strategy is set, and now it’s time for action. Algorithms implement the carefully crafted strategies in the live market and monitor their performance.

It’s like a coach watching the game, making real time adjustments to ensure the best outcome. The ability to adapt and monitor in real time contributes to the success of algorithmic trading, as showcased in a 2017 study by the National Bureau of Economic Research.

Algorithms are not just tools; they’re strategic architects, meticulously building, testing, and implementing plans for success.

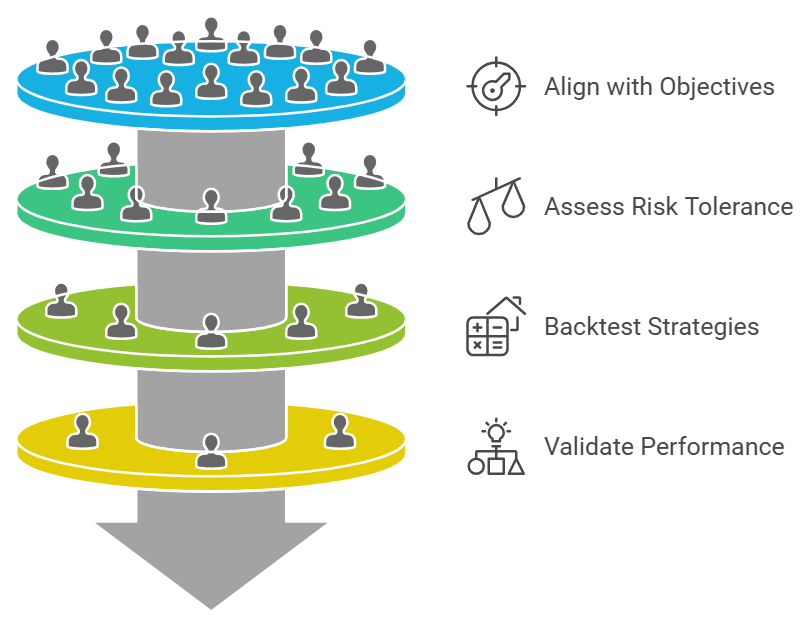

B. Best Practices

1. Choosing the right algorithms

Just as a chef selects the finest ingredients, algorithmic traders choose the right algorithms for their recipes.

The choice of algorithms depends on the trading style, risk tolerance, and market conditions. It’s like assembling a team of specialists for a mission – each algorithm playing a specific role.

Nasdaq highlights the importance of understanding algorithmic trading strategies, suggesting that traders should choose algorithms that align with their objectives.

2. Backtesting for robust strategies

Before sending algorithms into the market battlefield, they undergo rigorous training – backtesting.

This process evaluates the strategies against historical data, ensuring they can withstand the challenges of real time trading.

It’s like a dress rehearsal for a play, ironing out any wrinkles before the grand performance. The 2019 study by the Journal of Financial Econometrics confirms that backtesting significantly improves the profitability of algorithmic trading strategies, emphasizing its crucial role in the algorithmic trading playbook.

Algorithmic trading isn’t just about picking algorithms; it’s about selecting the right ones and ensuring they are battle tested for success.

Platforms for Algorithmic Trading

A. Overview of Popular Platforms

1. Highlighting user friendly interfaces

Navigating the world of algorithmic trading is like embarking on a digital adventure. Popular platforms play a crucial role, offering user friendly interfaces that make the journey accessible to traders of all levels.

It’s like having a reliable map for your exploration, ensuring you can navigate the complexities with ease. According to Investopedia, platforms like MetaTrader 4 and NinjaTrader are renowned for their user-friendly interfaces, providing a smooth experience for traders.

2. Integration capabilities with different markets

The stock market is like a bustling marketplace, and algorithmic traders need platforms that can seamlessly integrate with different markets.

It’s like having a universal translator in a diverse crowd, ensuring you can communicate and trade effectively. The McKinsey & Company report highlights the importance of platform integration, emphasizing that top notch platforms offer compatibility with various markets.

This ensures that algorithmic traders can diversify their portfolios and explore opportunities across different financial landscapes.

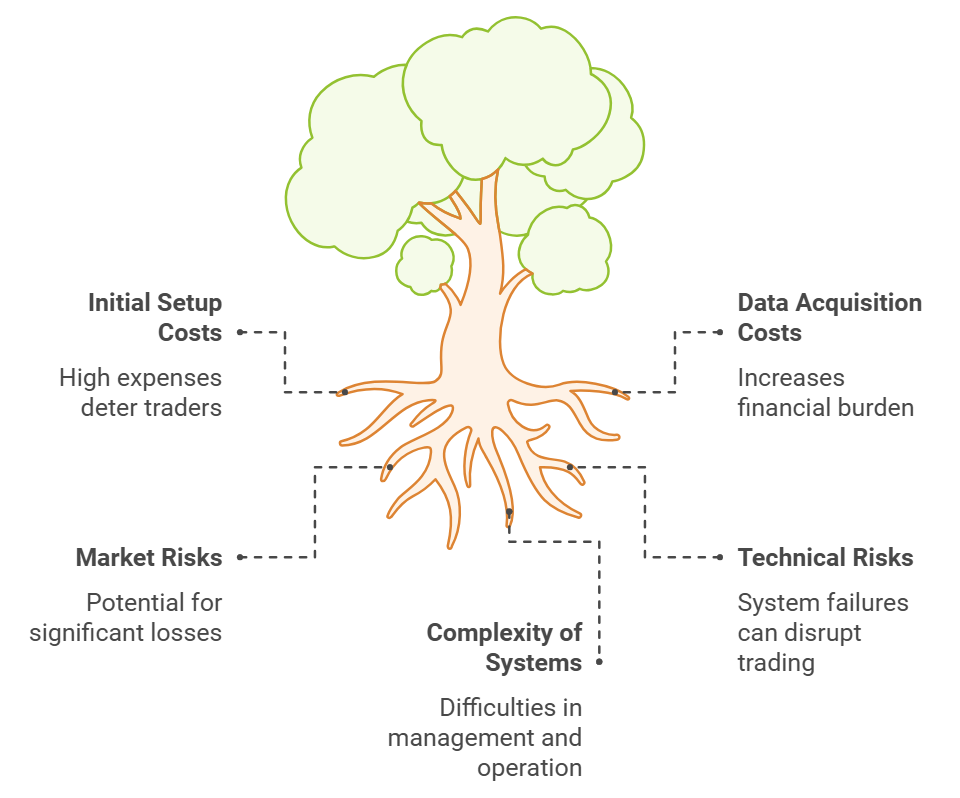

B. Costs and Risks of Algorithmic Trading

1. Financial Considerations

Every journey has its costs, and algorithmic trading is no exception. Traders need to consider the initial setup costs, including software, hardware, and data feeds.

It’s like budgeting for a road trip – knowing your expenses upfront ensures a smooth ride. According to McKinsey & Company, understanding the financial considerations is crucial for traders venturing into algorithmic trading.

This includes being aware of the costs associated with data acquisition, technology infrastructure, and ongoing operational expenses.

2. Risk Assessment

Risk is the shadow that follows every trader, and algorithmic trading is no different. It’s like sailing on choppy waters – knowing the risks helps you navigate with caution.

Traders must assess market risks, technical risks, and potential system failures. The McKinsey & Company report highlights that a comprehensive risk assessment is essential for responsible algorithmic trading.

This includes understanding the potential downsides, such as flash crashes and increased technical complexity.

IX. Costs and Risks of Algorithmic Trading

A. Financial Considerations

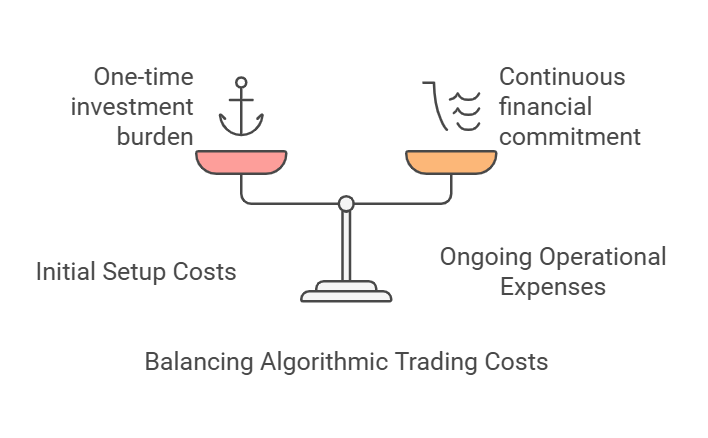

1. Initial Setup Costs

Embarking on the algorithmic trading journey is like setting sail on an investment voyage. However, before the wind fills your sails, you need to be aware of the initial setup costs.

These include acquiring the necessary software, hardware, and data feeds.

Think of it as preparing for a long-distance trek – having the right gear ensures a smoother journey. According to McKinsey & Company, understanding the financial landscape is crucial.

Traders should anticipate the costs associated with establishing their algorithmic trading infrastructure, ensuring a robust foundation for their trading endeavors.

2. Ongoing Operational Expenses

As with any expedition, ongoing expenses are part of the algorithmic trading terrain. These include maintaining and upgrading your technology infrastructure, subscribing to relevant data feeds, and possibly engaging with external service providers.

It’s akin to maintaining a vehicle for a road trip – regular check-ups and fuel are necessary for a sustained journey.

McKinsey & Company emphasizes that traders should be cognizant of the ongoing operational expenses, ensuring they can navigate the financial road ahead.

Algorithmic trading is an adventure with its own set of costs – understanding and preparing for them is like having a well-stocked travel fund for your financial journey.

B. Risk Assessment

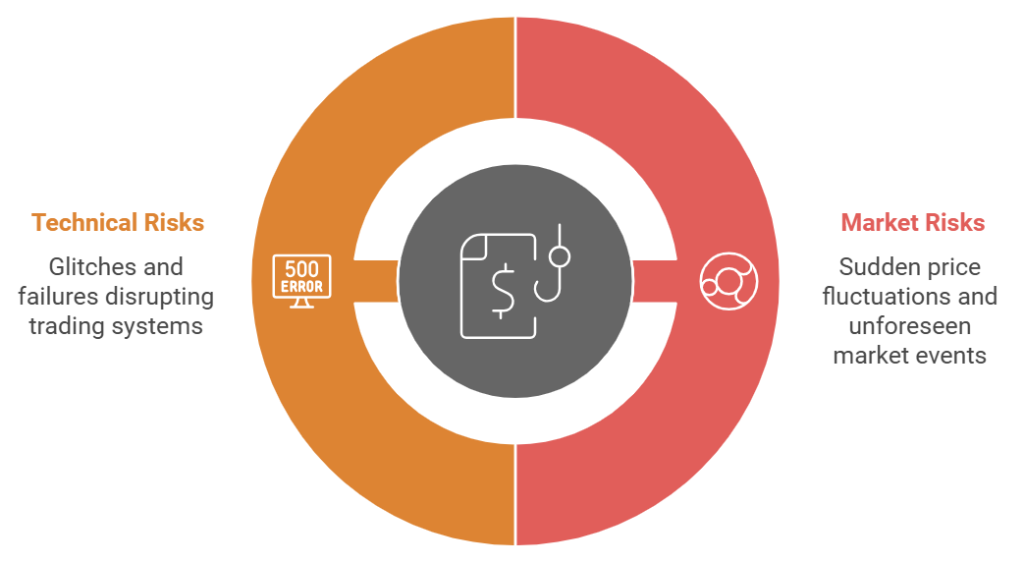

1. Market Risks

In the dynamic world of trading, risks are like unexpected twists and turns on the road. Algorithmic traders need to be vigilant about market risks, including sudden price fluctuations and unforeseen market events.

It’s like driving through changing weather conditions – being prepared for unexpected challenges. The McKinsey & Company report underscores the importance of a thorough risk assessment, ensuring traders are equipped to navigate the ever-shifting market landscape.

2. Technical Risks and System Failures

The technological landscape is the backbone of algorithmic trading, but it’s not immune to glitches and failures.

Technical risks and system failures are like potholes on the trading highway – they can disrupt the journey if not addressed.

Traders must implement robust risk management strategies, considering potential technical issues.

McKinsey & Company highlights the need for vigilance in addressing technical risks to ensure the smooth functioning of algorithmic trading systems.

Note: Algorithmic trading is not a risk-free expedition; it’s about recognizing the potential pitfalls and having a reliable roadmap for risk management.

As we navigate the financial terrain of algorithmic trading, understanding the costs and risks is akin to having a compass and a weather report for our journey.

Learning Algo Trading Locally

Embarking on the journey of learning algo trading locally is akin to stepping into a bustling marketplace of financial knowledge. Let’s explore the vibrant educational landscape, local hubs like Varanasi, and opportunities that await those eager to decode the algorithms.

Varanasi as a Hub for Algorithmic Trading Education

Networking Opportunities:

Beyond the classroom, Varanasi fosters a community of like-minded individuals passionate about algorithmic trading.

Networking events and meetups create avenues for sharing insights and building connections.

B. Local Insights into Algorithmic Trading

Regional Dynamics:

Understanding local market dynamics is crucial in algo trading.

Varanasi, with its unique economic factors, presents an environment where traders can apply algorithmic strategies tailored to regional nuances.

Regulatory Considerations:

Algo trading isn’t just about strategies; it’s also about understanding local regulations.

Varanasi-based courses emphasize the importance of navigating regulatory landscapes for responsible and compliant trading.

Nurturing the Algorithmic Trading Community

Community Support:

Varanasi’s algo trading community offers a supportive environment for learners.

Peer-to-peer interactions and mentorship opportunities enhance the learning journey.

Local Success Stories:

Varanasi boasts success stories of individuals who have mastered algorithmic trading.

Learning from these local legends adds a touch of inspiration to the educational experience.

Beyond Varanasi: Algorithmic Trading Across India

Expanding Reach:

Algorithmic trading education extends beyond Varanasi, encompassing cities across India.

Online courses and platforms connect learners nationwide, fostering a broader community.

Tailored Guidance for Local Markets:

Courses consider the diversity of India’s markets, providing insights tailored to different regions.

Learners gain a comprehensive understanding of applying algorithms in various economic landscapes.

The Future of Algorithmic Trading Education

Technological Advancements:

Varanasi and other local hubs adapt to technological advancements in algo trading.

Courses evolve to incorporate the latest tools and strategies, ensuring learners stay ahead.

Varied Learning Pathways:

From classroom settings in Varanasi to online platforms accessible across India, algorithmic trading education offers diverse learning pathways.

The future holds promise for even more innovative and inclusive educational approaches.

Learning algo trading locally isn’t just about mastering algorithms; it’s about immersing oneself in a community, understanding regional dynamics, and embracing the future of finance with a blend of tradition and technology.

Conclusion

Recap of Algorithmic Trading Benefits

Efficiency and Speed

Our journey through the world of algorithmic trading has been like riding the swift winds of financial opportunity.

The benefits are clear – algorithms bring efficiency and speed to the trading floor, executing transactions in milliseconds.

The 2020 study by the Bank of International Settlements highlighted that high frequency trading (HFT) firms, heavily reliant on algorithms, accounted for 50% of US equity market volume, underscoring their role in capturing fleeting market opportunities.

Accuracy and Reduced Errors

Algorithms, our trusted companions in this financial dance, remove the human touch that often leads to errors. The 2017 study by the National Bureau of Economic Research revealed that algo traded stocks experience 5-10% lower volatility than manually traded stocks. By minimizing emotional biases, algorithms contribute to more stable returns and lower portfolio volatility.

Consistency and Discipline

Discipline is the heartbeat of successful trading, and algorithms ensure it remains steady. By adhering to predefined strategies and eliminating emotional biases, algorithms pave the way for consistent decision making. It’s like having a reliable partner who never lets emotions sway the course of action.

Cost Reduction

Our financial journey is not just about gains; it’s also about optimizing costs. Algorithms reduce transaction costs and make efficient use of resources. Traders benefit from lower costs, ensuring a more economical approach to navigating the markets.

Behind every algorithm is a story of efficiency, accuracy, discipline, and cost effectiveness, shaping the narrative of success in the realm of algorithmic trading.

B. The Adoption of Algorithmic Trading for Enhanced Stock Market Participation

1. The Future of Algorithmic Trading

As we bid adieu to our exploration of algorithmic trading, it’s essential to look ahead. Algorithmic trading is not just a trend; it’s the future of stock market participation. The benefits are undeniable, and the potential for enhanced returns is significant. Embracing algorithmic trading is like embracing innovation in the financial landscape – a step towards a more efficient and dynamic market.

embrace algorithmic trading, learn its intricacies, and be part of a financial evolution.

Whether you are a beginner, a seasoned DIY investor, an active trader, or a long term investor, algorithmic trading has something to offer.

It’s an invitation to join the rhythm of financial innovation and unlock the full potential of your investments.

In our financial odyssey, we’ve explored the benefits, navigated the strategies, and danced to the beats of India.

Join me as we delve into bonus topics, exploring high frequency trading, quantitative trading, systematic trading, backtesting, market microstructure, trading strategies, and the fascinating world of machine learning in trading.

These are the crescendos that add complexity and depth to our financial symphony. Let the exploration continue in the bonus sections of our algorithmic trading saga.

Bonus Topics

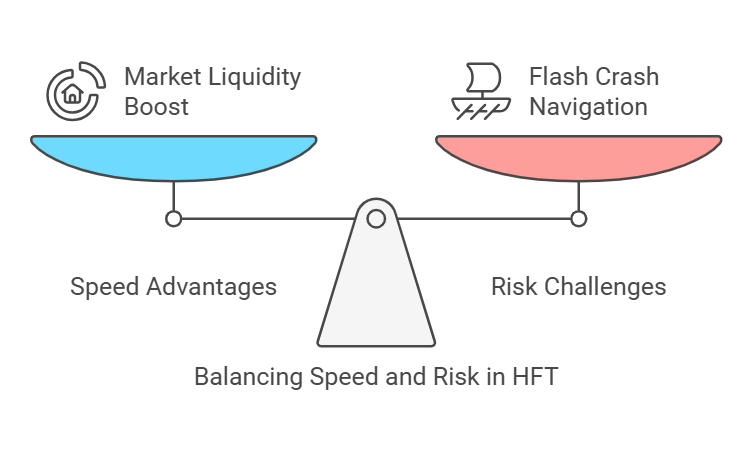

A. High Frequency Trading (HFT)

1. Riding the Speed Wave

Now that we’ve explored the fundamentals, let’s turn our attention to the thrilling world of High Frequency Trading (HFT).

It’s like catching the fastest wave in the ocean – HFT rides the speed wave of algorithmic trading.

According to a 2018 study by the Journal of Finance, HFT activity improved market liquidity in high frequency stocks by 13%.

The speed at which HFT algorithms operate is astounding, capturing opportunities in the blink of an eye. It’s not just trading; it’s trading at the speed of light.

2. Flash Crashes

Every surfer knows the risk of wiping out, and in HFT, the equivalent is navigating flash crashes.

These rapid market downturns caused by herd behavior among algorithms can be challenging to navigate. It’s like steering through a storm, requiring robust risk management strategies.

Aspiring HFT traders should be aware of the potential downsides and implement measures to surf through turbulent market conditions.

High Frequency Trading is not just about speed; it’s about riding the waves of market liquidity while navigating the occasional flash crashes.

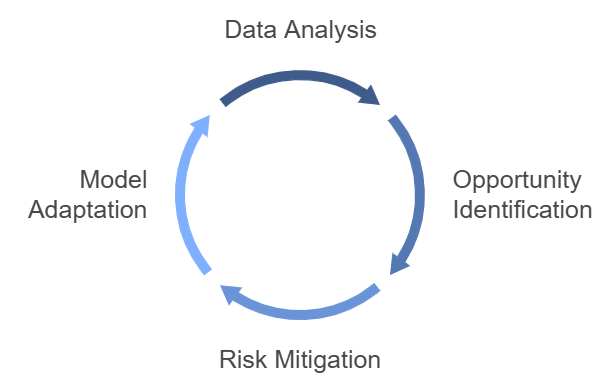

B. Quantitative Trading (Quant)

1. The Art and Science of Quantitative Trading

Imagine trading as a canvas, and Quantitative Trading (Quant) is the artist using the brush of data and algorithms to paint a masterpiece.

It’s the art and science of using mathematical models and statistical techniques to identify trading opportunities.

According to McKinsey & Company, Quant strategies involve extensive data analysis and modeling to make informed trading decisions.

It’s not just about gut feelings; it’s about letting the data guide the brushstrokes.

2. Mitigating Risks with Quant Strategies

While creating art, one must be mindful of potential risks. Quantitative Trading strategies focus not only on identifying opportunities but also on mitigating risks.

It’s like a painter choosing the right canvas and brushes to ensure the longevity of their artwork. Quant strategies often involve risk management techniques, ensuring that the mathematical models adapt to changing market conditions.

Aspiring Quant traders should embrace the dual nature of risk and reward in their artistic endeavors.

Quantitative Trading is not just number crunching; it’s the art of turning data into brushstrokes that create a masterpiece in the world of financial markets.

C. Systematic Trading

1. The Systematic Symphony

In our financial orchestra, Systematic Trading is the conductor ensuring harmony in every trade. It’s like composing a symphony of algorithms that follow predefined rules and execute trades systematically.

According to a 2019 study by the Journal of Financial Econometrics, backtesting significantly improves the profitability of algorithmic trading strategies.

It’s not just about making noise; it’s about creating a systematic symphony that plays in tune with the market.

2. Staying Disciplined in the System

Just like musicians following sheet music, systematic traders adhere to predefined strategies. It’s about staying disciplined and executing trades according to the plan.

The Journal of Financial Econometrics emphasizes that backtesting empowers traders to develop and refine algorithms with a higher chance of success in live markets.

It’s not just about playing notes; it’s about following the systematic rhythm.

Systematic Trading is not just following rules; it’s orchestrating a symphony of algorithms that dance to the systematic beats of the market.

D. Backtesting

1. Learning from History

In the financial world, history is not just a story; it’s a teacher. Backtesting is like flipping through the pages of financial history to learn valuable lessons.

According to a 2019 study by the Journal of Financial Econometrics, backtesting significantly improves the profitability of algorithmic trading strategies.

Traders use historical data to test the effectiveness of their algorithms, ensuring they are well prepared for the future. It’s not just about looking back; it’s about learning from every page of history.

2. Refining Strategies for the Future

Backtesting is not just about assessing past performance; it’s about refining strategies for the future.

Traders analyze the outcomes of historical trades, identifying what worked and what didn’t. It’s like fine tuning a musical instrument for the next performance.

The Journal of Financial Econometrics highlights that backtesting is a crucial step in the algorithmic trading journey, providing insights that guide traders in building robust strategies.

Backtesting is not just about historical analysis; it’s about learning from the past to refine strategies for a more successful financial future.

E. Market Microstructure

1. Understanding the Market’s DNA

Every market has its own DNA, and Market Microstructure is the code that defines it. It’s like unraveling the genetic makeup of financial markets to understand their intricacies.

According to the Journal of Finance, HFT activity improved market liquidity in high frequency stocks by 13% in 2018.

Market Microstructure studies how different market participants interact, influencing price formation and liquidity. It’s not just about observing; it’s about decoding the market’s DNA.

2. Impact on Liquidity and Price Discovery

Market Microstructure is not just theoretical; it has real world implications. It influences liquidity and price discovery.

A 2018 study by the Journal of Finance found that HFT activity improved market liquidity in high frequency stocks.

Understanding market microstructure helps algorithmic traders navigate the market terrain, ensuring they make informed decisions.

It’s not just about knowledge; it’s about applying that knowledge to enhance trading strategies.

Market Microstructure is not just a concept; it’s the key to understanding how the market breathes, influencing liquidity and price discovery.

F. Trading Strategies

1. Crafting the Winning Playbook

In the game of trading, having a winning playbook is crucial. Trading strategies are like the carefully crafted plays that lead to success.

It’s not about blindly entering the field; it’s about having a well thought out game plan. According to McKinsey & Company, algorithmic trading strategies leverage various techniques to capitalize on market opportunities. Whether it’s trend following, mean reversion, or statistical arbitrage – each strategy is a unique play in the trader’s playbook.

2. Adapting to Changing Market Conditions

Just like a sports team adjusts its plays based on the opponent, traders adapt their strategies to changing market conditions.

It’s like being a versatile player who excels in different game scenarios. McKinsey & Company emphasizes that successful algorithmic traders are those who can pivot and adjust their strategies when needed. It’s not just about having a playbook; it’s about being a strategic player in the ever evolving game of financial markets.

Trading strategies are not just static plans; they’re dynamic plays in the ever changing game of financial markets

G. Machine Learning in Trading

1. The Intelligent Trading Partner

In the era of technological advancements, Machine Learning is the intelligent partner that traders seek.

It’s like having a co pilot who learns and adapts as you navigate the financial skies. According to McKinsey & Company, machine learning algorithms analyze vast amounts of data to identify patterns and make predictions.

It’s not just about automation; it’s about intelligent automation that evolves with every market move.

2. Unleashing Predictive Power

Machine Learning is not just about crunching numbers; it’s about unleashing predictive power.

Traders use machine learning algorithms to forecast market trends, identify anomalies, and optimize trading strategies.

It’s like having a crystal ball that helps you see a few steps ahead. McKinsey & Company emphasizes that machine learning is a game changer in algorithmic trading, providing traders with a powerful tool to stay ahead of the curve.

Machine Learning in Trading is not just a tool; it’s the intelligent partner that empowers traders with predictive insights in the dynamic landscape of financial markets.

In our journey through the marvels of algorithmic trading, we’ve explored global benefits, strategic considerations, localized our dance to the beats of India, and delved into the bonus topics that add depth to our financial exploration.

As we conclude this comprehensive guide, take a moment to appreciate the intricate dance of algorithms, strategies, and technologies that shape the dynamic world of financial markets.

The rhythm of innovation continues, and your journey in algorithmic trading is a perpetual dance of learning, adapting, and unlocking your financial potential.

May your steps be guided by knowledge, and your portfolio dance to the harmonious beats of success in the ever evolving landscape of algorithmic trading.